Weekly Performance

| S&P 500 | -9.08% |

| Equal Weight S&P 500 (RSP) | -7.97% |

| NASDAQ | -10.02% |

| DOW | -7.86% |

| Russell 2000 | -9.70% |

Talk of the Tape

Wednesday’s tariff announcement from the rose garden shocked markets, across asset classes and globally. Equities tallied their worst single-day performance since COVID as markets tried to come to terms with a potential reality beyond the worst case.

The Week Ahead

Monday

- n/a

Tuesday

- n/a

Wednesday

- “Reciprocal” Tariff Deadline

Thursday

- CPI

Friday

- PPI

- Big Bank Earnings

Macro Movers

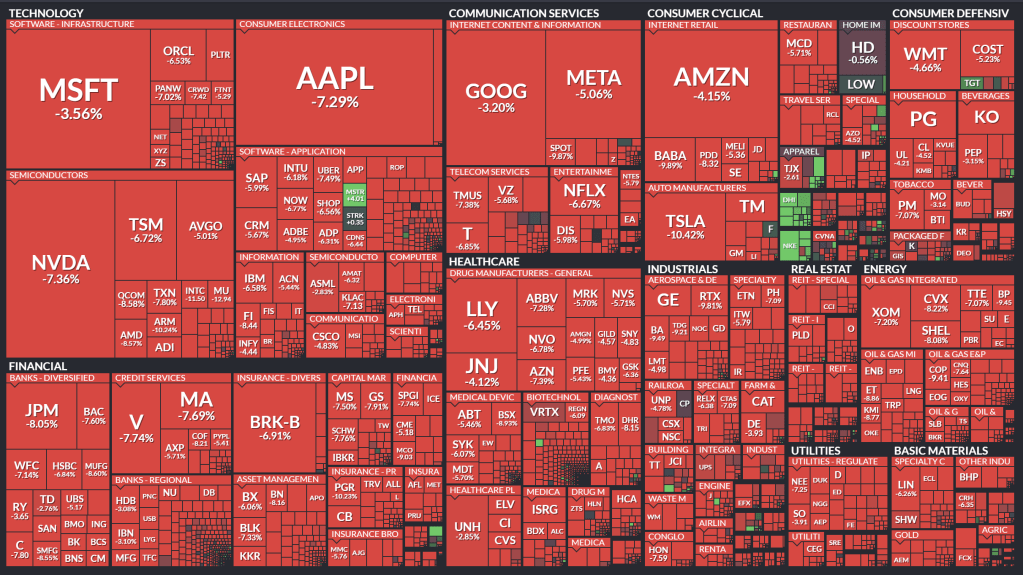

The Rose Garden rollout resulted in a bloodbath.

Not only did the tariffs far exceed expectations, but the “reciprocal rate” formula did not appear to be based on the premise of fairness, as the administration claimed, or reciprocity, as the name implies. The tariffs came off as mercurial, not methodical—further complicating an already complex issue.

The reaction was swift and cut across asset classes. Major U.S. indices were hit with high single-digit to double-digit losses. International equities fared better but still declined. Yields fell. Commodities slid—oil, natural gas, and copper hit new lows—while gold outperformed as a safe haven. Even after a strong March Payrolls print, Fed Funds Futures now project five rate cuts this year; prior expectations were for only two. The message? If this sticks, growth will slow.

Heading into this week, it feels like we’ve entered the negotiation phase.

While damage to U.S. brands and trust can no longer be undone with a single social media post, enduring economic damage can still be avoided.

Although the 10% baseline tariff on all imports went into effect over the weekend, the single-country “reciprocal” rates don’t take effect until Wednesday, April 9th. There’s still time for carve-outs and exemptions—for specific companies (perhaps Apple or Oracle) or for “good actor” countries like Vietnam and India. Although inflation data will be closely watched, I expect tariffs to dominate price action: relief on news of negotiations, carve-outs, or exemptions; pain on news of retaliatory tariffs or the emergence of new trade blocs.

Speaking of inflation, CPI and PPI are scheduled for Thursday and Friday, respectively. Despite the tariff escalation, Powell reiterated on Friday that the Fed doesn’t need to rush its response. And while softer CPI and PPI prints could justify the Fed’s patience, I’m not convinced it will matter. As with Payrolls, good news is welcome, but the scale of these tariffs—if left in place—threaten to reverse any positive trends in the macro data.

Consumer Price Index (CPI)

- MoM headline CPI: 0.1% expected (vs. 0.2% prior)

- YoY headline CPI: 2.5% expected (vs. 2.8% prior)

- MoM core CPI: 0.3% expected (vs. 0.2% prior)

- YoY core CPI: 3.0% expected (vs. 3.1% prior)

Producer Price Index (PPI)

- MoM headline PPI: 0.2% expected (vs. 0.0% prior)

- YoY headline PPI: 3.3% expected (vs. 3.2% prior)

- MoM core PPI: 0.3% expected (vs. -0.1% prior)

- YoY core PPI: 3.6% expected (vs. 3.4% prior)

Micro Movers

So, I’ll start by saying this: I bought Friday’s close.

Only the hits—core holdings, high conviction names. If this ends up looking stupid in year, so be it. I’m in the accumulation phase. I won’t need access to the money I just put to work for another 10+ years. And if you, too, have a long time horizon, history suggests you’re better served panic buying than panic selling in moments like this.

And boy oh boy, did we panic on Friday.

Check the box for a VIX spike—it closed at 45. The RSI on the S&P 500 is in oversold territory at 23.25, the lowest reading since COVID. Still not convinced? According to Finviz’s dashboard, which tracks ~10,000 stocks across the AMEX, Nasdaq, and NYSE, Friday’s session featured:

- 86% of stocks declining (only 11% advancing)

- 97% of stocks making new 52-week lows (just 3% making new highs)

- 87% of stocks now below their 50d SMA

- 82% below their 200d SMA

Is this capitulation? Are the sellers out of stock to sell? Based on Sunday futures, nope, which is fine because I’m not calling a bottom. If the headlines worsen, stocks could absolutely puke again. That said, Friday definitely felt like a washout, which suggests the next wave of selling may be less severe. We won’t need to wait long to find out. In moments such as these, I look for the market to rise—or at least stop falling—on bad news to gauge if we’re nearing a tradeable bottom. We haven’t had that yet.

I still believe this situation is similar to Jackson Hole 2022.

Powell’s explicit warning of economic pain kept markets in a downtrend until hints the view was no longer held. A tradeable bottom and a solid rally took shape well before we got the all-clear from Powell himself months later.

Applied to today, rallies will not be trusted until the Trump administration blinks or declares victory. Waiting for that verification is fine, but the opportunity cost is the meaningful rally that occurs before the all-clear. That’s the cost of not taking advantage of days like Friday, or worse, panic selling into them.

I would feel better if I felt better about earnings season.

A number of big banks usher in earnings premarket Friday. While front-running tariffs may buoy current quarters, this market trades on forward guidance, which is the root of my concern. Given the multinational nature of so many companies, management teams may struggle to issue guidance at all, let alone something analysts can believe in or model.

If there’s another shoe to drop, it’ll come as individual companies turn in quarters with questionable or downward guidance that justify revisions to full-year S&P 500 (or your index of choice) earnings.

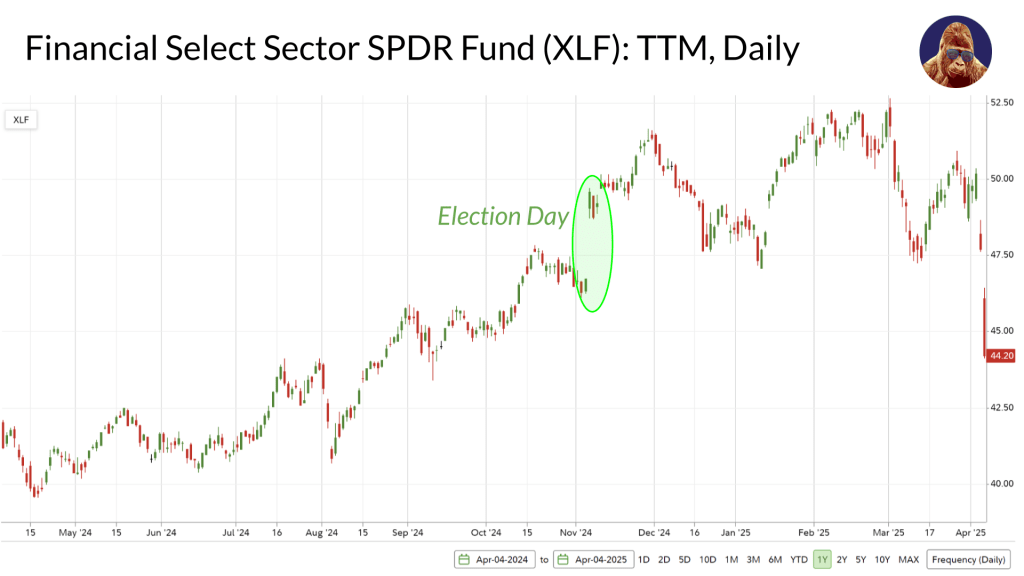

Big Banks – Earnings Kickoff

JPMorgan (JPM), BlackRock (BLK), Wells Fargo (WFC), Bank of New York Mellon (BK), and Morgan Stanley (MS) all report Friday before the bell, ceremoniously ringing in a new earnings season.

These names got slammed. The sector has given up all of its post-election gains and is down ~8% YTD. You could argue that these banks are no longer pricing in any of the upside associated with the Trump administration’s agenda for tax cuts and deregulation. In fairness, it’s unlikely they get to enjoy the full potential of that upside if tariffs send the global economy into recession. Not my base case, simply explaining why that upside is not likely priced-in.

These stocks are oversold, but an oversold stock can get more oversold. I do, however, expect U.S.-centric banks, such as WFC, to strike a lighter tone and perhaps be better positioned (especially given the solid quarters from Cintas and PayChex) than more international-reaching banks like JPM.