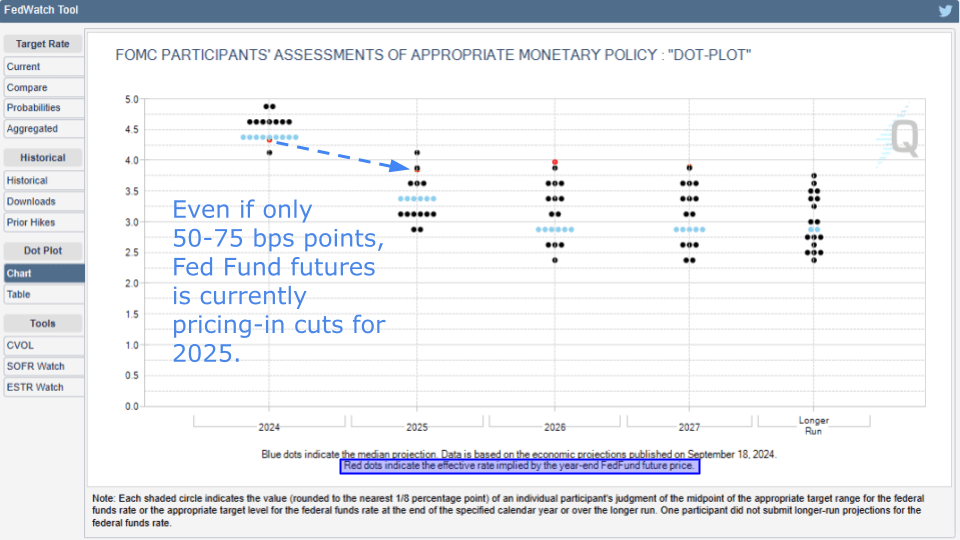

Today, the Fed is expected to cut rates by another 25 bps, bringing the Fed Funds range to 4.25–4.50%.

While futures have priced in ~3.75% for the end of 2025, recent economic data across inflation, labor, and growth has raised questions about whether further cuts are warranted. The debate is even more complex when factoring in potential policy shifts related to immigration and tariffs.

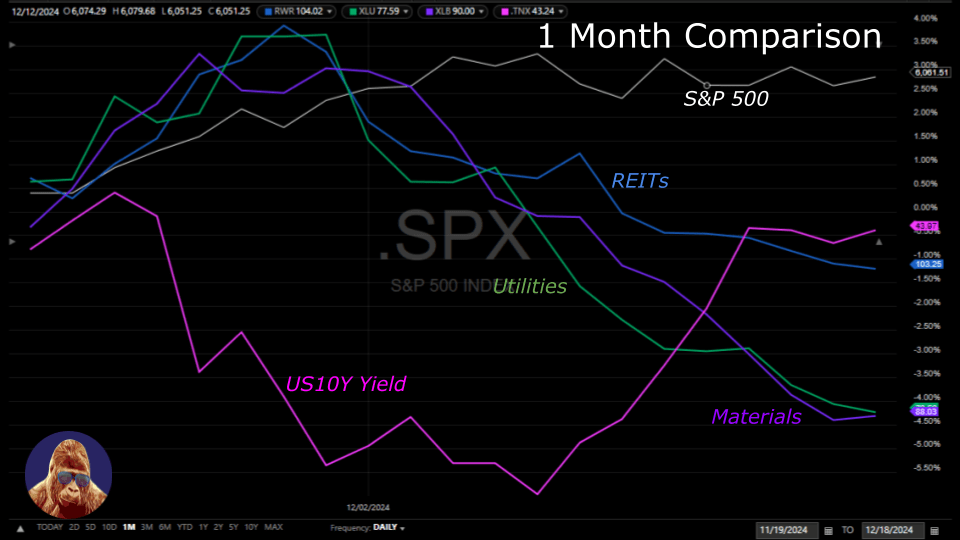

In my eyes, the bond market and certain equity sectors are signaling a path for interest rates that differs from the futures.

While the US2Y yield, sitting at 4.2%, obviously suggests the bond market sees little room for additional cuts, underperformance in REITs (RWR), Utilities (XLU), and Materials (XLB) paints a more compelling picture.

REITs and Utilities, driven by their dividend yields, struggle to compete as the rate of risk-free Treasuries rises. Materials, the weakest performer of the three, face headwinds as higher borrowing costs dampen industrial activity and homebuilding, reducing real-world demand.

Reduced exposure to these sectors – which continued even during the brief pullback in yields during the first week of December – signals preparation for a potential breakout in the US10Y yield, which admittedly looks ready to rip.

Both sides – the Fed Fund futures against a coalition of stocks and bonds – can’t be right. One must be wrong.

I expect today’s FOMC meeting – with a new dot plot and additional insights from Powell’s press conference – to force one side of this debate to readjust.

If the futures are right, then expect yields to cool-off and these sectors to bounce back. If the futures are wrong as these markets suggest, then we need to be ready for volatility as consensus surrounding the path of interest rates next year threatens shifts more hawkish, both in terms of Fed policy and long-bond trajectory.

Leave a Reply