“Japan is a hospital. China is a jail. Europe is a museum. The U.S. is a business.”

Why would you put your money to work elsewhere?

Nick Colas, co-founder of DataTrek Research, summed it up perfectly. I believe he workshopped this quote from Lawrence Summers, who served as U.S. Treasury Secretary from 1999 to 2001.

Let’s unpack each metaphor:

Japan: Despite having a moment in 2024 and introducing some shareholder-friendly policies, Japan lacks the growth industries and demographics necessary to sustain its recent momentum. I might be wrong, but I suspect the yen’s weakness has more to do with their equity market’s success than any meaningful fundamental shift.

China: Even if you believe the official numbers that portray competitive growth, China remains a command economy. Xi Jinping is a dictator, and in China, what he says goes. Investing there is essentially entrusting your money to him. There are far more trustworthy places to allocate your hard-earned investment dollars.

Europe: Europe continues to lag behind the U.S. in innovation. It is a window into the past, not an engine into the future. There are many reasons why, but at the end of the day, whether by design or luck, the U.S. has fostered an enduring environment – Silicon Valley – where bright minds can take risks and be rewarded better than anywhere else. There isn’t such a place in Europe, and I don’t see one developing anytime soon.

Bonus – India: The demographic trends in India are unmatched, and the region has attracted the interest of the world’s most influential companies. Everything seems poised for strong GDP growth, which should, in theory, support earnings. Unfortunately, good GDP doesn’t always translate to good earnings and equity returns. If it did, global equity markets would look very different. Don’t fall too deeply for this story; when you buy stocks, you’re buying earnings, not GDP. While India might be worth a flier, it’s far from a sure thing.

I don’t hate emerging or international markets…

In fact, I love the narratives—they’re underdogs. And who doesn’t like cheering for the underdog?

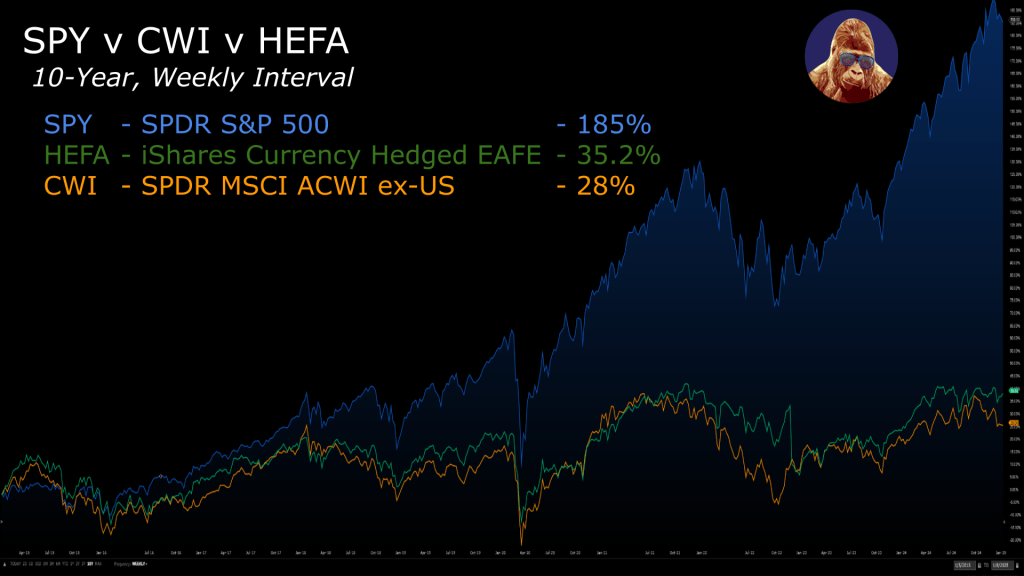

The problem is that, as the past decade has shown, these underdogs rarely outperform the favorite for any time period long enough to matter. Comparing accessible ETF options, the SPY – SPDR’s S&P 500 tracker – has well outperformed the CWI – SPDR’s MSCI ex-U.S. tracker – even if you hedged for currency using something like the HEFA.

That said, there are certain moments when ex-U.S. trades to shine. You just need a solid thesis… and (probably) really good timing.

- ILF (Latin America Top 40 ETF):

This trade leveraged the falling USD and treasury yields, which are the largest headwinds to ex-U.S. equities. In 4Q22, it appeared both had peaked and were on the decline. The ILF stood out due to the region’s uniquely high interest rates and distribution yield. I bought around $23, sold at $27, and collected a dividend during the six-month holding period, netting ~20%. However, ILF only outperformed the S&P 500 during 1Q23—by 2Q23, the S&P had caught up and surpassed the ILF. - EIS (Israel ETF):

In April 2024, during discussions of a potential ceasefire in Israel, I entered the EIS. But my thesis wasn’t about peace. Upon reviewing its holdings, I found EIS to be a basket of cybersecurity and tech stocks. Meanwhile, the Nasdaq appeared to be bottoming after a 7–8% pullback. Nvidia was set to report earnings, and after hearing from the hyperscalers, I anticipated Nvidia’s print would reinvigorate the tech sector. I was right, and the ETF has been on a tear since.

The point here isn’t to abandon ex-U.S. exposure but to rethink it.

Valuation Is Not a Thesis

A common theme in most ex-U.S. investments is mean reversion: the valuation premium the U.S. has over the rest of the world will eventually compress. In other words, the ex-U.S. investment theses center on a valuation re-rating. I don’t see that happening as long as the U.S. continues to fundamentally pull away from the rest of the world, especially if AI investments pay off. As I discussed in my recent piece on valuation, you need a fundamental catalyst for a re-rating.

Given the persistent underperformance over the last decade, holding anything more than a hedge-sized position requires a compelling thesis, To justify being bullish on ex-U.S. markets, two scenarios need to align.

- First, the U.S. would need to enter a slowdown or recession while another market is emerging from one or gearing up for an earnings expansion.

- Second, the Fed would need to hike rates while another country is cutting. In fact, both conditions might be necessary to see any meaningful outperformance.

However, considering that AI has likely averted a global recession and much of the AI buildout is concentrated on U.S. soil, such scenarios appear increasingly improbable.

Picking Winners Outside the U.S. Is Harder

The relative underperformance of ex-U.S. markets underscores how difficult it is to pick winners abroad. Even with access to the U.S. market—the best capital market in the world—picking stocks is hard. Why complicate things by fishing in a pond without as many big fish?

Final Thoughts

Ever since I started investing, many people—smarter than I—have pounded the table on emerging markets (EM) and international equities. While there have been small periods of outperformance, the long-term record is far from inspiring. The opportunity cost of allocating capital outside the U.S. has been significant. As long as the U.S. continues to lead in innovation, earnings growth, and capital market efficiency, expecting a meaningful re-rating seems impractical. Trading can be lucrative, but it’s harder to pick winners outside the U.S. than within. There is nothing wrong with allocating a portion of a portfolio ex-U.S., but it is important to set the correct expectations.

Leave a Reply