Weekly Performance

| S&P 500 | 5.70% |

| Equal Weight S&P 500 (RSP) | 7.43% |

| NASDAQ | 7.29% |

| DOW | 4.95% |

| Russell 2000 | 1.82% |

Talk of the Tape

Trouble in the bond market forced a tariff about-face. While the bond market did not respond much to the announcement, stocks sprung higher in relief as shorts were forced to cover and longs shored up positions.

The Week Ahead

Monday

- Goldman Sachs (GS)

Tuesday

- Bank of America (BAC)

Wednesday

- U.S. Retail Sales

Thursday

- Netflix (NFLX)

- Taiwan Semi (TSM)

- United Health (UNH)

- American Express (AXP)

Friday

- Market Closed: Good Friday

Macro Movers

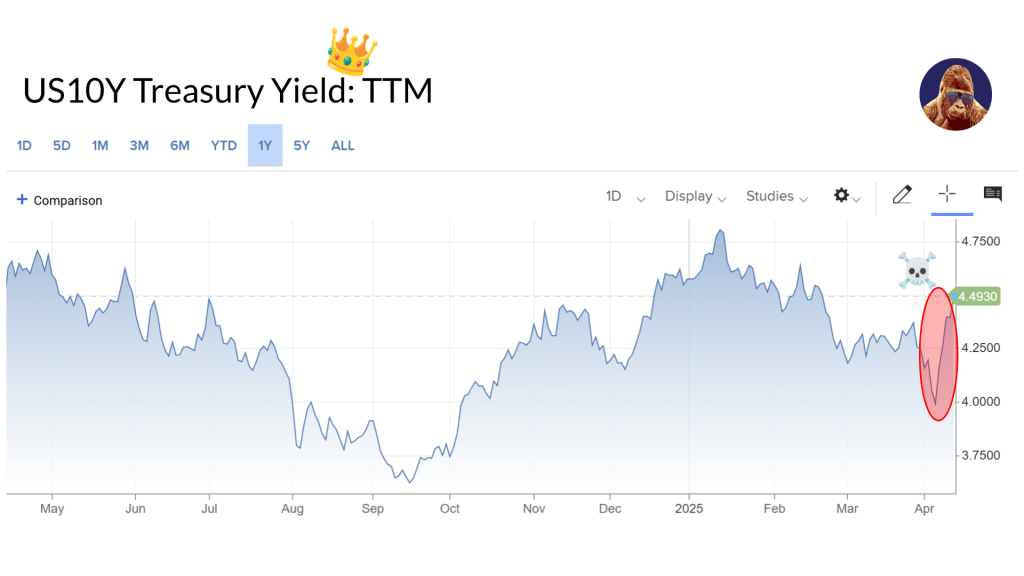

Write this down so you don’t forget: April 9th, 2025 – proof that bonds are king.

While the tariff-policy pivot likely stemmed from a combination of factors, the timeline makes one thing clear—the bond market was the primary force. After this week, we can put to rest the debate surrounding the “Trump Put”. It exists; It’s just not triggered by equities—it’s pulled by Treasuries.

It cannot be overstated how much worse a bond market event is compared to a stock market event.

A prolonged equity drawdown signals weakness and could lead to a downturn. But bonds? Bonds can create a downturn.

Take 2022: Recession fears stemming from the Fed’s rapid rate hike cycle drove a decline in stocks. Gradually throughout the year, corporate leaders—especially in tech—found fiscal religion by cutting the fat, trimming underperformers, and becoming leaner organizations. It wasn’t fun, but once it became clear a recession wasn’t materializing, equities roared back in 2023 and 2024.

Bonds are different.

Lose control of the bond market, and you risk losing the economy in real time. Adjustable-rate debt becomes unmanageable. Companies tighten spending or cut workers to stay solvent. Even those with fortress balance sheets delay expansion and hiring plans.

In short: the stock market demands eventual attention. The bond market demands immediate action.

Although all eyes should be on the bond market, specifically the 10- to 30-year Treasuries, Wednesday’s retail sales report is still consequential. Thanks to the very public nature of tariff negotiations, price concerns have gone mainstream. I expect adjustments to consumer behavior showing up as a weak print.

If the number misses meaningfully, we really ought to consider giving the Fed tariff power. Yes, I’m kidding. But, a data-driven argument could be made that three months of tariff threats have done more to crush demand and inflation than a full year of rate hikes (March 2022 to July 2023).

Of course, that argument falls apart when you consider Powell acted with the Fed’s dual mandate of maximum employment in mind. His approach was built to be less disruptive. Perhaps if Powell had mimicked Trump’s disregard for market stability by threatening to “go full Volcker” for three months, we’d be staring at similar outcomes—something we’ll pick back up in the micro section.

U.S. Retail Sales (March)

- Headline Retail Sales: 1.2% expected vs. 0.2% prior

- Minus Autos: 0.4% expected vs. 0.3% prior

Micro Movers

Weeks like these are a perfect reminder of why staying invested—especially when it’s uncomfortable—matters.

- 6 of the 10 best days in the past 20 years occurred within just two weeks of the 10 worst.

- Missing the 10 best days over a 20-year span can cut your total return in half.

- The best days often follow the worst.

To that final point: Wednesday’s rally—sparked by the administration’s tariff about-face—marked the S&P 500’s largest one-day gain since 2008, and its third-largest post-WWII advance (per CNBC). It followed a brutal four-day stretch where the index dropped 12% at a speed not seen since COVID.

While it felt good, let’s not confuse a rally with resolution.

Volatility like this isn’t a hallmark of a healthy market, especially not in fixed income. While money center banks posted stellar quarters and maintained guidance, a 90-day tariff pause may buy time but it doesn’t change the state of play.

Since February—if not earlier—corporations and households have been freezing economic decisions due to tariff uncertainty. In my view, a 90-day delay doesn’t reset the clock; it just extends the same paralysis. The longer this uncertainty keeps decision-makers on hold, the deeper the potential hit to earnings and the more severe any resulting recession could be. As such, here’s what Wednesday’s policy reversal didn’t change or improve:

- Concerns surrounding earnings guidance. Policy remains too uncertain for rosy forecasts.

- The timeline for laid-off public employees to be absorbed by the private sector (reprivatization) didn’t improve. Businesses aren’t going to hire while a tariff-driven recession is on the board.

- Risks associated with a negative wealth shock: the sudden, sharp drop in portfolio values causing consumers to pullback and defer spending, which is a legitimate threat to any service-driven economy.

That said, I see the S&P 500, 13% off the high, as the market pricing-in some damage to 2025 earnings. The key question is: how does the actual damage compare to what ~13% off the high prices in? That spread will determine how equities hold up during this stretch.

That said, let’s not understate what may have changed last week.

Navarro and Lutnick seem to be losing influence, while Bessent appears to be gaining the President’s ear. If that dynamic holds, I view it as a bullish development. Bessent is the adult in the room—and the market knows it.

One last point: stocks typically bottom about nine months before earnings do. So, if Q2 or Q3 turns out to be the low point for 2025 earnings, the market may have already hit its bottom. The sooner we get clarity on tariffs, the more likely it is that Q2 will be the trough. But you won’t know for sure until it’s in the rearview mirror—and by then, if you panicked and sold, it will be too late to get back in. Another reason it is notoriously hard (and sometimes punitive) to time the market.

In the interest of time, here’s a quick note on each company in lieu of a more in-depth breakdown:

- Goldman Sachs (GS) – IPO hopefuls are likely to stay sidelined during this volatile stretch, which won’t help GS’ bottom line. The tone of guidance may be bleak, but how the market reacts will be telling. A sustained rally on bad news could signal the worst is priced in, which makes for a great trade setup.

- Bank of America (BAC) – Arguably no firm has better real-time data on U.S. households. Expect the Street to listen closely for any shifts in broader consumer behavior on the call.

- Netflix (NFLX) – More defensive than many expect. Even if unemployment ticks up, the Netflix subscription is likely to be one of the last cuts. When I said I bought that ugly Friday, this was one of the names I bought. I’d do it again if the market allows me.

- Taiwan Semi (TSM) – This name features both tariffs and economic risk. The reaction to this quarter will be an important gauge of sentiment. With Apple and Nvidia as customers, their revenue outlook will offer clues on how, if at all, this macro uncertainty is affecting demand for AI-GPUs.

- UnitedHealth (UNH) – Up ~18% YTD while many others find themselves in bear markets (or worse), UNH continues to benefit from a defensive bid and improved CMS payouts. The question now is whether earnings trigger profit-taking or draw in more safe-haven seekers. If we get the former, it could start a rotation out of defensives and into quality growth.

- American Express (AXP) – Their more affluent customer base offers a unique lens into how the wealthy are handling rising economic anxiety. I’ll be watching closely for any flagged shifts in spending that might suggest a negative wealth shock is starting to unfold.