Weekly Performance

| S&P 500 | -0.71% |

| Equal Weight S&P 500 (RSP) | -1.18% |

| NASDAQ | -0.62% |

| DOW | -1.07% |

| Russell 2000 | -1.90% |

Talk of the Tape

A strong showing from Payrolls sent the major indices down 1-2% on Friday as investors sold the “good news”, interpreting it as a setback for rate cuts. Over the past two years, hindsight shows sell-offs triggered by strong economic data are buyable dips. This time feels no different.

The Week Ahead

Monday

- n/a

Tuesday

- PPI

Wednesday

- CPI

- J.P. Morgan (JPM)

- Citi (C)

- Wells Fargo (WFC)

- Blackrock (BLK)

- BNY (BK)

- Synovus (SNY)

Thursday

- Retail Sales

- Taiwan Semi (TSM)

- Bank of America (BAC)

- Goldman Sachs (GS) Morgan Stanley (MS)

Friday

- Housing Starts

- Regions Financial (RF)

- Truist (TFC)

Macro Movers

Last Friday, Payrolls came in so strong that it challenges the Fed’s narrative that the labor market is no longer a source of inflation. In response, yields spiked, and stocks dipped.

So, let me get this straight: The market sold off because the economy is too strong. Call me crazy, but this seems backward. You’re supposed to buy stocks when the economy can support higher earnings, not sell them.

Sellers opted to shoot first and ask questions later, assuming stronger economic data meant fewer rate cuts and lingering inflation. The former is clear but not necessarily bearish. The latter would be bearish – if it were clear. Let me explain:

First, the stock market is ultimately driven by earnings, not the Fed’s rate policy.

If a stronger economy and higher earnings mean fewer cuts—and they do—so be it. I’ll take stronger earnings over deeper cuts every time. As far as I’m concerned, fewer cuts—so long as hikes aren’t needed—is bullish.

Second, a stronger economy doesn’t necessarily translate to more inflation.

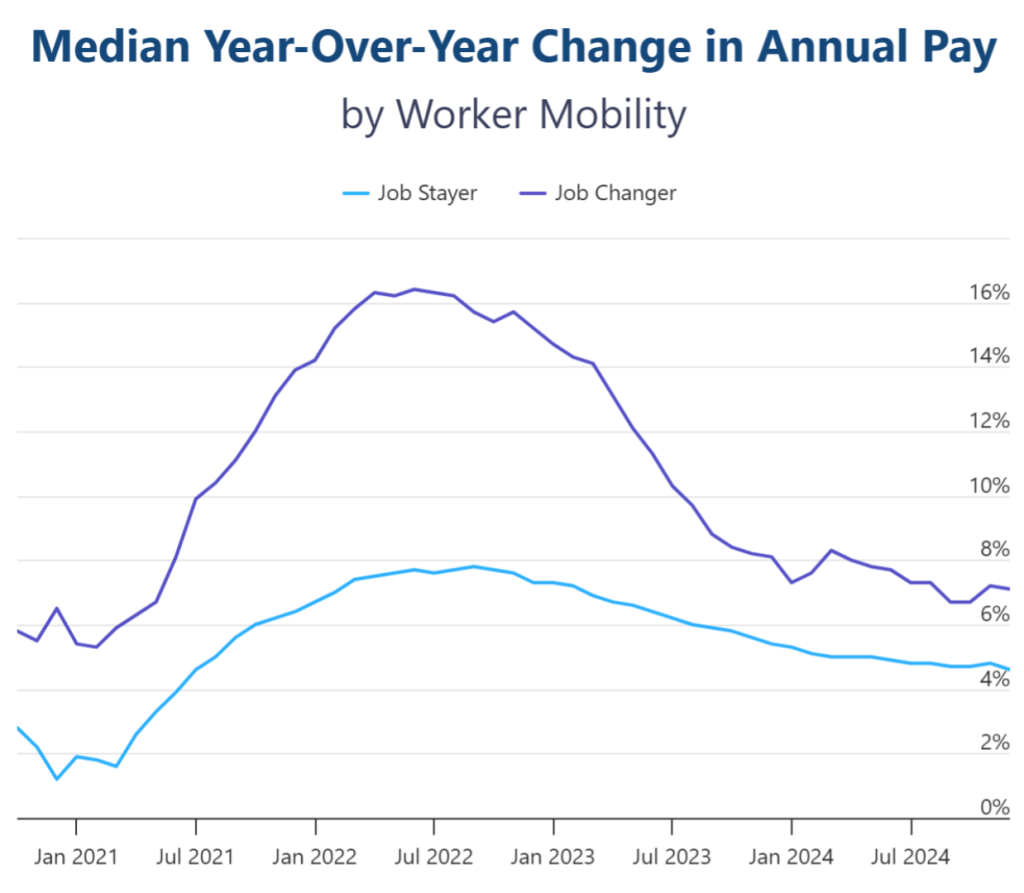

Have we already forgotten the entirety of our lived experience in 2024? To make matters worse, just two days before Payrolls, the ADP Employment Pay Insights Report revealed that wage growth for both job changers and job stayers decreased. For job stayers, the metric hit a new multi-year low. This decline coincided with the same period covered by the allegedly inflationary Payrolls report, raising further questions about the connection between growth and inflation.

If PPI and CPI on Tuesday and Wednesday fail to validate the inflationary narrative, last week’s stock sales will start to look hasty. Even more so if the dovish inflation data is followed by a beat on Thursday’s retail sales, which would improve the GDP and earnings outlook in an inflation-stable environment.

Concisely, if inflation doesn’t follow through for the bears, it is only a matter of time before investors connect the prospect of fewer rate cuts and rising long-term yields to improving growth prospects, rather than inflationary concerns. Once that connection is made, investors will get comfortable with yields where they are and buy stocks again.

That said, at 4.8% on the U.S. 10-Year Treasury, bonds are undeniably attractive to certain investors and managers targeting 8-10% annual returns. For these players, we’re no longer in a TINA (there is no alternative) world. This reality could cap upside for equities in the near term and cannot be ignored.

CPI and PPI

Core CPI is forecasted to rise 0.2% MoM, slightly lower than the prior month. The YoY expectation is 3.3%, holding steady from the previous print.

The forecast for Core PPI MoM matches last month’s result of 0.2%. YoY core is expected to print 3.2%, down from the prior 3.4% result.

Retail Sales

Consensus for retail sales sits at 0.4%, both for the headline figure and ex-autos. This reflects a decline from last month’s 0.7% headline but a notable jump from the 0.2% ex-auto print.

Housing Starts

Housing starts are projected at 1.32 million, modestly above the prior month’s 1.29 million. A brief dip in 30-year mortgage rates in December may have allowed for this slight uptick.

Micro Movers

Lost in the macro madness is the kickoff to earnings season. As mentioned earlier, I’ll take better earnings over more Fed cuts every single time. Now, we’ll begin to see if the companies can deliver them.

Big Money Centers

Wednesday, it all goes down. Before the market opens, J.P. Morgan (JPM), Citigroup (C), Wells Fargo (WFC), BlackRock (BLK), and Bank of New York Mellon (BK) will report. Meanwhile, Synovus (SNV), who couldn’t be bothered to hold a call that early, will release after the close. Thursday morning, Bank of America (BAC) rounds out the money centers before handing the microphone to the investment banks: Goldman Sachs (GS) and Morgan Stanley (MS).

Investors expect the financial sector to benefit from more favorable regulatory policy under the incoming Trump administration. Consequently, guidance will be the key focus here. Beyond the usual updates on consumers, the economy, and capital markets, we should also pay close attention to commentary regarding the impacts of tariffs, taxes, and immigration policies.

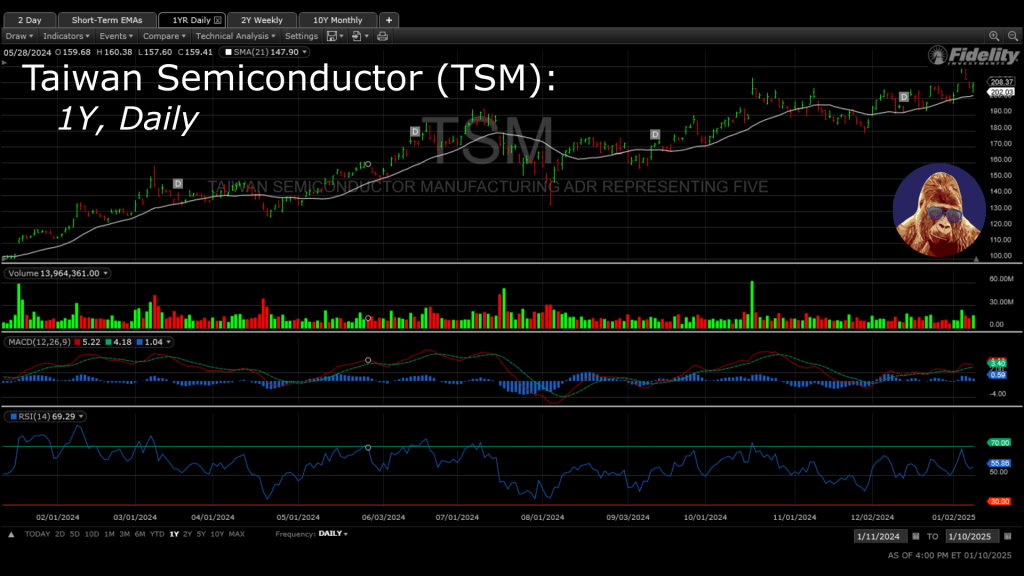

Taiwan Semiconductor (TSM)

This semiconductor foundry is the backbone of the chip world, supplying giants like Nvidia, Broadcom, and AMD. With its pivotal role in AI-driven growth, TSM’s performance – especially volume – is a direct readthrough for the broader sector.

All signs point to another strong quarter for TSM. December’s monthly sales report came in solid, and Taiwan’s Minister of Economic Affairs, Jyh-Huei Kuo, stated last week that U.S. tariffs are expected to have only a minor impact. We’ll learn more when TSM reports early Thursday morning.

For what it’s worth, the chart looks solid. Although the stock retreated after briefly hitting a new all-time high ~$220 on stronger-than-expected demand from Foxconn, it hasn’t lost the 21-day SMA and hasn’t triggered any bearish signals on my preferred indicators. Moreover, the valuation doesn’t imply exceedingly high expectations. As of Friday’s close, TSM is trading at 23.9x forward earnings, just 2 turns above its 5-year average of 21.9x.

Regional Banks

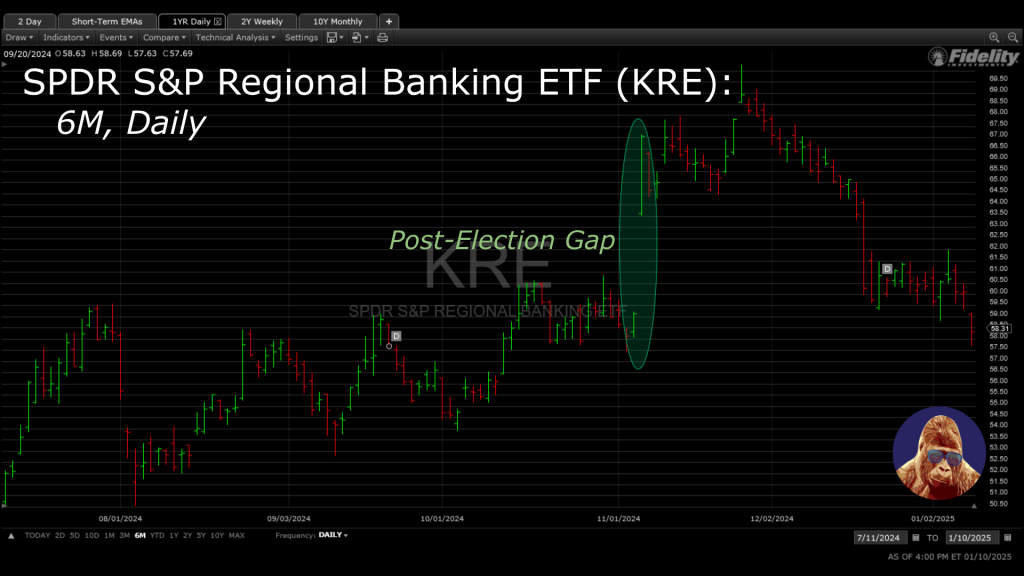

Much like the money center banks, regional banks are expected to show strong numbers, benefiting from a friendlier regulatory environment. While the space’s leaders – Zions and Comerica – aren’t reporting this week, Regions (RF) and Truist (TFC) will get the first shot at setting the tone Friday morning.

It is worth mentioning that the KRE – the sector’s ETF – has retraced all of its post-election rally. In my opinion, this suggests expectations are more balanced, which means individual names may only need to guide modestly higher to recapture investor optimism.

Leave a Reply