Weekly Performance

| S&P 500 | 1.47% |

| Equal Weight S&P 500 (RSP) | 0.69% |

| NASDAQ | 1.46% |

| DOW | 0.80% |

| Russell 2000 | 1.96% |

Talk of the Tape

Inflation hawks had a good week: Payrolls came in hot, and the tit-for-tat tariff escalation between Trump and Xi isn’t exactly a recipe for lower inflation. That said, bears didn’t gain much ground. Despite misses from AMZN and GOOG, increased AI-CapEx slowed negative momentum in the chip trade.

The Week Ahead

Monday

- n/a

Tuesday

- Marriott (MAR)

Wednesday

- CPI

- Vertiv (VRT)

- Reddit (RDDT)

- Robinhood (HOOD)

Thursday

- PPI

- Palo Alto (PANW)

- Draft Kings (DKNG)

- AirBnB (ABNB)

Friday

- Retail Sales

Macro Movers

Despite its importance, Payrolls seemed to get lost in a broader conversation about the economy and earnings. Tit-for-tat tariff headlines between Trump and Xi as well as Amazon’s AWS “shortfall” diverted focus from the premier labor market report.

As for the report itself, Payrolls meaningfully surpassed expectations: job creation beat estimates, the prior month saw a substantial upward revision, the unemployment rate contracted, and wages outpaced forecasts. Good for the economy; bad for inflation and future rate cuts. As expected, yields and the USD rose in response.

This week, we’ll see how it all plays out. In the Fed’s eyes, a strong labor market alone doesn’t justify a hike—inflation would need to signal an upward inflection to force their hand. CPI and PPI will be pivotal in shaping how markets interpret the strong Payrolls data. Retail sales may provide additional context, but to a lesser extent. I tend to group retail sales with GDP and economic growth rather than inflation. It’s all interconnected, but there are levels to this.

Consumer Price Index

- MoM Core CPI: Expected to rise 0.3%, same as prior month.

- YoY Core CPI: Forecast at 3.1%, a slight decline from last month’s 3.2%.

Producer Price Index

- MoM Core PPI: Expected at 0.3%, following last month’s 0.0% gain.

- YoY Core PPI: Consensus was not available at time of publication, but the prior month was 3.5%.

U.S. Retail Sales

- Headline Retail Sales: Forecast at 0.0%, a notable shift from last month’s 0.4% gain.

- Ex-Autos: Expected at 0.3%, slightly below last month’s 0.4%.

Micro Movers

With all but Nvidia of the Mag 7 having reported, macro stories are likely to drive more day-to-day volatility. Although earnings isn’t over, I think enough companies have spoken to draw a few notable conclusions:

First, for the past few quarters, we’ve asked how long investors will tolerate mega-cap tech’s massive AI spending. We now have an answer: as long as the underlying business justifies it. If AI investments don’t translate into strong results in the core business, the stock gets punished.

Quick recap:

- MSFT: Increased AI CapEx, but Azure missed → stock fell

- GOOG: Increased AI CapEx, but cloud missed → stock fell

- AMZN: Increased AI CapEx, but AWS missed → stock fell

- META: Increased AI CapEx, but ad business delivered → stock rose

Zuckerberg hit his number, so he gets to keep spending without consequences. The others didn’t, so their stocks took a trim.

Second, none of the hyperscalers pulled back on AI-CapEx—in fact, they increased spending. While DeepSeek may allow more players to enter the AI space with mid-range chipsets, it hasn’t (yet) changed the biggest players’ preference for top-tier chips. For that reason, I’m not concerned about Nvidia’s February 26th report.

Now, let’s talk about the companies reporting this week:

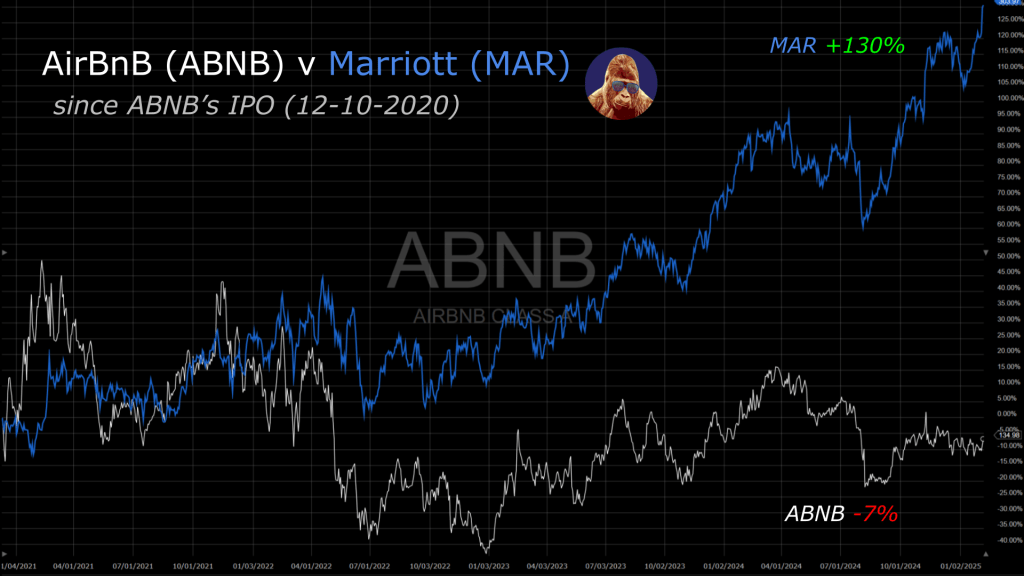

A Tale of Two Travel Stocks: Airbnb (ABNB) & Marriott (MAR)

Both stocks are tied to the red-hot travel and leisure bull market, yet their charts suggest they’re in completely different industries.

Why the disparity? My guess is positioning.

Marriott has a strong loyalty program, exposure to the cruise industry, is considered best-in-breed, and enjoys regulatory certainty.

AirBnB has no loyalty program, faces increasing competition, and operates in a realm of increasing regulatory risk.

For Airbnb, the stock needs to show signs of turning before it gets interesting. Marriott, on the other hand, could be a buy on a post-earnings dip. Companies have been hit disproportionately on revenue guidance misses, and Marriott—known for conservative guidance—could create an opportunity.

Degens at Heart: Robinhood (HOOD) & Draft Kings (DKNG)

My fellow degens, how we living?

In all seriousness, Robinhood has matured since the meme-stock era, much of which occurred in 2022. The launch of Robinhood Learn and Robinhood Retirement (offering both Traditional and Roth IRAs) helped shift the Street’s perception. Although Robinhood remains a home for YOLO trades and casual speculators, it has evolved to attract a growing base of retail investors who want to learn the craft.

DraftKings has grown, but has yet to evolve into a truly impressive business: customer acquisition costs remain high, and unresolved regulatory questions still hang over the industry.

So why pair these two together? Because Robinhood has teased the idea of integrating sports betting.

The overlap between people with a sports betting account and a Robinhood account is likely meaningful. I could see Robinhood users pulling funds from DraftKings or FanDuel to consolidate everything on one platform.

That said, I’m not sure this is a great strategic move for Robinhood.

Trailing 12M:

- Robinhood’s gross margin: 93.9% | Operating margin: 21.8%

- DraftKings’ gross margin: 38.5% | Operating margin: -11.15%

Sports betting isn’t a great business from an investment perspective. If you’re Robinhood, why dilute your margins? There are better places to take a swing.

Cooling and Feeding AI: Vertiv (VRT) & Reddit (RDDT)

Vertiv is leveraged to the data center buildout. AI-driven demand has made data centers more critical than ever, and mega-cap earnings suggest this ancillary sector still has room for upward revisions.

Reddit is sitting on an invaluable dataset. It isn’t all sunshine and rainbows, but it’s a hub for problem-solving, discussions, and memes—a unique data source for training AI models.

If Jevons’ Paradox holds, increased AI efficiency will drive more usage rather than less. That means:

- More demand for AI → more data centers → more cooling (Vertiv).

- More demand for AI → more training data → limited high-quality sources (Reddit).

Reddit already has LLM deals with Alphabet and OpenAI, and CEO Steven Huffman has made it clear they’re open for more—on the right terms.

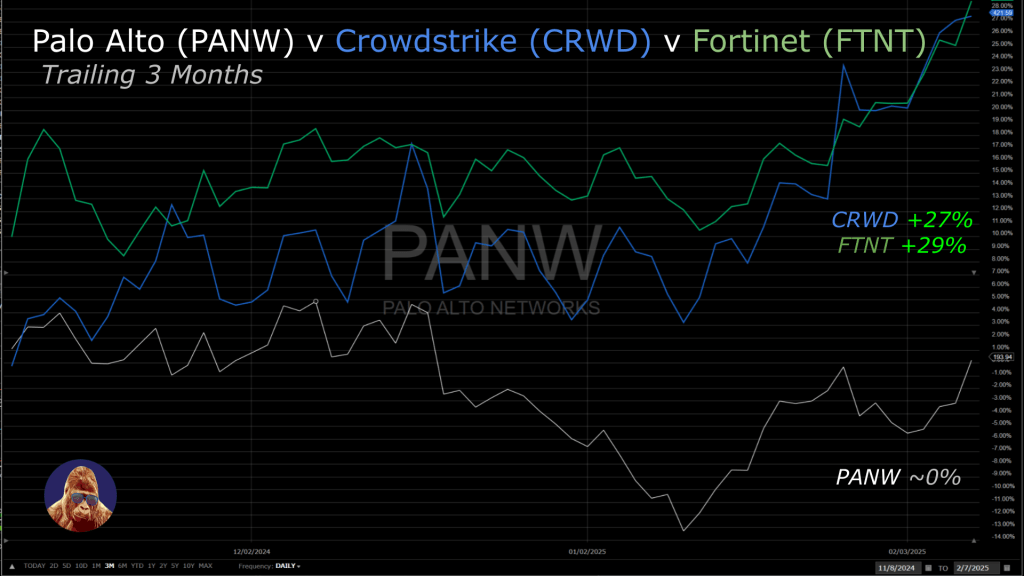

Fortinet and Friends Poised to go Higher: Palo Alto (PANW)

The takeaway is simple: DeepSeek making AI more accessible also makes it more accessible to cybercriminals.

Last week, Fortinet (FTNT) beat expectations and issued strong guidance. If not for a sour macro backdrop that engulfed the day, FTNT might have closed higher.

Of the Big 3 in cybersecurity, PANW has lagged the most. This quarter could be its chance to play catch-up.