June 2025

-

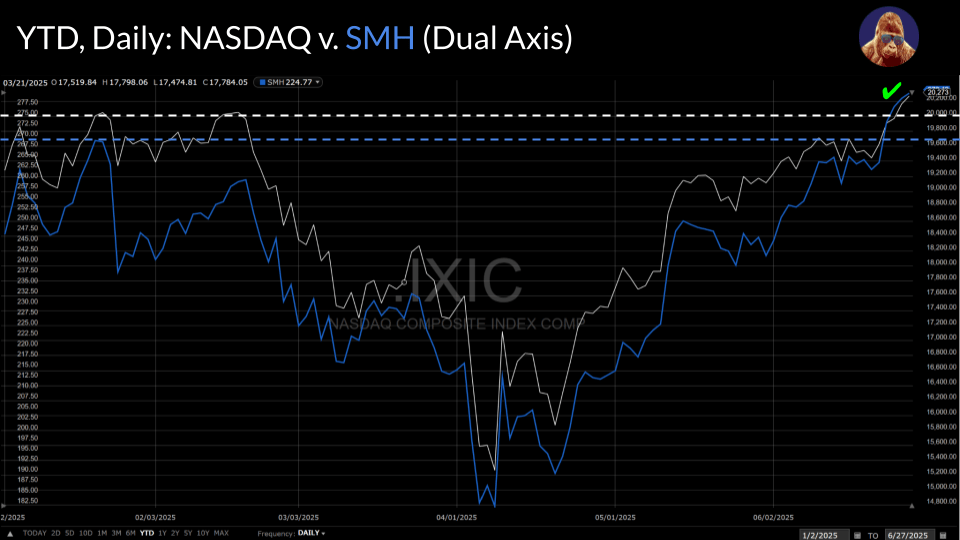

🍾Happy New All-Time Highs 🥂 Stocks did it. They climbed the wall of worry and did not succumb to it. If you stuck around, then you managed the same feat. Congratulations. It got scary there for a moment. Now, we play the confirmation game. Can the new highs be trusted? If we get confirmation from…

-

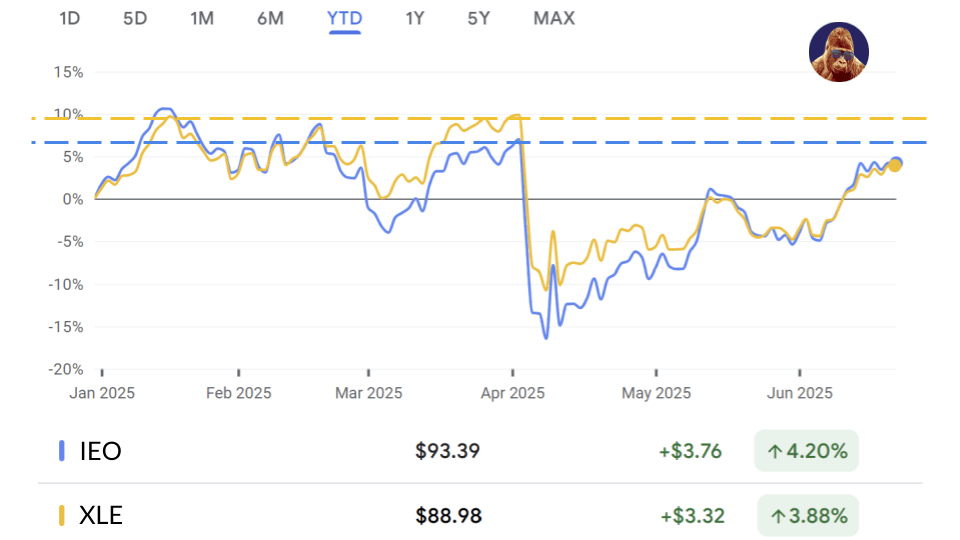

There are a number of factors working for a sector-wide breakout: 📈Momentum Energy components in the S&P 500 feature the highest median RSI at ~61. 🏃Catch-Up Trade Unlike the broader S&P 500, the IEO and XLE have both yet to reclaim the April levels. The current backdrop suggests a catch-up bid is appropriate. 💸Under-Owned Due…

-

👀Everyone’s watching oil as the situation in the Middle East escalates🛢️ In this edition of the 9:25, I spotlight a few charts that may lead you to opportunity in the market right now. I also share my thoughts on last week’s FOMC, preview this week’s economic releases, and let you in on what I’m listening…

-

The dots, or Summary of Economic Projections (SEPs), are still hot out of the oven. Smells of Stagflation.

-

Happy Tuesday! Due to travel and Father’s Day, there wasn’t much time to write. However, with retail sales fresh in our minds and the FOMC tomorrow, I figured I’d add my 6 cents on 3 matters (2 cents per matter) that would’ve made the 9:25: Oil, the Fed, and Retail Sales.