Weekly Performance

| S&P 500 | -0.75% |

| Equal Weight S&P 500 (RSP) | -0.11% |

| NASDAQ | -3.47% |

| DOW | 0.89% |

| Russell 2000 | -1.47% |

Talk of the Tape

Despite Nvidia’s triple beat and a benign PCE report, markets couldn’t overcome uncertainty in D.C. surrounding layoffs, tariffs, and Russia-Ukraine. Again, momentum was the epicenter of the sell-off, appearing to fund a rotation in safe-haven sectors.

The Week Ahead

Monday

- Manufacturing Data

Tuesday

- Crowdstrike (CRWD)

Wednesday

- ADP Employment

- Marvell (MRVL)

- Veeva (VEEV)

Thursday

- Broadcom (AVGO)

- Costco (COST)

Friday

- Payrolls

Macro Movers

Despite encouraging PCE data, uncertainty from D.C.—tariffs, Russia-Ukraine, and government layoffs—erased early gains. Yields continued falling, again for the wrong reason: growth fears. While the market stabilized before the close, bears clearly won the day (and the week).

With Nvidia in the rearview, focus shifts to the macro. Payrolls is the main event, but there’s plenty to get through first.

Monday morning brings fresh reads on U.S. manufacturing—S&P PMI, construction spending, and ISM. However, tariffs will likely dominate headlines. To clarify, the March 4th tariffs include an additional 10% on China (bringing the total to 20%) and the delayed 25% against Canada and Mexico. These are separate from the April 2nd reciprocal tariffs and the lesser-known steel and aluminum package set for March 12th.

My advice? No wholesale moves to start the week, no matter how the tape looks. A bearish Monday could reverse if tariffs are delayed or softened, while a quiet start could give way to a brutal Tuesday if tariffs are enacted as planned. It’s too unpredictable. Stay cool and wait it out.

Wednesday morning, the private sector report will be released, courtesy of ADP. Given growth concerns, a meet or beat on headline numbers would be welcome. Declining wage metrics would support a dovish sentiment. As government layoffs take effect and public sector workers transition to the private sector, private payrolls could increase, supporting further wage disinflation. Added bonus: if you believe private workers are more productive than government workers, we could also see a disinflationary boost in productivity metrics.

Now, even in a perfect world, it won’t be one-for-one—not every public job has a private market substitute. Either way, this report covers February, likely too early to reflect any DOGE-related impact.

As for Payrolls, the main event, similar to ADP, we want strong job creation and slowing wage growth. But for me, unemployment is the money number. While February is too soon to see DOGE’s impact—implying this report may already be stale—I struggle to buy into the growth scare narrative while unemployment remains this low and stable. Americans are world-class spenders—if we have jobs, we spend. Plain and simple. Payrolls will either reset or reinforce growth fears. I hope this report reassures us (and myself) that those concerns are overblown by a no-surprise unemployment number.

Manufacturing Data

- Consensus estimate for S&P U.S. Final Manufacturing PMI was unavailable at the time of writing; the prior reading was 51.6.

- Construction spending is expected at 0.1%, down from 0.5%, likely impacted by January’s weather.

- ISM Manufacturing is projected at 50.6%, slightly below last month’s 50.9%.

ADP Employment

- Private sector job creation is forecasted at 143K, down from 183K prior.

- Last month, job changers saw a 6.8% wage increase, while job stayers saw 4.7%.

Payrolls

- Job creation is expected at 160K, up from 143K prior.

- U.S. unemployment rate is projected to tick up to 4.1% from 4.0%.

- Wage gains YoY and MoM are forecasted to print 4.1% (in-line with prior) and 0.3% (down from 0.5% prior), respectively.

Micro Movers

Against the odds, Nvidia delivered—beating on revenue (overall and data centers), earnings, and guidance. Yet, even the stellar quarter couldn’t overcome uncertainty out of D.C.. Nvidia’s initial gains reversed into a ugly slide.

Still, all is not lost—especially for those with diversified portfolios.

While 2024’s hitmakers struggle, the proceeds are quickly rotating into safe-haven assets: insurance (IAK), real estate (IYR), and treasuries. In worse markets, broad wash-outs precede rotation or a return to stocks. In this market, there is no such patience: profits from winners are swiftly redeployed into opportunities elsewhere. Instead of indiscriminate selling, this market heals froth through rotation. The result? The true ugliness of brutal days for leadership is partially masked in the indices by strength elsewhere.

Concisely, caution is warranted, but it is still a bull market. To me, it feels like the middle innings of a corrective phase for momentum and growth, not the end of the road. Timing the bottom is futile. For many, now’s the time to start nibbling or building a buy list. Maybe some of this week’s reporters will make the cut.

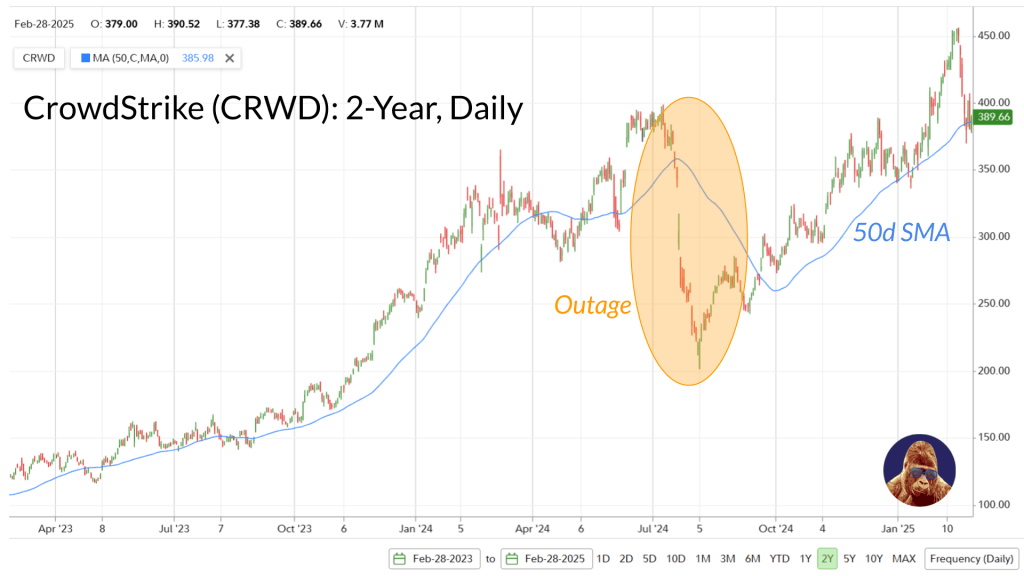

CrowdStrike (CRWD)

My top cybersecurity pick heads into earnings ~15% off its high. Fortinet (FTNT) delivered a stellar report recently, and I expect CRWD to do the same. While guidance will likely dictate the stock’s reaction, keep an eye on retention and margins. Right or wrong, slippage in either would give life to a (in my opinion, dead) bear argument that the outage lingers in clients’ and prospects’ minds and will pressure CRWD into promotional pricing to close extensions and deals.

Right now, CRWD is retesting the 50-day SMA, which, over the past two years (excluding the outage), has consistently been a solid entry point.

Marvell (MRVL) and Broadcom (AVGO)

I expect strong quarters from both, especially MRVL. They’re partnership with Amazon leverages them to their AI-spending, which Amazon just confirmed is not slowing down.

That said, a word of caution: While Nvidia’s post-earnings struggles were influenced by external factors, it’s tough to see a world where any semiconductor stock rallies on a good quarter when the sector leader couldn’t on a stellar quarter. Additionally, both have served as substitute trades for investors who “missed” Nvidia. If Nvidia keeps sliding, some of those investors may rotate into the real thing.

In fairness, it should be acknowledged that these companies are in their own bear markets: MRVL down 27%, AVGO down 20%. Maybe that’s enough punishment. I’m most interested to see how the market handles their quarters, especially if they’re as good as I expect them to be, after experiencing such declines.

Veeva System (VEEV)

Think of VEEV as the Salesforce (CRM) of pharma and life sciences. While I’ve traded it, I’m not deeply familiar with its fundamentals. However, given how CRM and ServiceNow (NOW) were received, an upside surprise feels unlikely. For those interested in this niche name, a post-earnings dip (assuming a solid quarter) could offer an attractive entry point.

Costco (COST)

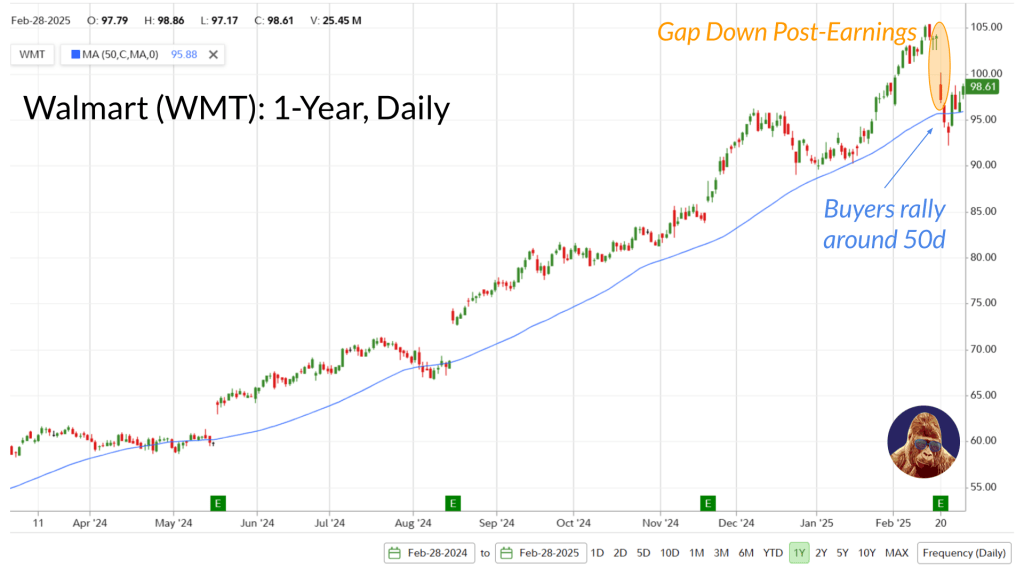

One of the few quality momentum names that has completely sidestepped recent turbulence. My stance remains unchanged: best-in-breed, buy dips. Though the reporting period doesn’t fully overlap with Walmart’s (WMT), I expect a similar pattern—solid results and conservative guidance that is initially read as soft, creating a dip that buyers quickly scoop up.