Weekly Performance

| S&P 500 | 2.24% |

| Equal Weight S&P 500 (RSP) | 1.92% |

| NASDAQ | 2.38% |

| DOW | 1.93% |

| Russell 2000 | 1.92% |

Talk of the Tape

Nvidia put to rest concerns that macro uncertainty would slow the AI-build out, soft data surprised to the upside, PCE was benign, and the courts are finally getting involved with tariffs. An expectedly busy week broke the way of the bulls as the majors gained nicely.

The Week Ahead

Monday

- Manu PMIs

Tuesday

- Job Openings

- CrowdStrike (CRWD)

- Dollar General (DG)

Wednesday

- ADP Employment

- Services PMIs

- Dollar Tree (DLTR)

- Five Below (FIVE)

Thursday

- Initial Claims

- Broadcom (AVGO)

- Rubrik (RBRK)

Friday

- Payrolls

Macro Movers

Soft Data Catch-Up

Conference Board consumer confidence printed 98 for May, meaningfully better than the consensus of 86.0 and a nice rebound from the prior 85.7. Many attribute the easing in China-U.S. tensions as the catalyst. I would add that the hard data indicates the negative impacts of tariffs have yet to materialize in the real economy in the form of higher prices, decreased selection, hiring freezes, or layoffs also has something to do with the improved sentiment.

I see the rebound as an exhale.

The soft data sounded an alarm so loud that it became a mainstream event, no longer confined to finance. Kesha and T-Pain were making music about partying in a trailer park. 60% of Coachella tickets were financed using buy-now-pay-later. Everyone tensed up for an economic gut punch. Then, perhaps due to all of the tariff front-running, it never came. The hard data hung in there.

The soft data had every reason to take a breath.

As last week came to a close, some made the case that it’s more likely we see the soft data catch up than the hard data catch down. Not sure I agree, but I love the idea. If we keep making progress on trade, I can see a world where equilibrium comes from each moving closer to the other. Hard data moves lower without breaking down. Soft data realizes that’s the case and improves.

Single Variable Analysis: Initial Claims

Speaking of the hard data, it’s done its part to avoid making headlines. Sure, tariffs have popped up in a survey here or there, but net-net, the impact hasn’t been as dramatic as many expected by now.

I agree with the consensus that the lack of drama is largely due to the labor market. People still have their jobs. While consumers are getting more selective, it hasn’t been enough to derail the eco data. Although a few stocks (Best Buy, Target, etc…) blew-up due to tariff impacts, the vast majority haven’t. Furthermore, none of the isolated blow-ups hold a candle to outright strength coming out of the enterprise economy thanks to AI and cybersecurity.

Unfortunately, Payrolls, the best measure we’ve got, lags by a month. That makes initial claims the only leading indicator into the market dictating economic resilience. Continuing claims are less noisy, but markets won’t wait for confirmation if initial claims start to rise. Assuming Payrolls is another nothing-to-see-here print, we’re likely in a stretch where initial claims claims – pun intended – hold a heightened level of market importance.

Manufacturing PMIs (May)

- Final for S&P Manufacturing is expected to print 52.3, in-line with the prior estimate.

- Consensus projects ISM Manufacturing at 48.5%, a 0.2% decrease from the prior 48.7%.

Job Openings (JOLTs, April)

- 7.192 million new job openings were recorded for March. At time of publication, no estimate was available.

ADP Employment

- 112k, a nice rebound from last month’s 62k, is the forecast for private sector job creation.

- While there is no estimate, last month job stayers and changers experienced a 4.5% and 6.9% YoY wage increase.

Services PMIs (May)

- S&P Services is projected to print 52.3, in-line with the prior estimate.

- ISM Services is projected to print 52.2%, a tick higher than the preliminary 51.6%.

Initial Jobless Claims

- Initial jobless claims is expected to print 232k, down from the prior week’s 240k.

May Payrolls

- 125k is the forecast for headline job creation, down from 177k last month.

- Unemployment is projected to remain stable at 4.2%

- Hourly wages on a monthly basis is expected to tick up 0.3%, a touch hotter than the prior 0.2%; on a yearly basis

Micro Movers

AI > Tariffs

It was a great quarter, and NVDA management went to great lengths to explain it would’ve been even better if not for U.S. government restrictions on chip exports. What I walked away with was this: despite the uncertainty surrounding global trade, the runway for AI demand hasn’t shortened an iota. Sovereigns and hyperscalers refuse to risk being left behind. The number of AI tokens (requests) continues to grow, and so the buildout persists.

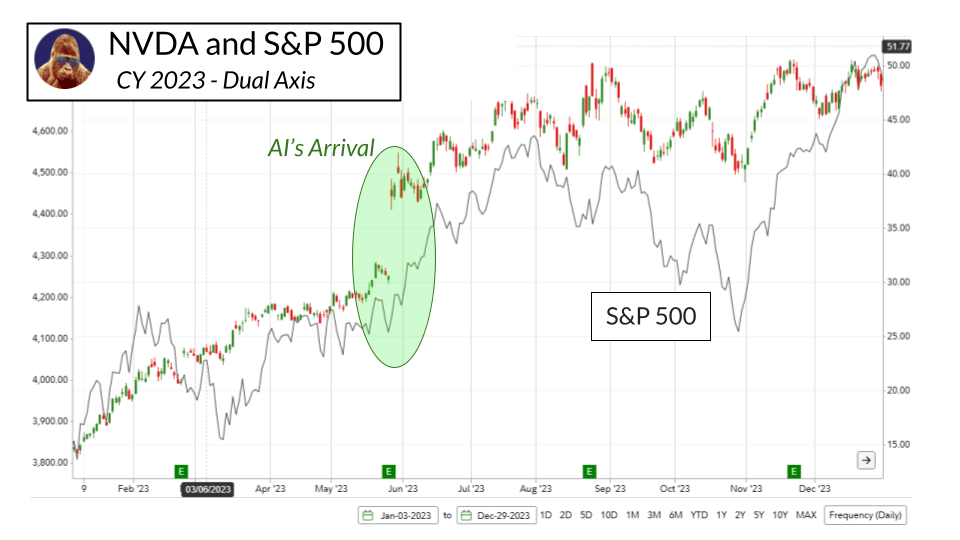

You could argue NVDA, and by extension AI, saved the stock market in 2023. Prior to their May 2023 quarter, which made it clear the AI-hype was real, markets were still grappling whether the economy would crack under the weight of the Fed’s historic hiking cycle. Turns out, when you get a new tech cycle like we did with AI, you can have an extremely imbalanced economy (housing is still frozen), restrictive rates, and still avoid recession.

If we are, in fact, still early in this AI cycle, it nicely explains why enterprise earnings and spending haven’t contracted as much as one might expect from a “normal” economy facing today’s conditions. The earnings buffer it creates eases the pressure to initiate layoffs, which helps contextualize the labor market resilience keeping this economy chugging along.

AI saved the market in 2023. Can it do it again in 2025? Maybe, but not in the same way. In 2023, AI changed the earnings outlook. This time it will need to keep the earnings outlook alive until the rest of the market can pull its weight once there is some degree of certainty surrounding trade.

Earnings Highlights

- CrowdStrike (CRWD) & Rubrik (RBRK): Cybersecurity has been the place to be this year. Both stocks recently hit new all-time highs. If business-as-usual quarters are sold, I’d see it as an opportunity to average in.

- Broadcom (AVGO): A clear second to NVDA in the semiconductor world. Over the last three months, AVGO (21%) has outperformed NVDA (8%) and the broader cohort (SMH, 3%). Portfolio diversification has had a strong 2025. AVGO’s business is well-balanced across software, hardware, and client geography. Fitting to see an adjacent talking point playing out in a related area.

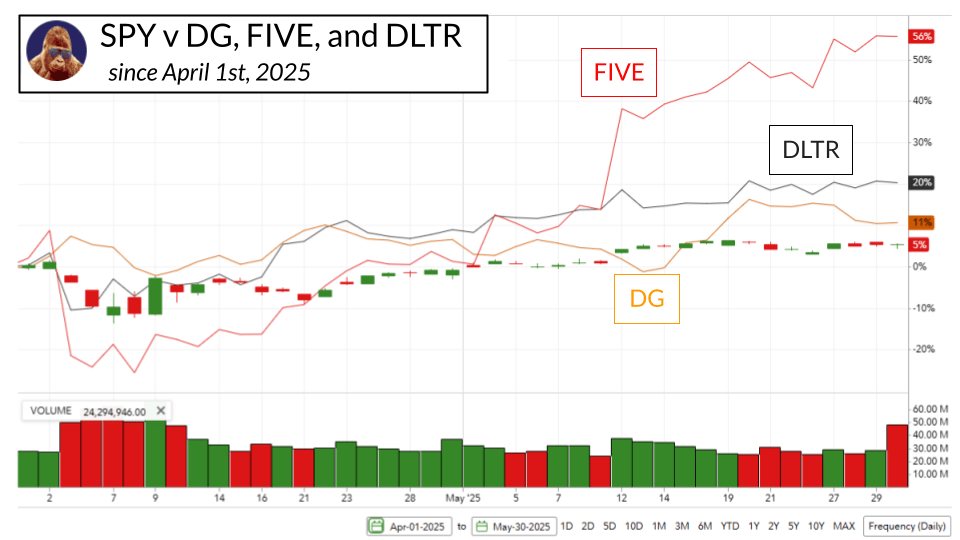

- Dollar Tree (DLTR), Five Below (FIVE), & Dollar General (DG): These stocks weren’t spared the April sell-off, but coming out of it, along with a heightened sense of recession, they have outperformed the S&P 500 on the way out.

Not sure if their quarters will justify the moves or if ongoing trade complications remain enough to keep investors in regardless of the quarterly results, but it’s certainly worth pointing out that some stocks have recession in their price.