Weekly Performance

| S&P 500 | 0.56% |

| Equal Weight S&P 500 (RSP) | — |

| NASDAQ | 1.00% |

| DOW | 0.54% |

| Russell 2000 | -0.95% |

Talk of the Tape

PPI and CPI eased fears of an imminent wage-price spiral, cooling yields and the USD. Combined with robust earnings, this backdrop fostered the best weekly gain for the majors since the presidential election.

The Week Ahead

Monday

- Manufacturing Data

- Palantir (PLTR)

Tuesday

- JOLTS

- AMD (AMD)

- Alphabet (GOOG)

- Chipotle (CMG)

Wednesday

- ADP Employment

- Uber (UBER)

- Disney (DIS)

Thursday

- U.S. Productivity

- Eli Lilly (LLY)

- Amazon (AMZN)

- Fortinet (FTNT)

Friday

- Nonfarm Payrolls

Macro Movers

First, a word on tariffs. Headlines started breaking Friday afternoon and continued developing over the weekend. Unless a last-minute agreement is reached, Tuesday is going to be a showdown: 25% tariffs on Canada and Mexico, almost certainly met by counter-tariffs from each. So far, the market has largely dismissed tariffs as political posturing rather than concrete policy. But, it appears we’re at an impasse. Today’s reaction out of the market and D.C. is worth watching.

With that out of the way, we pivot to the real focal point of the week: labor data. JOLTS, ADP, Productivity, and Payrolls all hit the wire. While there is a plethora of other matters to attend to, it’s hard to shake the idea that Payrolls—given its weight and timing—will get the definitive say on the labor conversation.

Manufacturing Data

The S&P Manufacturing PMI final, construction spending, and ISM manufacturing data are scheduled for release shortly after Monday’s open. In aggregate, these reports have the potential to move rates.

JOLTS

The JOLTS report includes job openings. The median forecast for December is 8.1 million, in line with last month’s data. While this report may briefly influence labor market discussions, I would hesitate to react to it. Ultimately, the Nonfarm Payrolls report—releasing Friday—will be the definitive gauge of the labor market.

ADP Employment

Consensus for private sector job creation is projected at 149k, compared to last month’s 122k. Personally, I pay close attention to the Pay Insights section for wage trends. Last month, job stayers experienced a 4.6% YoY increase in annual pay, while job changers saw a 7.1% rise. These numbers have been declining since their mid-2022 peak; further downside would be interpreted as dovish for inflation.

U.S. Productivity

Typically, I don’t spotlight this release, but its importance has grown recently.

Productivity offers crucial context for understanding inflation and economic growth. Generally, the two are inversely correlated: as productivity increases, inflation tends to decrease. The logic is straightforward—higher productivity means more goods and services are produced, and with demand constant, an increase in supply leads to lower prices.

In short, higher productivity will bolster sentiment around inflation and improve the return on AI investments. Consensus for 24Q4 is 1.4%, down from 2.2% in the previous quarter.

Nonfarm Payrolls

Saving the best for last, Friday morning’s release of the government’s Nonfarm Payrolls survey will provide a comprehensive snapshot of the labor market. Headline job creation is expected to come in at 175k, down from last month’s 256k. Employment is forecast to remain steady at 4.1%. MoM, wages are anticipated to gain 0.3%, consistent with last month. YoY growth is projected at 3.7%, down from 3.9%. To reinforce a bullish narrative, we’re looking for a robust headline number, no surprises in unemployment, and some downward pressure on wage metrics.

Micro Movers

Despite two of the Mag 7 and Eli Lilly reporting this week, I suspect our overall sentiment will ultimately hinge on the payrolls report. That said, we’re in the heart of earnings season, and noteworthy companies are stepping up to the mound in hopes of hitting a homerun.

Palantir (PLTR)

Palantir has undergone a remarkable transformation. What was once a meme stock is now a best-in-breed company that’s discovered a way to mint money using AI.

After recouping all of the DeepSeek decline, the stock will enter the quarter trading at the all-time high, which implies a high bar for upside. That said, the best companies often harbor the highest expectations. I remember thinking expectations were elevated when the stock was trading at $30. Palantir was ready for the show then. I’m not brave enough to say it isn’t now.

The upcoming call is crucial not only for shareholders but for all market participants. CEO Alex Karp is among a select few with the rare knowledge and insight required to add value to DeepSeek conversation, and I doubt I’ll be the only one tuning in for that purpose.

Advanced Microdevices (AMD)

DeepSeek’s architectural breakthrough suggests that legitimate AI models can be built without relying on top-tier semiconductors. I expected AMD to be a prime beneficiary—surely this news would have major companies calling about running AI models on AMD’s Instinct MI or Max AI chipset?

Instead, the stock kept falling, with no sign of a rebound. Even if you take out last week, the longer-term trend still signals significant market concern over AMD. Lisa Su will need to find her leather jacket to pull the stock out of this funk. Until then, AMD has “falling knife” written all over it.

Alphabet (GOOG)

Alphabet has a lot going for it.

Given Meta’s results, I anticipate that YouTube will generate some stunning advertising numbers. Waymo is making real headway as an autonomous ride-hailing service. Their deal with Reddit appears to have been beneficial in training Gemini, which in turn has helped protect their search business. Quantum computing “supremacy” is another feather in their cap.

Trading at roughly 23x forward with expected EPS growth of 12% for 2025, I like the setup for upside surprises. Of course, their cloud business still needs to deliver, but with everything else in play, I believe GOOG will outperform the current 12% EPS target.

Chipotle (CMG)

The stock’s struggle to get above $60 reflects the underlying bull–bear debate.

On one hand, bulls point to successful throughput improvements, AI-driven customer engagement, strong LTO (smoked brisket) performance, and aggressive new store openings. On the other hand, bears are right to question the pace of European expansion. While the region is off to a decent start, replicating the success seen in Canada is a different beast. Moreover, rising food and labor costs, along with the potential for diminishing pricing power, could pressure margins.

I remain bullish. I believe management will expertly control what they can, but pricing power is a more elusive matter. Chipotle undoubtedly demonstrated remarkable pricing power in 2024, and its ability to do so in 2025 may depend on the brand’s capacity to remain a symbol of status, health, and wellness… put another way, its ability to stay cool.

Uber (UBER)

Uber has struggled since the election, partly due to the long-Tesla/short-Uber (and vice versa) trades that have gained popularity over the past 3-6 months. These trades have made it so that a gain in Tesla sometimes comes at the expense of Uber, regardless of the catalysts moving either stock. More recently, it appears that the market’s view on the impact of autonomous ride-hailing on Uber diverges from mine.

Last December, Uber took a significant hit when Alphabet’s Waymo announced plans to expand its autonomous ride-hailing service to Miami in 2025, with a broader rollout anticipated in 2026. The downside in Uber was driven by the thesis that autonomous ride-hailing apps from Waymo, and eventually Tesla, would siphon demand from Uber.

My belief is that Uber will ultimately serve as the aggregator for all autonomous ride-hailing services. I foresee a lucrative partnership between all autonomous ride-hailing providers and Uber. In this scenario, autonomous ride-hailing services can leverage Uber’s established ride-hailing infrastructure—their functional app, sizable install base, and fleet management capabilities—without incurring the massive human and financial capital outlay required to build and maintain such a system. In return, a portion of the ride revenue would flow to Uber, solidifying its role as aggregator in this evolving ride-hailing ecosystem.

It is similar to the emerging thesis surrounding Apple and AI. Apple doesn’t need to invest in retail AI. Whichever consumer-AI model wins (DeepSeek, Meta, ChatGPT, etc…) will want to be on the iPhone. If you want to be on the iPhone, then you need to pay for access to that ecosystem.

Disney (DIS)

I don’t follow it closely, but for the first time in years, the stock has been on a respectable run—up 32% since bottoming six months ago. Personally, I believe Netflix’s huge beat on subscriber growth was Netflix-specific, though I remain open to the possibility of being wrong.

But, let’s say I’m not.

If Disney+, one of Netflix’s few true streaming competitors, fails to show comparable subscriber growth just a month after Netflix’s record beat, I expect the market will rerate Netflix higher to reflect its growing separation from its peers.

Eli Lilly (LLY)

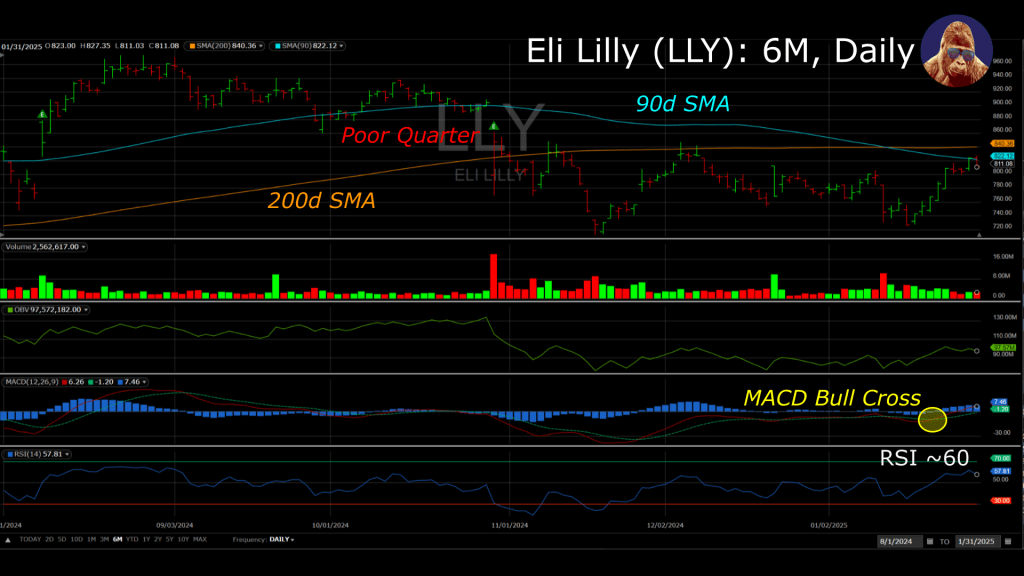

On the coattails of a challenging week for growth stocks, the healthcare sector finally caught a bid. Eli Lilly wasn’t left behind.

The stock has had a rough couple of months. Last quarter introduced concerns that its Alzheimer’s and GLP-1 lineup wouldn’t perform as previously anticipated. Then came the RFK sell-off, which sent both the stock and the sector further downward.

Now, the stock has mounted a notable comeback. LLY is above its 90d SMA for the first time since that poor quarter, is approaching its 200d SMA with momentum, and avoided gapping down in sympathy with its European competitor, Novo Nordisk.

Although this still feels like a “show us” quarter, the bullish activity indicates that traders believe management has righted the ship. That conviction is evident in their decision to act ahead of the print.

Amazon (AMZN)

As a company integral to the AI-theme, Amazon’s quarter has far-reaching implications for the semiconductor trade. If Andy Jassy decides to play hardball with Nvidia, we will see ramifications the following morning. That said, neither Microsoft nor Meta showed signs of slowing their AI-spend during their quarters. Slowing down would open the door for competitors to gain an edge in chip allocations. I doubt Jassy takes that chance.

Specific to the stock, we’ll want solid numbers out of AWS and advertising. After what appeared to be a robust holiday season, I expect retail numbers to further bolster optimism around the quarter and the overall U.S. economy.

Fortinet (FTNT)

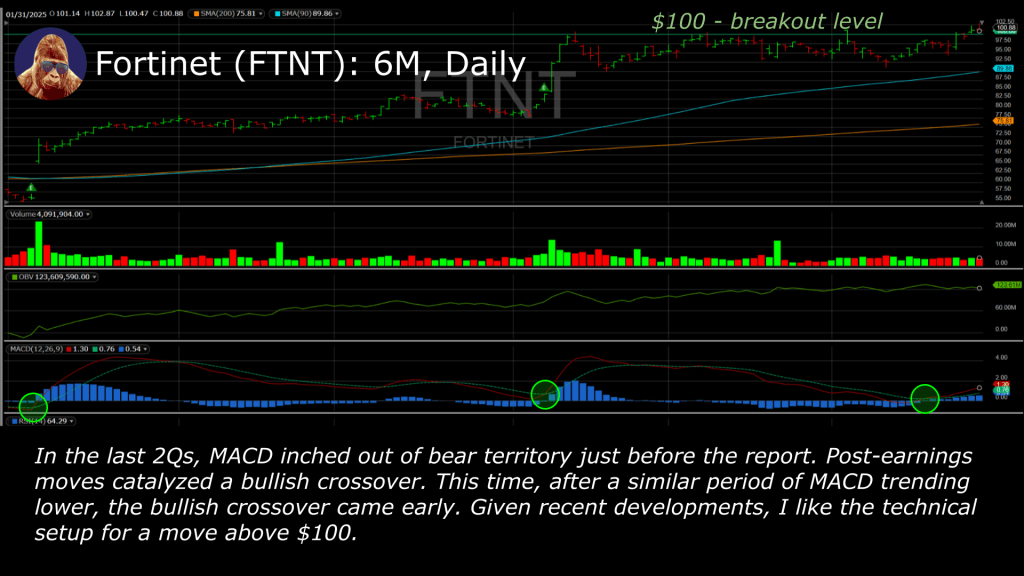

If DeepSeek means that viable AI-models can be produced on middling chipsets, then AI has become far more accessible—even to cyber criminals. More attacks translate into increased security spending. I don’t know if you were watching, but the (fictional) line for cyberattacks in 2025 on DraftKings gapped higher last week.

I recently wrote a piece on how the big three in cybersecurity were poised for moves higher. Well, they’re moving. While FTNT’s quarter still needs to deliver for the stock to breakout as the chart suggests it can, I like how it is setting up.