In a fundamental sense, when you buy stocks, you’re buying an ownership interest in a company priced as the current value of future earnings. It’s a little like paying an NFL QB: you aren’t paying for what they’ve done, but for what they’re going to do.

Although fear has returned to the equity market—manifesting itself in some lousy price action—valuations remain rich, which means earnings need to perform to justify them. King Dollar (USD) could be the greatest threat to earnings.

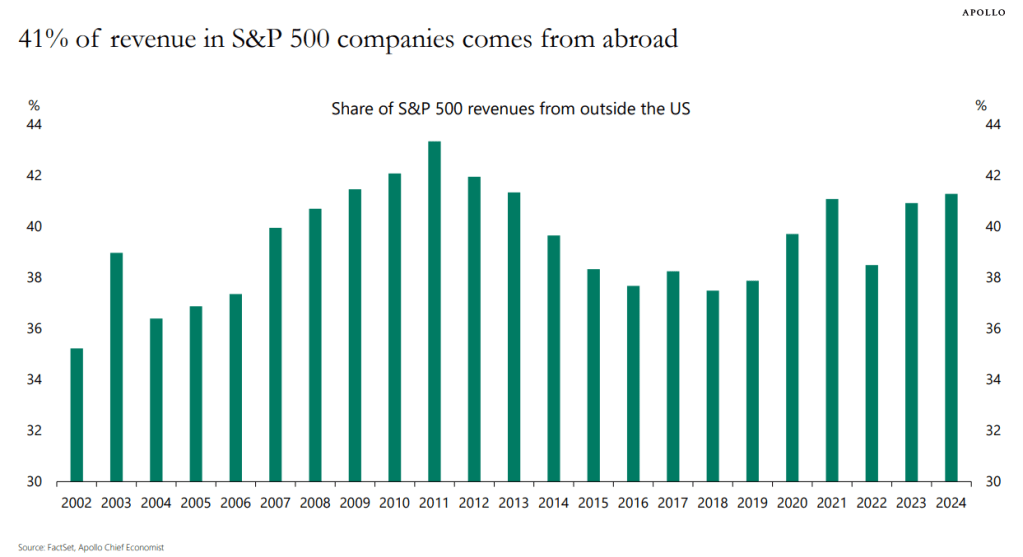

The S&P 500 and Overseas Revenue

According to the hitmakers at Apollo, 41% of S&P 500 revenue comes from overseas. When those S&P 500 companies convert their revenues from colorful foreign currencies into beautiful, familiar greenbacks, the exchange rate is not favorable. Be ready for the phrase “constant currency” to explain reported shortfalls.

For example, you might hear a CFO say, “Year-over-year, revenue grew 8% constant currency, but only 5% as reported, due to unfavorable FX rates (foreign currency exchange rate).”

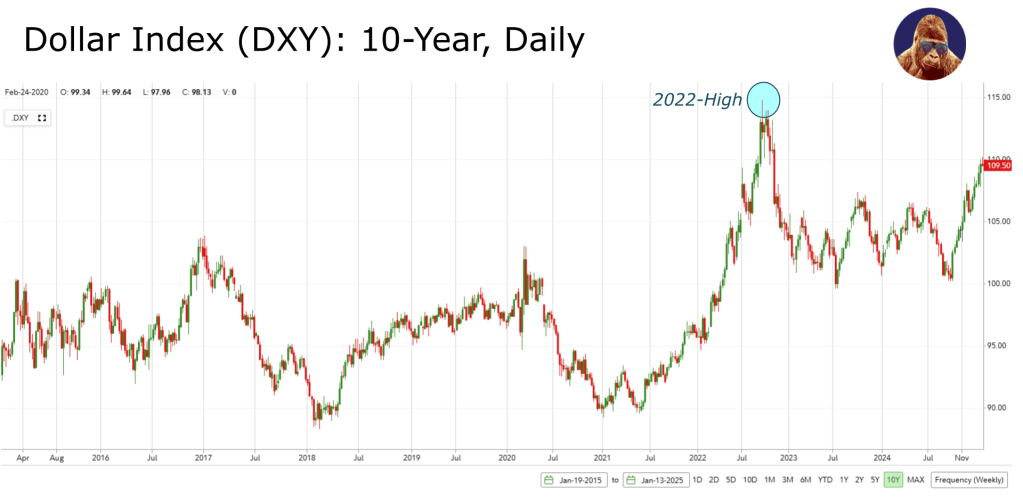

The Dollar’s Path Higher

Historically, the market overlooks these discrepancies as short-term distortions. Today’s retreat in the Dollar Index (DXY) notwithstanding, the USD remains en route to test the 2022 high made at peak-Fed hawkishness.

USD Tailwinds:

- The U.S. economy remains stronger and is trending better than other geographic markets.

- The U.S. central bank—the Federal Reserve—is tighter than other central banks.

- Policies of the incoming Trump Administration—depending on the degree of implementation—on tariffs, immigration, and taxes promise to support a stronger dollar.

Right or wrong, I see a world where the typical short-term nature of an FX distortion is brought into question.

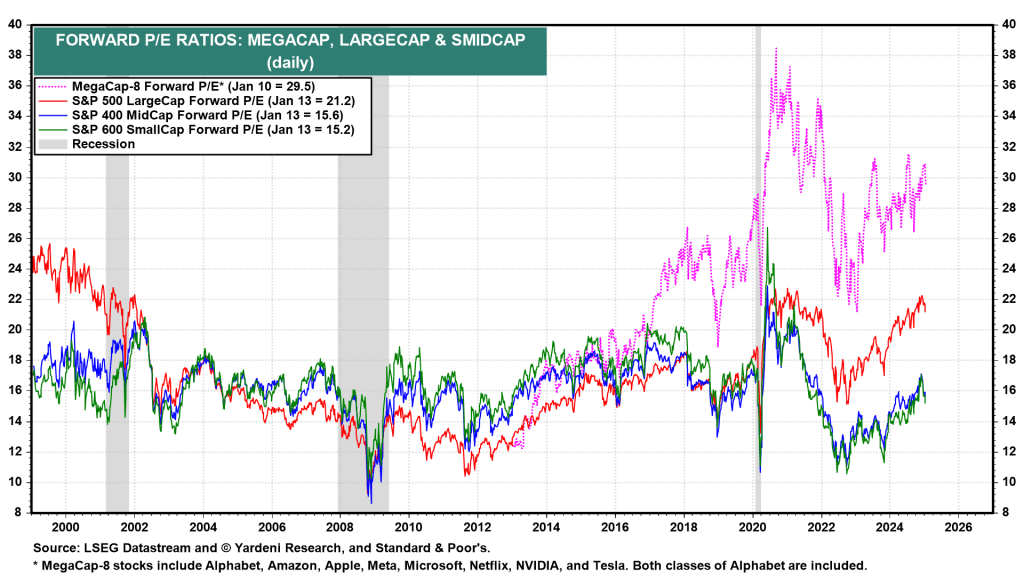

Valuation-Implied Expectations

While valuations don’t hold predictive value, they do tell us where expectations lie. Valuations are high enough to suggest some names are priced for (or beyond) perfection, meaning investors will overlook 99.9% of an awesome and hyper-fixate on a 0.1% blemish to take profits.

Glasses Off

I see the market selling robust fundamentals (earnings and revenues) due to FX as a short-term overreaction with the potential to create real opportunity. That said, unless tomorrow’s CPI results in a complete breakdown in the USD, the risk of lingering underperformance attached to a strong USD needs to be accounted for. You can hedge by using something like Invesco’s DB US Dollar Index Bullish Fund (UUP), but the lower volatility associated with currencies makes it harder to size effectively. At a minimum, I suspect stabilization in the USD—and yields as well—will be required before any opportunity becomes actionable. Until then, you risk being too early, which is often painful.