Weekly Performance

| S&P 500 | -2.58% |

| Equal Weight S&P 500 (RSP) | -2.32% |

| NASDAQ | -2.71% |

| DOW | -2.46% |

| Russell 2000 | -3.65% |

Talk of the Tape

Although Friday featured a nice reversal, all major averages moved lower as growth concerns outweighed bullish results from Broadcom and a dovish Payrolls print.

The Week Ahead

Monday

- Oracle (ORCL)

Tuesday

- JOLTs

- Kohl’s (KSS)

- Dick’s Sporting Goods (DSG)

Wednesday

- CPI

Thursday

- PPI

- Dollar General (DG)

- Ulta Beauty (ULTA)

Friday

- UMich Consumer Sentiment

Macro Movers

Last week’s economic data provided concrete evidence that DOGE-related impacts are surfacing beyond just sentiment data.

ADP came in soft, and layoff announcements hit their highest level since 2020. While DOGE-driven effects didn’t show up in government payrolls—which I interpret as a small victory for inflation doves—some underlying metrics painted a tougher environment for consumers. Rising underemployment, lower labor force participation, and more workers taking part-time roles for economic reasons all suggest it’s becoming incrementally harder to make ends meet.

Chairman Powell was the real hero last week. The market was ready to dismiss the dovish payrolls report until headlines from the U.S. Monetary Policy Forum hit. His calm, clear message that the Fed is in a comfortable position to hold rates steady injected enough confidence—and removed enough policy uncertainty—to stabilize markets. As his words hit the wire, major averages and the US10Y yield both bottomed and drifted higher into the close.

This week will be about inflation… and maybe reciprocal tariffs if Trump was serious about accelerating the timeline.

Before we get to CPI and PPI, we’ll see the JOLTs report Monday morning. It covers January, which we now know was weakened by weather. Worth mentioning given increased labor-market scrutiny, but ultimately too stale to have a lasting impact.

CPI takes center stage Wednesday, followed by PPI on Thursday. Fingers crossed these reports reinforce Powell’s calm, confident stance on inflation that stabilized markets on Friday.

Finally, we close out the week with the preliminary UMich Consumer Sentiment reading for March. Last month’s significant miss sent a clear message: Trump’s election honeymoon is over. Some argue that weakened sentiment puts consumer spending at risk, thus the decline in stocks and bond yields. I don’t hate that take, but I’m in the camp that these surveys are better predictors of future approval ratings than actual spending.

To that point, job security—not sentiment—drives U.S. consumer spending. Recent data suggests job security concerns are creeping in. Whether it’s confidence in keeping a job, the ability to find a new one, or needing a second job, the trend isn’t moving in the right direction. This conversation isn’t over. In fact, mark your calendar for the same time next month to coincide with another round of payrolls and tariffs.

JOLTs (Job Openings)

Given the staleness of the data and low expectations implied by the bond market, I view the risk as skewed to the upside. The only real surprise can be generated from an incremental upside surprise that would undoubtedly boost labor market sentiment from its depressed level.

Consumer Price Index (CPI)

CPI drops Wednesday morning before the open. I expect the narrative to be shaped by food, shelter, energy, and automobiles.

- Food: The obsession with egg prices—as entertaining as it is important—will get its fair share of airtime.

- Housing: The 30-year mortgage rate fell to a five-month low, likely raising hopes for softer shelter inflation.

- Energy: Oil and gasoline spent all of February in a downtrend. Investors will expect that dovish move to show up in the data.

- Automobiles: While I don’t expect meaningful price changes, the Big Three U.S. automakers’ exposure to the Canada-Mexico tariffs will put this category under heightened scrutiny.

The consensus for core YoY and MoM are 3.0% (versus 3.0% prior) and 0.3% (versus 0.4% prior), respectively.

Producer Price Index (PPI)

Many wholesale (producer) reports suggest inventory build-ups ahead of tariff enactments. This allowed for the argument that any uptick in PPI should be viewed as temporary: a one-time surge meant to build an insulatory warchest ahead of tariffs, rather than a lasting signal of inflationary pressure.

That said, the headline index is expected to print 0.3% MoM, a tenth lower than the prior 0.4%.

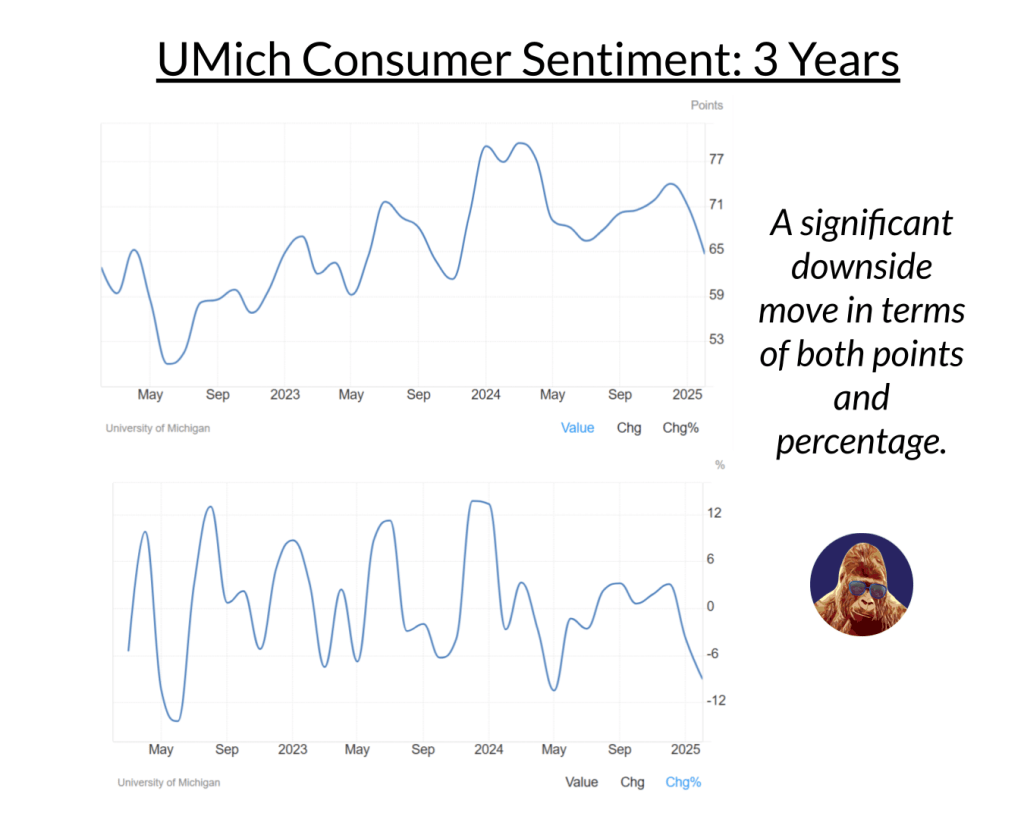

UMich Consumer Sentiment March Preliminary

Typically, the University of Michigan Consumer Sentiment survey isn’t a market mover. But sometimes, the market fixates on transient data points—just like we saw last year with initial jobless claims when they approached the 250-300K “danger zone.” The recent interest in consumer sentiment stems from last month’s sharp downside surprise, which was large enough to raise concerns about the broader economy.

To elaborate on my earlier comments, while I don’t believe it should dictate investment decisions in a vacuum, I am open to the idea that it is a “canary in the coal mine”. Where I push back is on the debate about what it’s actually signaling. In terms of consumer spending—which ultimately drives earnings—I’d bet this is a false positive, assuming unemployment stays where it is. But in terms of broader shifts in sentiment and political attitudes, it carries more weight. The two are connected, but not the same.

With that setup, consumer sentiment is expected to tick lower to 64.0 from last month’s 65.7. Given the general malaise toward D.C. and the survey’s demographic makeup, I’d be shocked if the number doesn’t come in toward the downside.

Micro Movers

In my opinion, last week told us everything we need to know: the macro is in control of the market.

Take Broadcom (AVGO) as a prime example. It delivered a masterclass quarter.

It was up as much as 10% pre-market, but by the open, that gain had shrunk to 6% and nearly flatlined by 10:30 AM. If not for Powell’s comments stabilizing sentiment, I bet it would have gone negative instead of ending the day up 9%.

Meanwhile, the S&P 500 closed back above its 200-day SMA, but the retest is far from over. If CPI and PPI come in dovish, bulls could regain control. If not, I wouldn’t expect much meaningful support until 5535—a full 10% correction.

For the record, on average, corrections happen every 10 months. We’re well overdue. That doesn’t make this any less nerve-wracking—they are never comfortable. But unless we see material cracks in unemployment or earnings shortfalls, they end up being buying opportunities in hindsight.

If you’re unsure what to buy, no worries. When the whole market gets cheaper, the whole market becomes a buying opportunity. Put another way, SPY (or your favorite index ETF) will serve you well if the market’s recent pessimism proves incorrect or overdone.

Oracle (ORCL)

Oracle’s cloud business is on fire, and I expect a strong quarter. However, as we saw with Broadcom (AVGO), even stellar numbers may not be enough to withstand a hot CPI print or unexpected tariff headline.

If you’re long or trading ORCL, keep in mind the macro landmines scattered across the field. Great earnings won’t save a stock if the market enters risk-off mode.

Checking in on the Consumer

It’s a meaningful week for consumer discretionary, with a diverse slate of earnings reports.

- Tuesday: Kohl’s (KSS) & Dick’s Sporting Goods (DKS)

- Thursday: Dollar General (DG) & Ulta Beauty (ULTA)

Without getting too granular, these reports will contribute to the broader conversation about the economy and consumer strength. However, one detail stands out—Dollar General (DG) continues to struggle despite mounting growth concerns. To me, that’s a tell—no one truly believes growth is at risk or that a recession is on the table. If it were, DG would be trading much better.