Weekly Performance

| S&P 500 | -1.76% |

| Equal Weight S&P 500 (RSP) | -1.06% |

| NASDAQ | -2.24% |

| DOW | -2.89% |

| Russell 2000 | -4.31% |

Talk of the Tape

Overall, earnings guidance hasn’t lived up to elevated expectations, and last week’s reports did nothing to change that narrative. However, it was Friday’s wave of risk-off data that sparked a broad sell-off—with momentum names taking the hardest hit.

The Week Ahead

Monday

- Realty Income (O)

Tuesday

- Home Depot (HD)

- Cava (CAVA)

Wednesday

- Nvidia (NVDA)

- Salesforce (CRM)

Thursday

- 24Q4 GDP (2nd Revision)

Friday

- PCE

Macro Movers

We ended last week with a brutal sell-off, driven by bearish surprises in consumer sentiment and inflation expectations. It seems as though all the talk of tariffs, government dysfunction from spending freezes and unclear directives, and layoffs across both the private and public sectors have finally materialized in data that Wall Street actually cares about.

The reaction was textbook flight to safety: dump stocks, buy bonds. Yields fell across the curve, and the USD ended lower for the week. Typically, stocks would welcome a drop in yields. However, the context of falling yields often matters more than fall itself. The shift in consumer sentiment and inflation expectations imply consumers may turn more defensive and the Fed may turn more hawkish: not a good setup for future earnings. Stocks can’t rally on that, even if yields technically give permission.

This week, there are two important eco-releases: GDP and PCE.

If you’ve followed my work, you’ll know I don’t put much weight on 2nd revisions to GDP. They rarely add incremental value beyond the initial read, and when they do, they’re quickly overshadowed by the final (third) revision.

As for the Fed’s preferred inflation gauge, PCE carries significant weight. Last week’s FOMC minutes and Fed speak painted a clearer picture: the committee has a pausing bias rather than cutting bias. Given February’s data, that stance isn’t surprising, but here’s the understated risk: a move toward pausing is also a move toward hiking. If PCE delivers a nasty, “unexplain-away-able” upside surprise, rate hikes could be back on the table.

That said, the Fed has the most at stake here. Even discussing hikes would be seen as admitting to a policy error. I don’t think this is the report that forces the Fed’s hand—unless inflation prints something truly alarming. For bulls, this print needs to confirm that the Fed can continue holding steady. To be clear, we want downside surprises. Any more hawkish surprises, and the market may start repricing for a much less friendly rate path.

2024 Q4 GDP – 2nd Revision

- Consensus is set for 2.3%, which is in-line with the preliminary reading.

Personal Consumption Expenditures (PCE) Index

- YoY core is expected to print 2.6%, 0.2% down from last month’s 2.8% figure.

- MoM core is expected to print 0.3%, a tenth above last month’s 0.2% figure.

Micro Movers

As I alluded to earlier, Friday was not a good one for portfolios. Momentum names took the hardest hit without sector bias. Walmart, Shake Shake, and CrowdStrike – three stocks, three different sectors – all had days featuring a 5% decline last week. One commonality: each had notched a 20% gain within the last 3-6 months.

The agnostic nature of the sell-off helps put it into perspective. Last week’s data told managers to de-risk. The easiest way to do that quickly? Trim positions that have outgrown their typical size: the best performers. It’s tough to fault moves that lock in profit without triggering wholesale changes. As a result, if your stock was a “winner” over the past few months, then it got sold like a “loser” on Friday.

While Nvidia is the main event this week, I’ve highlighted names in other sectors to provide insight into what’s happening beyond semis.

Realty Income (O)

While homebuilders have lost the benefit of the doubt that lower interest rates will automatically drive upside, REITs remain technically strong. Names like VICI Properties (VICI), Simon Property Group (SPG), and Prologis (PLD) are first-in-mind.

Realty Income (O) recently increased its dividend, which is paid monthly, further reinforcing its reputation as a reliable cash-flow generator. This is a great name in the space, especially for its reliable monthly cash flow, but given the weight of PCE and earnings, I’ll be waiting until the end of the week before deciding whether to pull the trigger.

Home Depot (HD)

Although yields have behaved, housing stocks have struggled under the weight of lackluster guidance and poor commentary from the likes of Toll Brothers (TOL), Lennar (LEN), and FirstSource (BLDR). That said, this doesn’t mean HD can’t deliver a strong quarter and regain momentum.

Last quarter, a better-than-feared same-store sales number led many to declare it “the last bad quarter”, signaling that the business had turned a corner. If that thesis holds, HD will rebound nicely. However, if the market misjudged the prior quarter as the inflection point, look out below.

Cava (CAVA)

CAVA was on a strong run, until Wingstop (WING) reported a stinker. The stock slid in sympathy and kept falling alongside the broader momentum sell-off. The result? A spectacular breakdown.

For all the concern stemming from the weaker-than-expected consumer sentiment survey, SHAK’s robust quarter showed that performance in this restaurant niche is company-specific. That said, despite a near-flawless quarter from SHAK, the bad tape erased its post-earnings gains. We may be going through a period where post-earnings pops aren’t allowed to survive the week. Until that changes, “wait and see” is my strategy.

Even so, I can’t help but feel opportunities are being created here. If not in CAVA—we’ll know soon enough after they report—then certainly in SHAK.

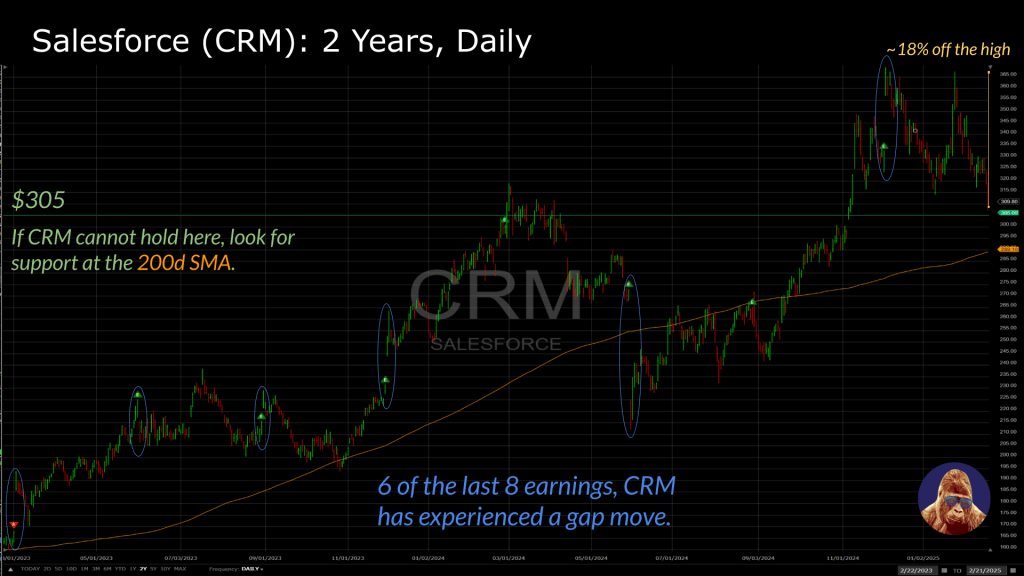

Salesforce (CRM)

Two words: Agentic AI.

Agentic AI refers to AI systems capable of advanced reasoning and complex problem-solving without human oversight. These systems can adapt in real-time, handle dynamic tasks, and collaborate seamlessly with human teams.

Salesforce’s Agentforce product, which leverages that technology, allows clients to build AI agents tailored to specific processes. In short, this product has the potential to create a digital workforce, automating tasks that were previously handled by humans. The productivity boost and cost savings could provide Salesforce’s extensive client base with a real, tangible return on AI.

The stock has faced some turbulence recently and has a tendency to do a lot around the quarter. At this point, it’s hard to expect another huge year from the Mag 7—many are simply too big for another +20% rally to feel likely. But at ~$300B market cap, a $60B move (20%) isn’t unrealistic for the company that first monetizes agentic AI. To put into perspective, that $60B move would put CRM just 3% above its 52-week high.

Nvidia (NVDA)

Based on what we’ve heard from META, GOOG, MSFT, and AMZN, there’s no mystery about Q4 results—they’ll be strong. The real question is in the guidance.

Overall, beats and meets or beats and misses have been the story. Very few companies are delivering the optimal beat and raise. With political uncertainty and analysts constantly upping their whisper numbers, at some point, Nvidia will miss on a metric. It’s inevitable. Fortunately, when you have the best product—and Nvidia does—you can talk people down if a shortfall happens. That said, NVDA is up 20% since the DeepSeek bottom. Expectations are, again, high. Price doesn’t permit an argument to be made that expectations are not.

I see a path for a beat and raise: Jevons’ Paradox suggesting that DeepSeek’s efficiency breakthrough will drive accelerating demand. However, the timing of that demand hitting P&Ls remains uncertain.

In my view, the most likely scenario is a beat and meet. Given the uncertainty surrounding semiconductor exports and tariffs, it’s tough to predict a bold guide. Any softness will be met with selling, but, if the softness is driven by politics and not economics, then I would expect markets to stabilize rather quickly.