Weekly Performance

| S&P 500 | 1.03% |

| Equal Weight S&P 500 (RSP) | 1.53% |

| NASDAQ | 1.20% |

| DOW | 1.93% |

| Russell 2000 | 1.66% |

Talk of the Tape

Payrolls defied ADP weakness, reassuring investors – at least for the next 30 days – that the labor market hasn’t cracked. The positive eco-read allowed markets to inch closer to the all-time high, continuing the most hated V-shape recovery following one of the most rapid declines in history.

The Week Ahead

Monday

- n/a

Tuesday

- n/a

Wednesday

- CPI

- Oracle (ORCL)

Thursday

- Initial Jobless Claims

- PPI

- Adobe (ADBE)

Friday

- n/a

Macro Movers

The Data is Why: Initial Claims

With Payrolls out of the way, the only real suspense until next month comes from initial jobless claims.

An initial claim is filed by someone newly unemployed seeking to determine eligibility for unemployment insurance. It’s a leading data point that gives a real-time glimpse into layoffs.

A quick rise in this weekly series, released every Thursday morning, would indicate more people are getting laid off. If that rise is confirmed by an uptick in continuing claims – meaning those laid off aren’t finding new work – then we have a real problem.

Here’s a look at the 4-week moving average for the first six months of the last three years to see how 2025 stacks up:

Does 1H24 look better than 1H25? Sure, by about 10.5k or 4.6%. But let’s not forget that the Sahm Rule, a harbinger of recession, falsely triggered in the back half of 2024. Compared to 2023, this year doesn’t look dramatically different. 2H23 featured a few noisy prints above 250k that (thankfully) turned out to be nothing. In both cases, despite labor market scares, the S&P 500 managed yearly gains better than 20%.

Now, I don’t love how the current data looks. But is it “S&P 500 down 19% in 2 months” bad? I don’t think so, especially considering how the last two years played out in combination with last week’s JOLTs and Payrolls that indicate the economy is still generating enough jobs for job seekers.

So, what does this have to do with V-shaped recovery?

To tie it all together, here’s an economic truism unique to the U.S. that you already know:

So long as Americans are employed, Americans will spend. So long as Americans spend, the U.S. economy will be fine.

The market rebound indicates the world’s investable capital (an un-bullshit-able brain trust backed by an unfathomable amount of money) has determined, for now, employment – and by extension, a recession – is not the concern it was briefly feared to be in April’s darkest hours. Thus, a legitimate basis for a recovery in stocks.

Still Disagree?

You can take the other side, believe the die is cast and the downturn is inevitable. But don’t forget: inflation, earnings, margins, and growth were all supposed to go the wrong way by now. They haven’t. Being early often turns into being wrong. If “time” is your only bear catalyst, set a deadline for when to change your mind. Otherwise, you’re just hoping for the worst, which years of stock market returns suggests is a terrible strategy.

In my opinion, it is in no one’s interest to continue playing the economic version of a Cold War classic: mutually assured destruction (MAD). The game changed on April 9th when the bond market forced the White House to toss the tariff display into the fire. Deals will come. Corporations know it, which reduces the risk of mass layoffs, bankruptcies, and blowups.

Payrolls Fallout

The Fed has a dual mandate: one focused on inflation, the other on employment. April’s inflation data (which we’ve seen through the course of May) showed that price pressures remain manageable. Friday’s payrolls report allows you to conclude the same for the labor market. If you’re a Fed voter, I can’t imagine there’s much urgency to cut. Futures markets continue to price in two 25-basis-point cuts by year-end.

At this point, I think it is more likely we only see one or four. If the data through year-end looks like it does now, there will be no reason to cut beyond bringing rates closer to neutral. However, if the economy finally rolls over in the manner some have suggested, the Fed will cut by more than 50 basis points. Right now, I would argue the former is more likely than the latter.

This week is our first look at inflation for May. Assuming initial claims don’t reintroduce labor market concerns, the main story will be CPI. We want this measure of consumer inflation to continue inching toward 2%. PPI, which measures what wholesalers pay, is a bit more nuanced. For this release, we’re hoping for a no-news number to imply there isn’t any tariff-driven inflation entering the system.

In my mind, given the bounce back in Conference Board sentiment, there is some risk CPI comes in a touch hot. Not necessarily because of tariffs, but because the paralysis from public trade negotiations that gripped consumers is beginning to thaw as the news flow and expectation of the future improve, albeit from depressed levels.

Consumer Price Index (May)

- Headline CPI YoY: Expected at 2.5%, up from 2.3% prior

- Headline CPI MoM: Expected at 0.2%, unchanged from April

- Core CPI YoY: Expected at 2.9%, up from 2.8% prior

- Core CPI MoM: Expected at 0.3%, up from 0.2% in April

Produce Price Index (May)

- Headline PPI YoY is expected to print 2.6%, slightly hotter than the 2.4% recorded in April.

- Headline PPI MoM is expected to rise 0.2%, rebounding from April’s deflationary -0.5% print.

- Core PPI YoY is expected to print 3.0%, marginally cooler than the 3.1% seen prior.

- Core PPI MoM is expected to rise 0.3%, recovering from the previous month’s -0.4% decline.

Initial Jobless Claims

- Consensus on initial claims is 242k, ~5k fewer than last week.

Micro Movers

The Data is Why: Earnings

If you are particularly skeptical of forward estimates and guidance right now, I’ll hear your argument. Some companies pulled guidance; others provided ranges so wide they may as well not have been given. For those that gave traditional guidance, the backdrop was so uncertain when issued that it’s fair to apply an extra serving of scrutiny.

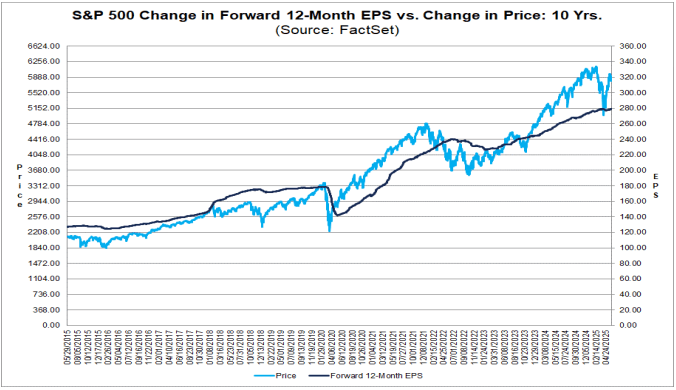

That said, assuming the worst in all cases isn’t intellectually honest either. And with recession odds dropping as trade talks have progressed, it makes sense to take an incrementally more constructive view. As such, here’s what the market sees:

In a phrase: not much. I’ll be the first to admit – hand up – I was just as bearish as anyone in April. I thought earnings were going to fall off a cliff. Rules and discipline kept me in. But, earnings are not moved by emotion. They don’t care what you think, how you feel, or about any survey. They are what they are. Real enough for corporations to pay taxes on and significantly better than the depths of April led us (reasonably) to fear. Thus, permitting the swift, durable recovery in stocks.

This brings me to my next point, which I kindly ask you forgive me for repeating:

On April 9th, this cardboard was jettisoned from reality. From an earnings perspective – and thus the market’s perspective as well – it may as well have been a fever dream. Yet for many, this is still what comes to mind when visualizing the future. I still have L-Day PTSD, but it can’t hurt anyone anymore. It’s hard, but it’s time to let this image go.

In lieu of the heinous cardboard, I’m viewing earnings through the lens of 10-15% universal tariffs with plenty of carve outs. So, are earnings projections possibly a touch high? Maybe. But not S&P 4800 bad.

Still Disagree?

You still believe earnings are going to collapse? So, you didn’t get it wrong? You’re just early? Whatever. Tell that to the people you scared out of the market and never encouraged back in. I know I just said it, but it bears repeating: being early often turns into being wrong.

But let’s have the conversation. If you can answer the following questions, then by all means, be bearish:

- Why are next quarter’s earnings going to magically evaporate? What got worse?

- What is going to stop the people who did business this quarter from doing business in the next?

- Do you understand that S&P 500 CEOs are Michael Jordan ruthless?

- What is going to stop the AI-tech cycle from fostering an enterprise economy incredible enough to mask almost any degree of ugliness elsewhere?

If you can’t, then stop scaring yourself and others.

Earnings Highlights

- Oracle (ORCL): Enterprise software, particularly Microsoft, is coming back into fashion. Oracle is a top software company by worldwide revenue, giving it an impressive data lake to teach AI. While Nvidia is certainly the pioneer in the space, I’m curious to hear what Oracle management is seeing in their data and through their customers when it comes to integrating AI into client clouds.

- Adobe (ADBE): Concerns about AI disrupting their monopoly still hold this stock hostage. In many ways, the situation reminds me a bit of Alphabet: a great company with a near monopoly in its space. Can Adobe capitalize on AI? Sure, and the same can be said for Alphabet. But will being a winner in AI be better than being a monopolist in their respective fields? The jury is still out. I don’t have anything at stake in this one, just find the similarity in situations interesting.