Weekly Performance

| S&P 500 | -2.27% |

| Equal Weight S&P 500 (RSP) | -1.28% |

| NASDAQ | -2.43% |

| DOW | -3.07% |

| Russell 2000 | -1.51% |

Talk of the Tape

Despite dovish surprises in inflation data, the averages extended their decline for another week. However, Friday’s rally—despite worsening sentiment data—offered a glimmer of hope that markets may be reaching a near-term bottom.

The Week Ahead

Monday

- U.S. Retail Sales

Tuesday

- Xpeng (XPEV)

Wednesday

- FOMC Meeting

- Ollie’s (OLLI)

Thursday

- Initial Jobless Claims

- Micron (MU)

- FedEx (FDX)

Friday

- n/a

Macro Movers

The Case For Optimism

Risk has returned to risk-assets, and recession concerns tied to government policy errors are gaining more credibility. That said, let’s not operate under the premise that everything is bad. Despite the rapid correction, the S&P 500 still trades north of 20x earnings. If everything were bad, the multiple wouldn’t have a 2-handle.

So, not be cavalier about the current risk set, but here are a few macro positives worth noting:

- Oil prices are low – Both WTI and Brent are at six-month lows, which is a tailwind for consumer spending.

- Yields have stabilized – The US10Y yield looks poised for a mean reversion move higher, which could support growth sentiment.

- Labor market resilience – February Payrolls didn’t show a sharp slowdown in job creation, a spike in unemployment, or a flare-up in wage inflation.

- Inflation remains contained – CPI was benign, PPI was flat. This backdrop leaves the U.S. economy in a strong position to deal with tariffs and allows the Fed room to be accommodative if needed.

Of course, markets front-run fundamentals. This correction—driven by a notable shift in soft data (consumer sentiment, inflation expectations)—suggests the market is pricing in a deterioration of at least some positive factors. Historically, once a 10% decline is reached, further downside typically requires confirmation from hard data—a hot CPI or PCE print, a spike in unemployment, weak Payrolls—or an exogenous shock. Given that Friday’s rally occurred despite worsening soft data, there is—albeit based on just one day of trading—some evidence that the market has priced-in soft data weakness and will require hard data to deteriorate before declining further.

This week belongs to Powell and the FOMC.

While there’s risk associated with a new set of dot plots, the data flow—ADP, Payrolls, CPI, and PPI—has all gone the Fed’s way. It reinforces the calm and clear messaging Powell delivered at the Monetary Policy Forum in early March.

In short, the door is open for a “business as usual” FOMC meeting, where the Fed holds rates as expected, and Powell says a lot without saying much at all. Given the mess of mixed messaging over the past month, markets would likely welcome a straightforward, uneventful Fed meeting. While this may not end the buying-strike on Wall Street, it has the potential to improve morale, at least temporarily.

U.S. Retail Sales

January’s contraction—both headline and ex-autos—was largely attributed to poor weather. February’s report will tell us if that consensus was correct and whether weak consumer sentiment data has actually impacted spending.

- Ex-autos: Forecasted at +0.3%, rebounding from -0.4% prior.

- Headline retail sales: Expected at +0.6%, a modest bounce from January’s -0.9%.

FOMC Meeting

- CME FedWatch Tool: 98% probability the Fed holds rates steady.

- Will the dots or Powell’s tone/answers hint at a dovish or hawkish tilt?

Initial Jobless Claims

- Consensus is 222K, essentially flat versus last week’s 220K.

Micro Movers

What We Need For Stocks To Bottom

It’s important to remember what caused this correction—the Trump administration’s refusal to rule out a recession.

Trump, Bessent, and Lutnick may use different diction, but the message is the same: the next few months could be turbulent as they right-size the federal government (DOGE) and level the playing field for U.S. businesses (tariffs). The thesis behind reprivatization is that reducing government involvement in certain functions will allow the private sector to step in—creating better jobs and operating more efficiently than the public sector. The expectation is that—after an unavoidable transition period—this shift will lead to a stronger, more dynamic economy as private businesses replace government-led inefficiencies.

The administration’s unwillingness to rule out a recession during this reprivatization push suggests they see it as an acceptable trade-off and won’t step in to prevent an economic downturn. That stance raises the question: why put money to work if we’re on the edge of a policy-driven recession?

An adversarial White House caused this correction—that stance needs to change before it’s “safe to buy” again. But markets will bottom before we get that rhetoric. Remember, price front-runs fundamentals, meaning stocks will turn before the all-clear signal arrives.

Jackson Hole 2022 seems a fitting analog.

Powell explicitly warned that taming inflation would require economic pain. Markets vomited and kept falling until hints of a Fed shift away from peak hawkishness emerged. I believe the market will need a similar catalyst before a bid returns.

With that, let’s talk about corporate earnings this week.

With the FOMC meeting in focus, earnings will take a backseat. That said, a few companies stand out—not because they’ll move the averages, but because their results could provide incremental insight into important market narratives that may not immediately reflect in stocks and yields.

Xpeng (XPEV)

Tesla’s weakness in international markets—particularly the EU—has been linked to consumer boycotts stemming from Elon Musk’s ties to the Trump administration. While Xpeng primarily operates in China, their international expansion plans and sales commentary could reinforce or counter the narrative surrounding Tesla’s challenges overseas.

Ollie’s Bargain Outlet (OLLI)

Following last week’s Dollar General (DG) report, OLLI offers another anecdotal look at the U.S. consumer. While DG popped, it wasn’t for reasons that fed recession fear—the upside came from plans to downsize, not an upside fundamental surprise caused by recession-driven trade down.

Similar to Dollar General and Dollar Tree, I view OLLI’s report as a way to help gauge the consumer, providing insights that won’t be reflected by yields or the broader averages.

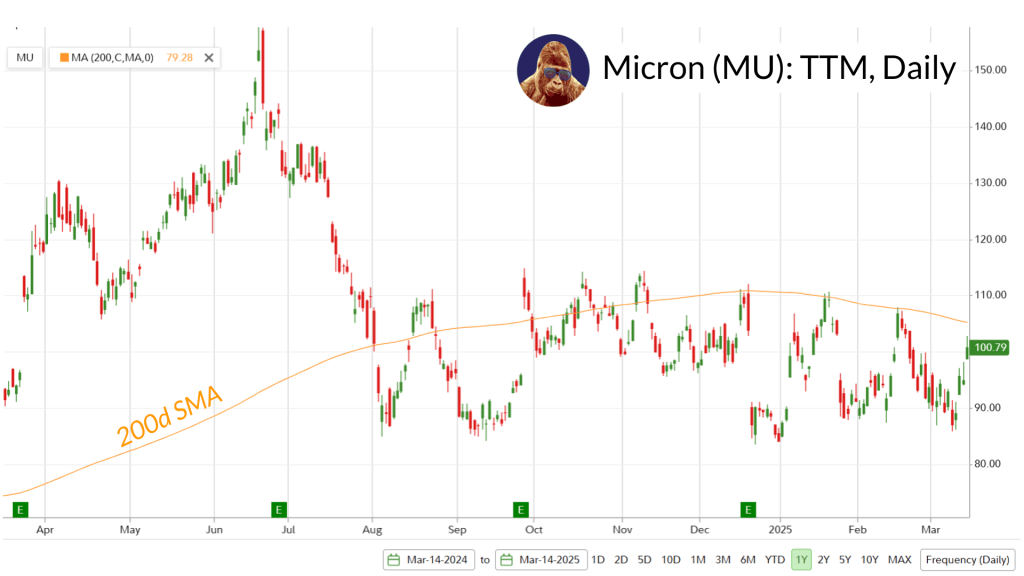

Micron (MU)

For the first time in roughly a month, semiconductors (SMH) posted a positive week. I’ve been bullish—and therefore wrong—on Micron for the last 6-8 months, but I still see opportunity.

On the growth side, Micron supplies high-bandwidth memory (HBM) necessary for Nvidia’s AI (Blackwell) and gaming (RTX) hardware. On the regulatory side, while tariffs and export restrictions are still an overhang, I maintain my view that Micron’s U.S. manufacturing presence makes it a uniquely insulated pick in the sector.

Since topping last June, MU has been range bound ($85-$110). Last week, MU defended the lower bound ~$85. At ~$100, expectations feel balanced for the quarter. While the sector hasn’t received the benefit of the doubt since the calendar turned, I see a plausible scenario where Micron benefits from increased orders as companies look to secure domestic semiconductor supply to avoid potential tariff-related disruptions.

FedEx (FDX)

Unlike the others, FedEx has a non-zero chance of becoming a macro event.

As a widely held bellwether of global logistics, FDX punches above its weight. While I don’t foresee the quarter as a negative macro catalyst, it’s worth noting that their September 2022 quarter was exactly that during the 2022 bear market.

Clearly, today’s situation is notably different from September 2022: recession fears were much higher, and the S&P 500 was flirting with a bear market (20% decline as opposed to the current ~10% correction). That said, similar to today, consensus at the time was that a tradeable bottom based on technicals and sentiment was forming. Then, FedEx CEO Raj Subramaniam openly called out a global slowdown, triggering another leg lower.

Could history repeat? Possible, but unlikely.

Unlike in 2022, the economy isn’t perceived to be on the brink, and there’s even a scenario where tariff front-running boosted FedEx’s numbers, which I imagine will soften management’s tone. However, if their guidance signals serious demand concerns, similar to Delta’s recent quarter, investors may double down on growth fears and hit the sell button—not to the same magnitude of 2022, but still something to keep in mind when they report Thursday night.