Weekly Performance

| S&P 500 | 2.91% |

| Equal Weight S&P 500 (RSP) | 4.40% |

| NASDAQ | 2.45% |

| DOW | 3.69% |

| Russell 2000 | 3.96% |

Talk of the Tape

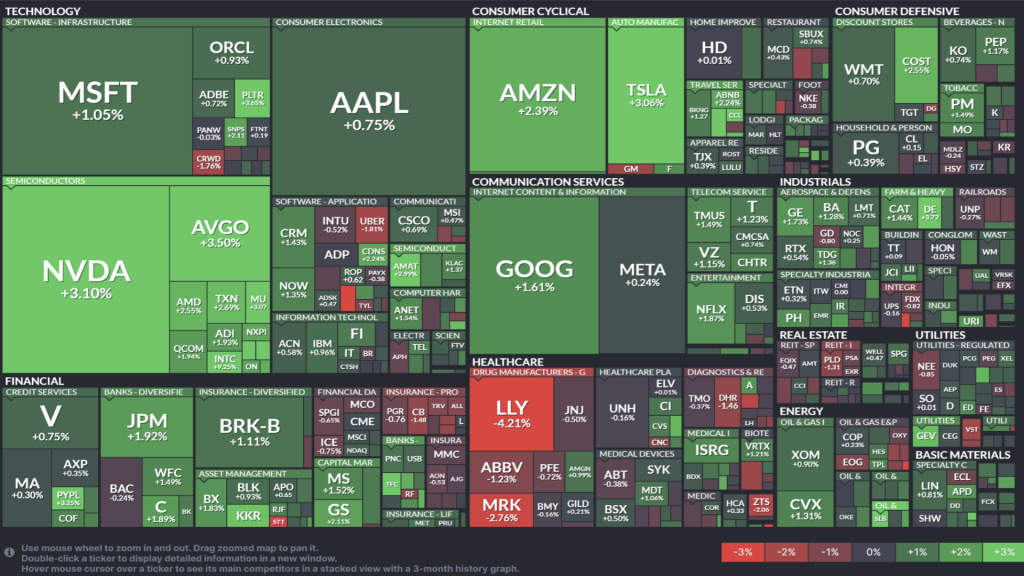

PPI and CPI eased fears of an imminent wage-price spiral, cooling yields and the USD. Combined with robust earnings, this backdrop fostered the best weekly gain for the majors since the presidential election.

The Week Ahead

Monday

- Market Holiday: MLK Day

- Presidential Inauguration

Tuesday

- 3M (MMM)

- Netflix (NFLX)

- Zion (ZION)

Wednesday

- Leading Economic Indicators

- Halliburton (HAL)

- Kinder Morgan (KMI)

- Johnson and Johnson (JNJ)

Thursday

- Jobless Claims

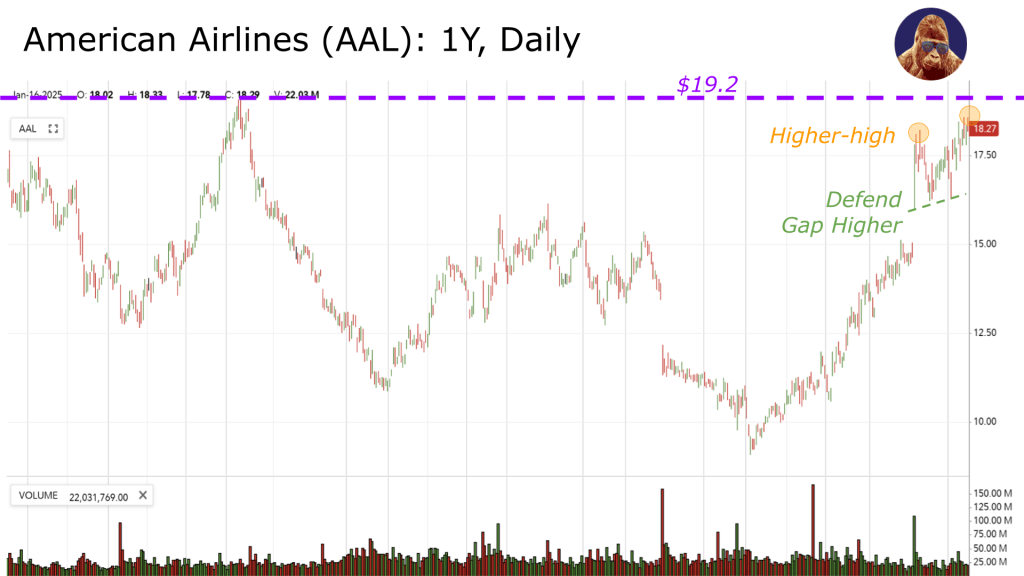

- American Airlines (AAL)

Friday

- S&P PMIs

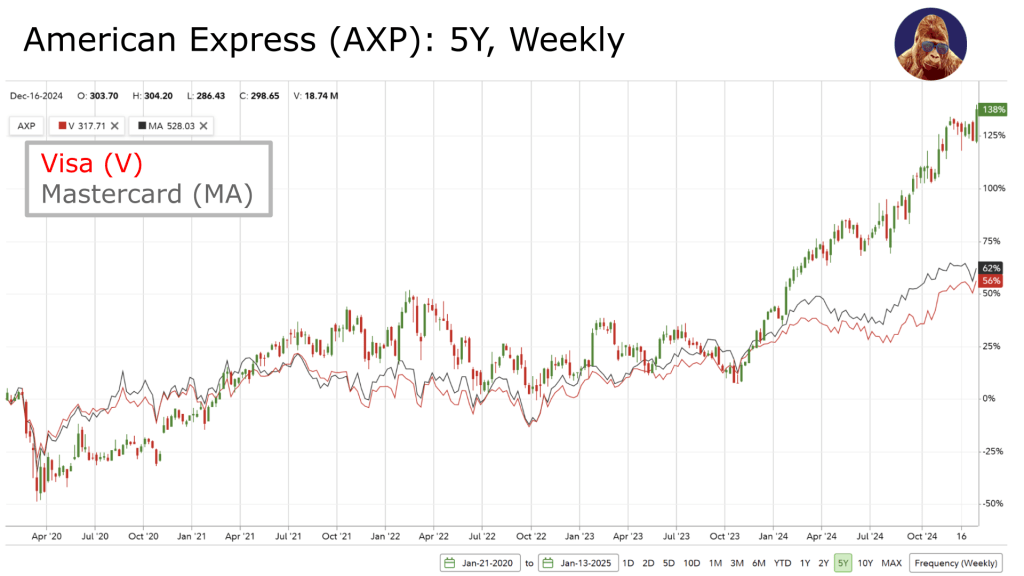

- American Express (AXP)

Macro Movers

The Dollar Index (DXY) and US10Y yields didn’t break down last week, but stocks welcomed their ~0.5% and ~3.5% declines, respectively. Dovish CPI and PPI exposed the Payroll-hawks as pigeons. This shift in sentiment allowed the narrative to focus squarely on earnings season, which, thanks to strong performances from money center banks, is shaping up to be robust.

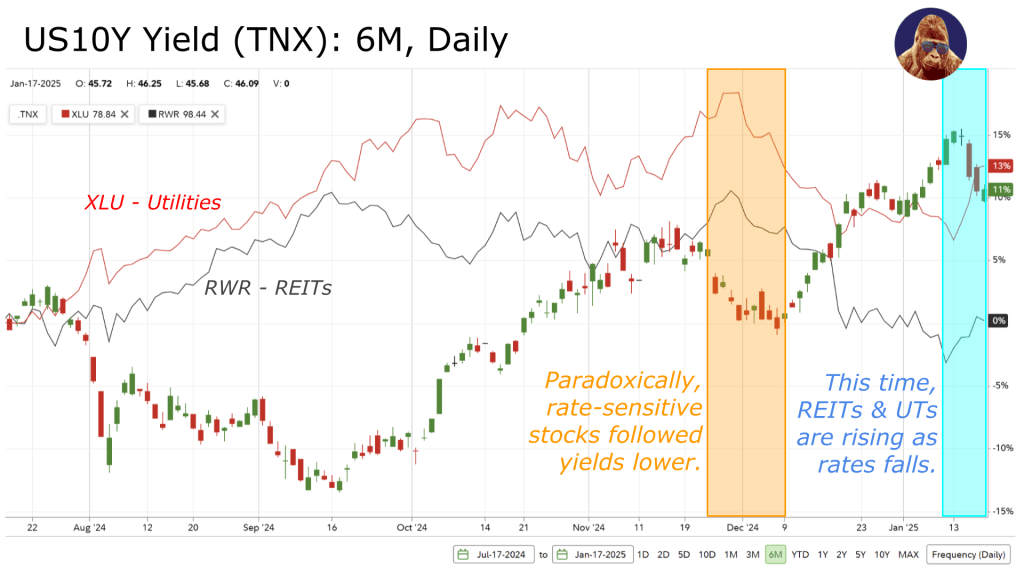

Decline in Yields & the Dollar: For Real or Fugazi?

December’s downward move in yields turned out to be a head fake, but this decline features a notable difference. Typically, rate-sensitive stocks ‒ REITs and UTs ‒ trade higher as yields move lower. In December, the opposite occurred, correctly signaling the decline as fugazi. This time, rate-sensitive stocks are doing what you’d expect ‒ moving higher as yields move lower ‒ which I interpret as signaling that this move in yields (and the Dollar too) is for real.

REITs, in particular, stand out. Key names like Realty Income (O), Federal Realty (FRT), Prologis (PLD), and Simon Properties (SPG) appear to have bottomed and are now featuring bullish setups. While breakdowns in yields or the Dollar have yet to materialize, the rapid positioning for breakouts in rate-sensitive stocks suggests that market participants are positioning for it.

Perhaps, we should too.

Buy the Election, Sell the Inauguration: For Real or Fugazi?

It’s a holiday-shortened week, with markets closed on January 20th in observance of Martin Luther King Jr. Day, coinciding with Inauguration Day. Psychology provides an interesting twist—“buy the rumor, sell the news” morphs into “buy the election, sell the inauguration.”

As cute as this sounds, it’s fugazi.

Without much eco-data to divide our attention, this week belongs to earnings, which is often bullish… but, here’s how it could be for real: there have been reports that Trump’s mass exportation initiative will begin Tuesday morning (today) in Chicago. If media coverage gets graphic, creating a larger story, there could be a “sell the inauguration” dynamic ‒ yields higher, stocks lower ‒ attached to the expected inflationary consequences of shrinking the labor force.

U.S. Leading Economic Indicators

Consensus estimates call for -0.1%, down from the prior month’s 0.3% gain.

Initial Jobless Claims

Expectations are set at 215k, barely a pebble’s throw from the 3-year median of 216k.

S&P Flash Manufacturing and Service PMI

At the time of writing, estimates have yet to be published. For reference, the prior readings were 49.4 for manufacturing and 56.8 for services. Numbers above 50 indicate expansion, while those below 50 indicate contraction. These flash (preliminary) PMIs might have an impact on yields, which could create some volatility.

Micro Movers

There is a lot on the earning’s docket this week, far more than would fit in the Week Ahead box. As such, I chose a few that I anticipate will have a legitimate impact on sentiment or that allow me to opine on some interesting, developing stories worth monitoring.

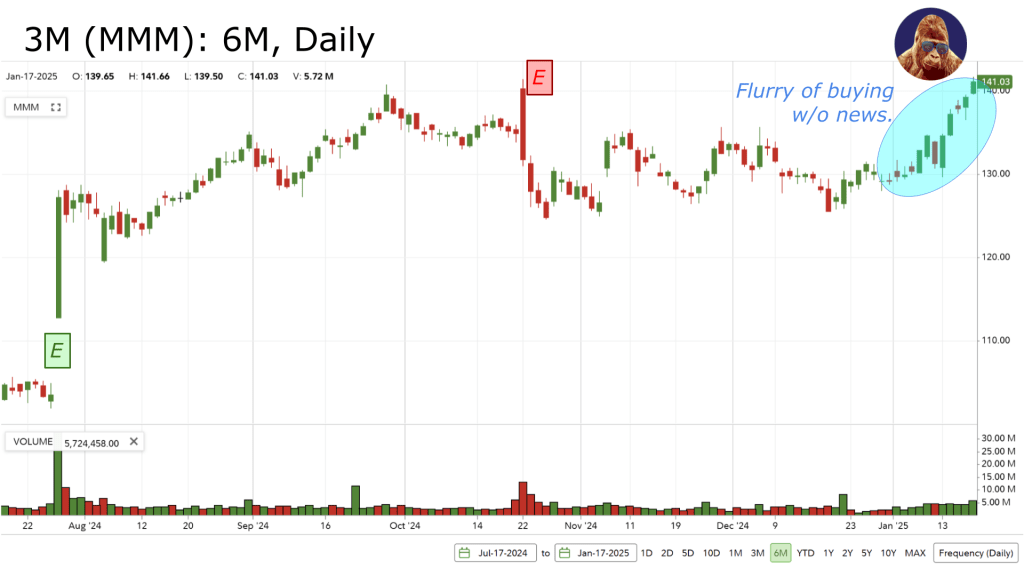

3M (MMM) – U.S. Industrials

After trading in a tight $125-$140 range for the last 6 months, 3M caught a strong bid this week. Friday, the stock opened and closed above $140.

The last two quarters were solid. Management is on track with the turnaround, which will not feature any major divestitures or spin-offs that could complicate the revenue and earnings story. From a sector perspective, Trump’s tariff policies are a real tailwind for re-/near-/friend-shoring, benefiting U.S. industrial stocks.

Back to 3M specifically, all of this was known well before this week. Under any circumstance this sudden bid would be bullish, but I find the timing suspect. Perhaps information on the quarter leaked, and those with it are trying to get in ahead of it.

Netflix (NFLX)

While this is technically the first of the mega-caps to report, I think many have come around to correctly realize that NFLX’s results in no way provide insight for the rest of the mega-caps. That said, for what it’s worth, it may provide some insight into the streaming services at Disney and Time Warner.

As of Friday’s close, NFLX is 8.9% off the ATH. While I expect that their entry into live sports through the NFL and WWE will have increased subscribers, we won’t know for certain as this is the first report that will not include global subscriber numbers. Analysts may attempt to backdoor an answer by analyzing the P&L and through management Q&A, but it’ll be challenging to confirm given subscription pricing variances across tiers and geographies.

Although Disney is trying to compete, most notably through their partnership with Fubo to incorporate sports into their Disney+ ecosystem (which now includes all of Hulu), Netflix remains king. Until a competitor can rival their cash-flow profile, expect Netflix to keep their crown. If the stock sells off after a business-as-usual quarter, I’ll be adding to my position.

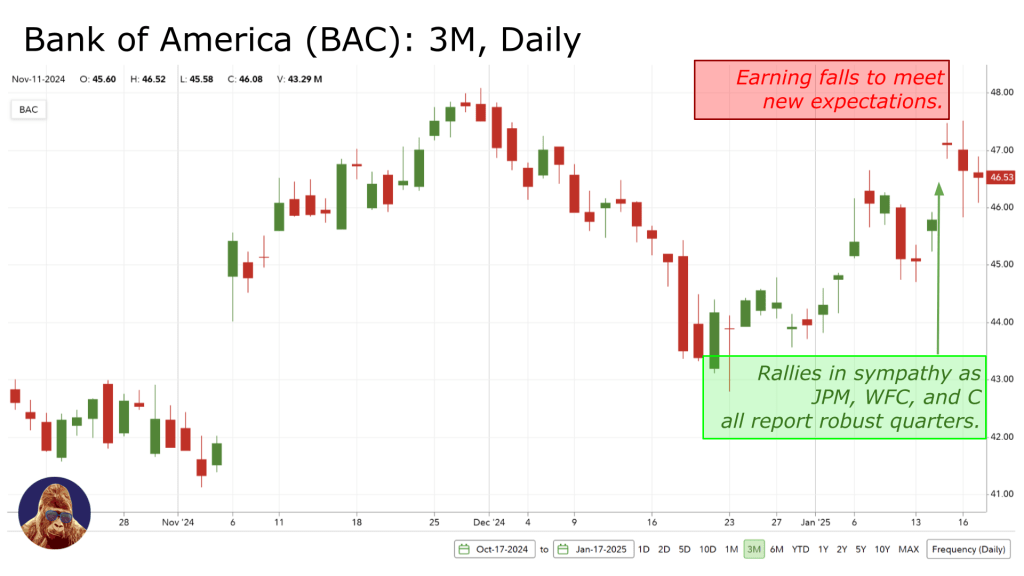

Zion (ZION) – Regional Banks

A combination of animal spirits and big bank flexes catalyzed an 8.2% rally in the regional bank index (KRE). Zion (ZION), an industry leader, outperformed by 0.6%. In my view, the rally has taken some of the post-earnings pop potential out of these names.

It sets up a Bank of America situation: a stock rallies in sympathy on strong numbers from the cohort but sells off after reporting because expectations were ratcheted up too high. Consequently, if you’re looking to increase regional bank exposure, it probably does not make sense to act ahead of their quarters.

Broadly speaking, the case for regionals is deregulation, but the same is true of the better-capitalized money centers and investment banks. As such, unless you have a keen eye for regional bank analysis (which I don’t) or an ultra-specific thesis (as I do with SOFI), it’ll probably serve your portfolio best to gain exposure to this macro theme through the better-capitalized, better-managed money centers and investment banks.

Halliburton (HAL) and Kinder Morgan (KMI) – Energy Services and Infrastructure

Halliburton and Kinder Morgan make the cut this week because I view these two kinds of businesses as the best ways to play the revival in energy equities.

Halliburton provides products and services to energy operators aimed at maximizing operations. Investing in energy service providers is a play on operator activity—mining, drilling, fracking, etc.—rather than directly on commodity prices. Although higher commodity prices tend to attract greater activity, the regulatory burden under the Biden administration limited new activity to support these stocks. The new administration’s “smarter approach” to energy policy promises to attract activity and investment in the space that has been lacking throughout the last half-decade.

Kinder Morgan (KMI) is a natural gas infrastructure company. These companies typically make money on the sale, transport, storage, and processing of natural gas. While the U.S. is already exporting a meaningful amount of liquefied natural gas (LNG) to Europe, the Trump administration could significantly expand these efforts by reversing Biden’s 2024 pause on new LNG export terminals.

More export terminals would not only increase revenue from natural gas transport and processing but would likely result in higher commodity prices. Reversing the moratorium would unlock unmet European demand for U.S. LNG, akin to introducing a new buyer into an established market, driving up volume and prices (assuming supply doesn’t increase immediately to meet demand).

Johnson and Johson (JNJ)

Recently, JNJ acquired Intra-Cellular Therapies, a biopharmaceutical company with promising treatments for central nervous system disorders. Aside from signaling shifting winds in the M&A world, the stock provides an opportunity to discuss the sector.

Friday morning, HHS announced 15 additional drugs selected for Medicare price negotiations. Ozempic and Wegovy—name-brand GLP-1s—made the list alongside treatments for blood cancers, autoimmune diseases, heart failure, cholesterol management, and blood clots.

The news made for an ugly tape for the sector, the worst performer on the day. Lower costs of medicine—while good for patients—create cost pressures for pharmaceutical companies and insurers, resulting in a decline. However, I suspect that in some cases, GLP-1s included, these negotiations will bring certain treatment prices to levels where more insurers are willing to cover them. Increased sales to a broader market could more than offset lower unit revenue.

American Airlines (AAL) & American Express (AXP) – Travel and Spending

Personally, I have no financial or personal stake in these stocks. I profitably traded AXP but left too much on the table to feel good about it. These stocks will provide an update on the travel story and some tea leaves on higher-income consumers.

I don’t consider American Airlines to be among the airline leadership, but strong results should reinforce the narrative that 2025 is shaping up to be another robust year for air travel supported by retail and business travel alike. If they drop the ball, it would suggest they are falling behind Delta (DAL) and United (UAL), which I believe have clearly separated from the rest of the cohort.

I could’ve covered AXP alone to discuss travel spending. Their spending data is that rich. AAL is in the spotlight because the setup into earnings is undeniably bullish. The stock made a higher high and will challenge the 2022 high around $19.20. If earnings come through, this stock could go north of $20 (~10% from Friday’s close). If this stock collapses on a bad print and drags the sector, DAL and/or UAL could be worth picking up.

AXP is in full breakout mode, consolidating at a new all-time high in the 300s. Their focus on premium (affluent) customers and deals with travel and experience packages has given them an edge over Mastercard and Visa. Positioned to fully capitalize on unprecedented travel demand, AXP remains a winner. Since I sold too early, I’ll admire this one from the sidelines and use their quarter for spending insights. For more skilled traders, there is clearly something to play for in an earnings-catalyzed breakout.