Weekly Performance

| S&P 500 | -1.53% |

| Equal Weight S&P 500 (RSP) | -1.63% |

| NASDAQ | -2.59% |

| DOW | -0.96% |

| Russell 2000 | -1.64% |

Talk of the Tape

Although the averages notched two solid up days to start the week, Wednesday’s surprise tariff rhetoric and Friday’s hotter-than-expected PCE print triggered a sharp downside reversal.

The Week Ahead

Monday

- n/a

Tuesday

- JOLTs

Wednesday

- April 2nd Tariff Deadline

- ADP Employment

Thursday

- Conagra (CAG)

- Lamb Weston (LW)

Friday

- Payrolls

Macro Movers

Coming out of the last Fed meeting and PPI release, the consensus was clear.

The Fed was in a good position to watch and wait. The updated dot plot echoed the stance Powell had laid out at the monetary policy forum: steady hands, no rush. Despite February’s PCE coming in more or less in line, many were quick to assign Friday’s sell-off in equities as a revision to that consensus.

I don’t buy it. Neither did the bond market. Treasury yields, which had climbed in sessions prior on inflation fears, fell after the PCE print: a dovish reaction.

Although I can’t prove the counterfactual, I believe equities would’ve sold off even if PCE had surprised to the downside. The narrative likely would’ve shifted to a reluctance to celebrate backward-looking inflation data with two major catalysts—clarity on tariffs (hopefully, April 2nd) and hard data like Payrolls—just days away. With two high-stakes events just days away, it simply doesn’t make sense to get all bulled up ahead of the results. I wouldn’t love that explanation, but I could understand it.

That brings us to this week, which is critical for the broader debate.

Is gloomy soft data (sentiment) bleeding into hard data (job creation, layoffs, wages, spending, earnings) that drive stock prices? Personally, I think those forecasting the vibe-cession turn into a recession underestimate two things: the American consumer’s propensity to spend, and corporate America’s hesitation to cut headcount prematurely after the COVID experience. That said, I’m open to being proven wrong and adjusting my opinion accordingly.

While the debate will continue beyond this week, I expect this stretch of data to meaningfully influence the tone going forward. Below is a preview of the most important upcoming releases and how they may shape that conversation.

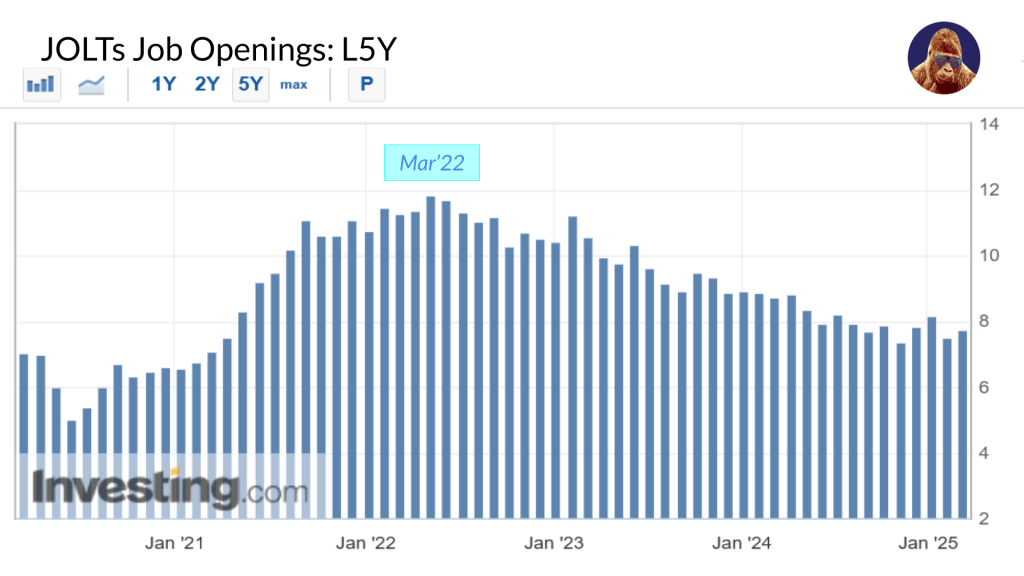

JOLTs (Job Openings)

While the JOLTs report includes several labor market details, job openings are the focal point. Openings have steadily declined since peaking in March 2022, and this month’s print is expected to come in flat at 7.7 million.

A meaningful downside miss would reinforce the idea that corporate America is growing more cautious. Corporations hire less when expecting less. On the other hand, given how low sentiment sits, even a modest upside surprise could meaningfully improve the market’s footing ahead of the rest of this week’s key releases.

ADP Employment

ADP measures private-sector employment. While headline job creation typically gets the most attention, I also keep a close eye on the wage data.

DOGE-related layoffs should, over time, push more ex-government employees into the private sector. That influx shifts the balance of power toward employers, allowing them an upper hand in negotiating starting salaries and to issue smaller bonuses or raises to retain talent compared to last year.

While we may see economic uncertainty (tariffs) adversely impact headline job creation, I think it’s still a little early to see the potential dovish impact of DOGE on wage metrics. Many of those impacted, directly or indirectly, are likely still on severance or collecting unemployment benefits, and haven’t yet re-entered the private workforce in large enough numbers to tip the scale.

- Headline job creation (payrolls) is expected to print 120k, a notable improvement from the prior month’s 77k.

- Last month, wages for job stayers and changers grew at 4.7% and 6.7%, respectively.

March Payrolls

This is the most important release of the week. The key line items are headline job creation, the unemployment rate, and hourly wages.

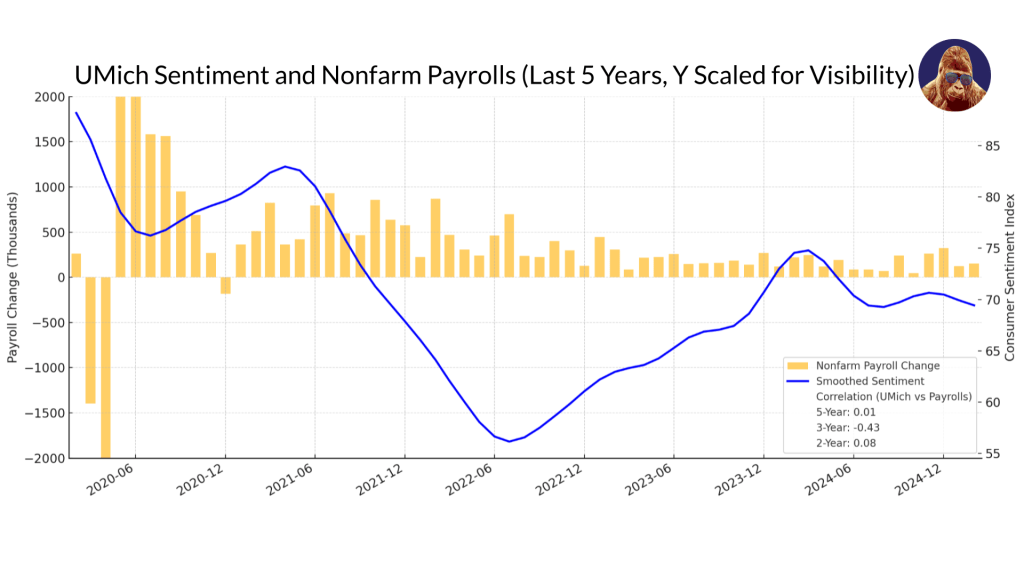

The core fear is that tariff chaos and DOGE-related disruption will ultimately dent job creation and push unemployment higher. As households—whether directly affected or know someone who has been—begin cutting back spending in response, the shortfall eventually hits corporate earnings, which drives stock prices. While the chart above indicates sentiment does not correlate well to payrolls, that doesn’t guarantee this time won’t be different.

As such, upside surprises in job creation and a steady unemployment rate should help create a durable foundation for stocks. Wages will be watched, but in my view, they’re secondary for now.

- Job creation is expected to print at 140K, down from 151K last month.

- The unemployment rate is forecasted to remain unchanged at 4.1%.

- Average hourly wages are expected to rise 0.3% MoM (same as last month) and 3.9% YoY (down from 4.0%).

Micro Movers

There isn’t much on the earnings calendar this week. And even if there were—absent a Mag 7 name—it likely wouldn’t matter. Right now, nothing a company says can outweigh what’s coming from the macro. That said, it’s worth taking a moment to talk CoreWeave and two companies I’ll be lending an ear to when they report this week.

Everything the Market Hates IPO’d: CoreWeave

CoreWeave’s IPO raised $1.5B, making it the largest U.S. tech IPO since 2021. It represents the only pure-play data center operator running an infrastructure-as-a-service model. While the stock didn’t do much in its first session, I don’t think anyone (except the bears) walked away feeling emboldened by the debut.

After initially setting a range between $47–$55, bankers settled for $40.

That’s not supposed to happen.

That wasn’t the only red flag: big insider selling, the reduced initial price, talks of downsizing the issue made this a rough setup from the start. CoreWeave is the exact kind of company the market hates right now: high-growth, high-debt, no profits, and an unfathomably long runway (big future growth prospects).

This IPO is emblematic of the current investing landscape: there’s simply too much macro uncertainty for the market to reward (or give the benefit of the doubt) a company based on what it might do years from now.

Even if it had IPO’d a month earlier—under more favorable conditions—I still would’ve had concerns due to the company’s heavy customer concentration. That said, CoreWeave may prove useful as a sentiment gauge. How the stock behaves in the weeks ahead could tell us a lot about how the market views longer-duration assets.

Food Inflation: Conagra (CAG) & Lamb Weston (LW)

A key contributor to the soft-data-driven vibe-cession is persistently high grocery bills. Scarcity has played a role. Whether it’s natural disasters or crop disease disrupting yields, or avian flu literally killing egg producers, supply has decreased while demand holds steady.

This week’s quarters from Conagra (Act II, Slim Jim, Swiss Miss, etc.) and Lamb Weston (Grown In Idaho) will provide more than just a read on supply chain logistics and pricing dynamics. They’ll also give us insight into how consumers are responding to high food prices. When times are tough, consumers often trade down to cheaper private label brands. However, it’s important to keep in mind that GLP-1s have already taken a meaningful bite out of demand for all things snacks.