Weekly Performance

| S&P 500 | 2.60% |

| Equal Weight S&P 500 (RSP) | 1.55% |

| NASDAQ | 3.58% |

| DOW | 0.92% |

| Russell 2000 | 0.73% |

Talk of the Tape

Despite continued disappointment on UMich sentiment, benign inflation and a return of Trump “the businessman” during his trip to the Middle East fostered a more optimistic view on Wall Street.

The Week Ahead

Monday

- n/a

Tuesday

- Home Depot (HD)

- Palo Alto (PANW)

- Toll Brothers (TOL)

Wednesday

- Target (TGT)

- TJX (TJX)

Thursday

- Flash PMIs (May)

Friday

- n/a

Macro Movers

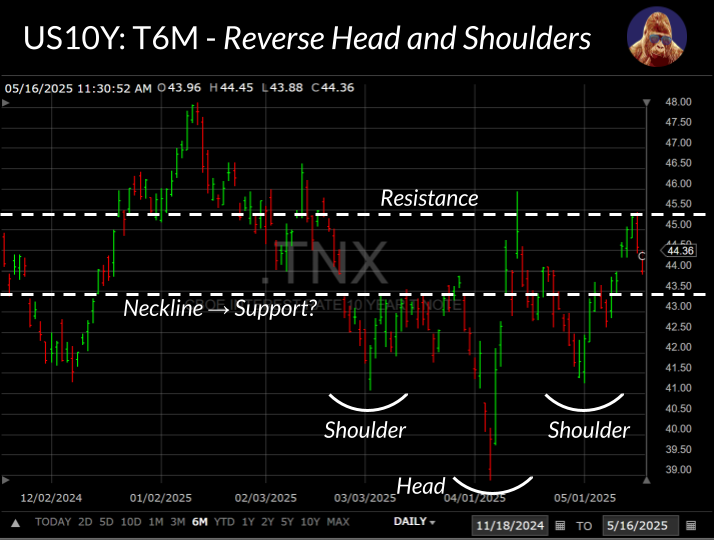

Technician’s Look: US10Y Yield

To start May, the benchmark US10Y yield executed a perfect reverse head-and-shoulders move. However, it was unable to break beyond resistance just a touch higher. Given the lack of new data over the next month, I see a backdrop where yields remain range-bound between the neckline at 4.325% and overhead resistance at 4.55%. In my opinion, a period of low bond market volatility fosters an accommodative backdrop for breadth expansion and single-stock breakouts as the broader averages consolidate.

The Last Tame Inflation Report

CPI and PPI for April were unexpectedly benign. Many who predicted otherwise were quick to go on the record claiming this month will be the last of the tame inflation data. When we get data for the month of May in June, they say, tariffs will begin to adversely affect the numbers.

Maybe so.

Perhaps built-up inventory has finally turned over. During their quarterly call, Walmart announced tariffs were still too high and that the company could be forced to raise prices as soon as this month (May). Walmart is an S-tier business when it comes to scale. If they’re feeling inflationary pressure, it’s hard to imagine it isn’t worse elsewhere.

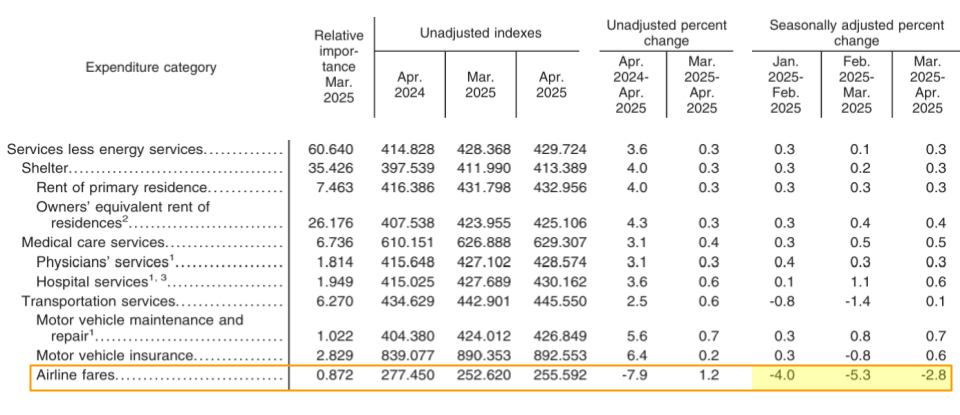

I’m of the opinion that tariffs will increase goods inflation at the expense of services inflation. As households are forced to spend more on basic goods (food, insurance, medicine), they won’t be able to spend on services, which leads to disinflation or deflation in those components.

We’re already beginning to see it in travel. The airline fares component of CPI has been in deflation for the past three reports. Assuming services continue to carry a greater weight in inflation measures (>60% in CPI), I think that in the event we experience material goods inflation, it will be masked by the resulting disinflation/deflation in services inflation.

S&P flash U.S. Services and Manufacturing PMI (May)

- Services PMI is expected to print 50.8, in line with last month’s result.

- Manufacturing PMI is expected to print 49.8, slightly down from the prior 50.2.

Micro Movers

The Easy Money’s Been Made

The S&P 500 gave you all of five seconds to buy at 18x earnings at 4800. Now, it’s back to trading north of 20x. The easy money has already been made, and it was made quickly. At this point, there isn’t much room for negative narrative divergence. Could the S&P 500 make a new high? Of course it could. We’re only ~3% off the high. It would be silly to rule it out.

In my opinion, the price action suggests the tariff saga is over. Deals are in the hopper, and carve outs make it so that substantial contributors to index earnings won’t endure a multi-quarter dip. While the economy may slow, it likely won’t slow to the point where C-suite decision-makers are forced to lay off enough workers to create a true recessionary backdrop. The bad part of Trump’s agenda is through. Now, we can focus on the good stuff: tax and deregulation.

You don’t need to agree with that assessment. I am not sure that it is my assessment. I just believe this is what price is saying.

There are too many crosscurrents to be sure. When I find myself in these situations, I tend to lean on what the market—the collective brain trust made up of the world’s financial capital—is saying. To that point, a plethora of technical and momentum indicators, alongside a number of historical precedents, all suggest the bottom was made at 4800. To breach it, a new bear would need to enter the woods.

Are We Back To Promises of Trump 2.0?

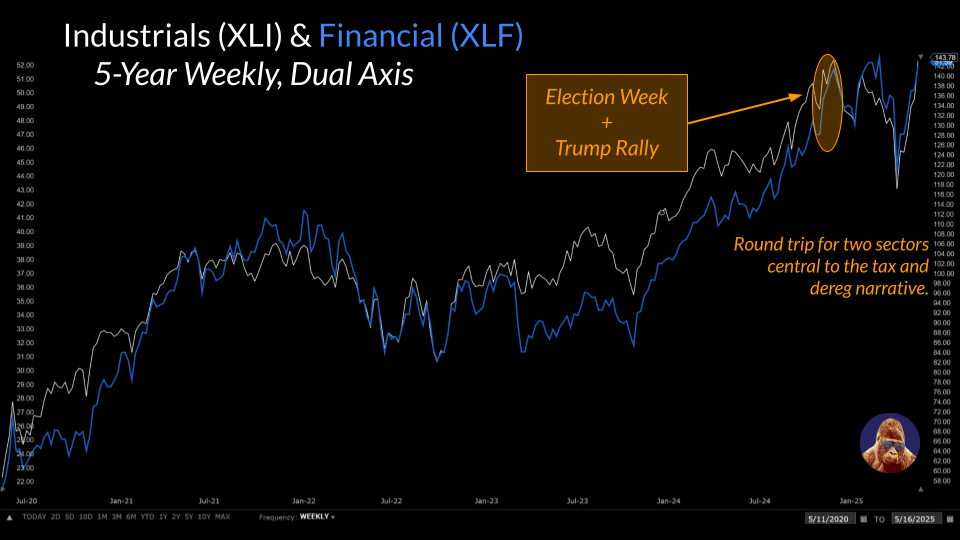

It seems as though the animal spirits that came alive following Trump’s victory last November are making a comeback.

We went into his presidency forecasting a resurgence in M&A and IPOs. Now that the market is on better footing, corporate leaders are taking their shot. Last week, Charter announced a deal to buy Cox, and Dick’s Sporting Goods announced a deal to acquire Foot Locker. CoreWeave reported a quarter with 420% (nice) revenue growth that sent the stock to a new high. Etoro (ETOR), a Robinhood (HOOD) competitor with deeper ties to crypto, opened at $69.69 (again, nice), which was 34% higher than the IPO price.

That’s not all. Industrials (XLI) and financials (XLF) are on the precipice of new all-time highs. It’s hard to argue this isn’t the result of the market pivoting its focus from tariffs to tax and deregulation.

In my opinion, his trip to the Middle East reemphasized his traits as the businessman the market was originally excited to have in office. Peter Navarro—a voice the market has particular distaste for—is a few weeks away from showing up on the back of milk cartons. While the easy money has been made, I believe there are still clear opportunities in stocks to outperform an S&P 500 that I expect needs to consolidate before its next move.

Earnings Highlights

- Home Depot (HD): While pressure on the US10Y has eased, the 20Y and 30Y still remain near the highs. This creates a headwind for construction, but the renovation side of the business and the upcoming planting season offer reasons to stay optimistic. Same-store sales will be the metric to watch.

- Palo Alto (PANW): With markets in a better mood, the stakes don’t feel as high for PANW. Regardless of the business climate, cybersecurity budgets don’t get cut. Unless this quarter is a thesis-changer, you can buy the big three on dips: CRWD, FTNT, and PANW (no particular order).

- Toll Brothers (TOL): As a homebuilder operating in the luxury price range, I’ll be interested to hear management’s comments on the business environment for the higher-end market.

- Target (TGT): The price doesn’t imply expectations are high. Maybe for good reason. Walmart has been the superior operator since COVID. Given what Walmart said, I can’t see a scenario where Target is thriving.

- TJX (TJX): I sold this one too early. It has limited exposure to tariffs and will benefit by offering lower prices for comparable goods than competitors. I expect higher inflation expectations to intensify the psychological payout surrounding the “treasure hunt” experience TJX offers shoppers. This stock acts funny around earnings. You can’t just rely on the post-earnings reaction. Be sure to give it a listen to understand what’s really going on.

I am long PANW.