Weekly Performance

| S&P 500 | -0.64% |

| Equal Weight S&P 500 (RSP) | -1.91% |

| NASDAQ | 0.34% |

| DOW | -1.82% |

| Russell 2000 (VTWO) | -2.58% |

Talk of the Tape

While the major indices didn’t rollover, market breadth has evaporated as inflation data drove yields higher. The NASDAQ managed to stay flat, buoyed by pockets of strength in technology – most notably AVGO and TSLA, both hitting new all-time highs.

The Week Ahead

Monday

- n/a

Tuesday

- Retail Sales

Wednesday

- FOMC Meeting

- Micron (MU)

Thursday

- Q3 GDP 2nd Revision

- Paychex (PAYX)

- Cintas (CTAS)

- FedEx (FDX)

Friday

- PCE

Macro Movers

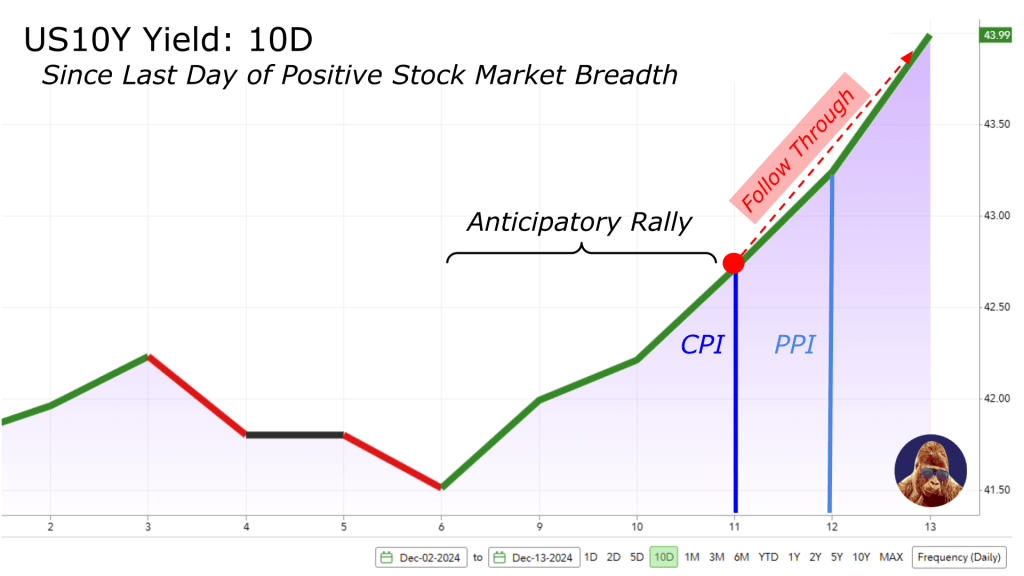

Although CPI came in line, PPI, contrary to prior prints, signaled there may be inflation down the pipeline. As a result, the narrative focused on the plateau in inflation progress.

Yields, which rallied into and out of the prints, ended the week higher. The US2Y appears to be a bond market signal for fewer interest rate cuts from the Fed. The US10Y is harder to interpret, but what you need to know is that rising long yields are a challenge for market breadth. Friday marked the 10th consecutive session where declining stocks outnumbered advancing ones – the longest streak since 2001. This streak coincides with the reversal higher in the US10Y yield.

As per the docket, it’s a pivotal week for macro. While the FOMC meeting is the main event, I see retail sales as a close second. In my view, retail sales carry the greatest potential for a surprise, which could significantly shift expectations for holiday spending.

CPI and PPI have already set the stage for a hotter PCE, and I see 2nd revisions to GDP as a “lame duck” event. Second reads lack the impact of an initial release and are quickly replaced by the final revision a month later. Both may nudge sentiment, but neither is likely to reshape the narrative the way retail sales could.

Retail Sales

The headline number is forecasted at 0.6%, an improvement over last month’s 0.4%. Excluding autos – which I prefer – consensus is 0.4%, notably higher than the 0.1% gain last month.

FOMC Meeting

As of Saturday afternoon, the FedWatch Tool assigns a 96% probability to a 25 bps rate cut. While I expect some dissent among voting members, I’d be shocked if the committee doesn’t deliver what the market so clearly anticipates. In my view, this will be the final “recalibration” cut. From here, the data will need to do more before the Fed does, especially with uncertainty surrounding tariffs and immigration.

3Q GDP (2nd Revision)

2.9% is expected, marking a 0.1% upward revision from the advanced estimate of 2.8%.

Personal Consumption Expenditures (PCE) Index:

The PCE Index, the Fed’s preferred benchmark for its 2% inflation target, mirrors the stalled progress seen in CPI. At this point, I believe absolute progress will ultimately be necessary to stabilize yields.

Most of November’s CPI increase came from housing, which carries a 33% weight in that index. Housing, however, accounts for just 15% of PCE, suggesting this data may appear less inflationary than last week’s CPI report.

Year-over-year, core PCE is projected at 2.9%, a slight uptick from last month’s 2.8%. Month-over-month, core PCE is expected to rise by 0.2%, a step down from October’s 0.3% increase.

Micro Movers

We’ve entered a quieter period for corporate earnings, but a few key reporters this week will offer insights into economic trends. I also give Micron (MU) some attention, in honor of Broadcom’s (AVGO) AI-fueled quarter.

Micron (MU)

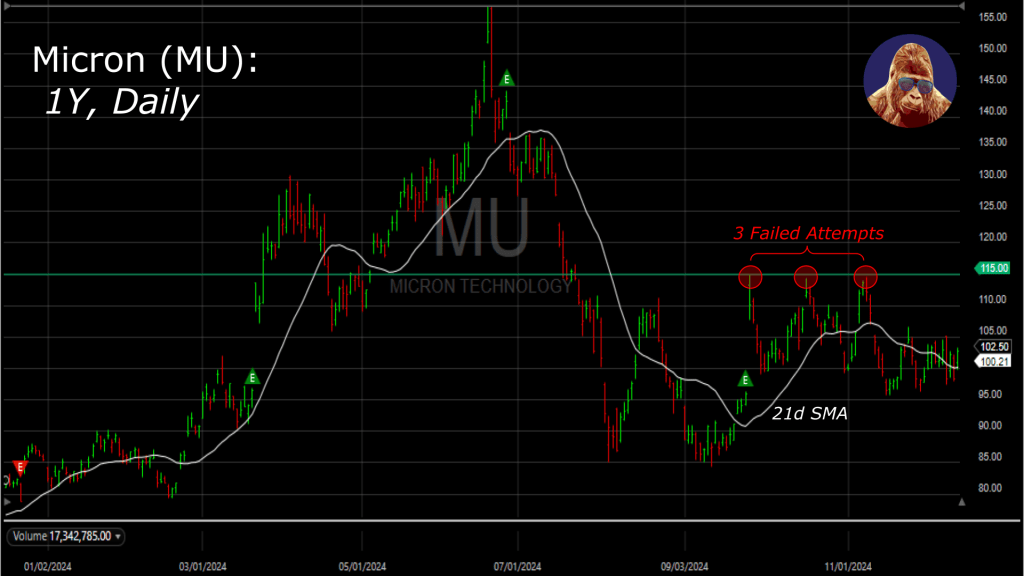

Broadcom’s stellar quarter, driven by its AI infrastructure segment, sent its shares soaring 25% and propelled it into the $1T Club. Many semiconductors rallied in sympathy, including Micron, which rallied a little more than 4%. However, Marvell (MRVL) – arguably the best positioned to replicate Broadcom’s results – was the biggest indirect beneficiary, adding better than 10%. Still, Broadcom’s performance bodes well for the sector.

Micron doesn’t design AI processors like Nvidia, but its memory and storage chips are critical enablers of those processors. As AI adoption grows, so will demand for Micron’s products. That said, this space is highly competitive. Samsung, the heavyweight in memory chips, has a history of flooding the market to suppress prices and margins to undermine emerging competitors.

Despite the competition, Micron has strategic advantages for the next four years. As a U.S. company, it avoids tariffs on domestic sales, unlike foreign competitors like Samsung. This gives it a pricing edge in the U.S., where AI investment is concentrated. Additionally, with only 12% of its revenue tied to China, Micron is relatively insulated from the region’s struggling economy, which has weighed on other companies reliant on Chinese markets.

As for the stock, $115 has been a stubborn resistance level. Bulls reclaim it, and momentum will carry it higher.

Paychex (PAYX), Cintas (CTAS), and FedEx (FDX)

These companies will offer a snapshot of economic health. Paychex and Cintas, by the nature of their customer bases, provide a lens into the well-being of small-to-medium-sized businesses—a critical segment of the U.S. economy. Meanwhile, FedEx’s logistics volume and cadence will shed light on broader business activity both domestically and globally.

While I don’t expect their results to overshadow the narrative set by macro releases, these reports could reinforce or challenge the prevailing sentiment.

Leave a Reply