December 2024

-

Today, the Fed is expected to cut rates by another 25 bps, bringing the Fed Funds range to 4.25–4.50%. While futures have priced in ~3.75% for the end of 2025, recent economic data across inflation, labor, and growth has raised questions about whether further cuts are warranted. The debate is even more complex when factoring…

-

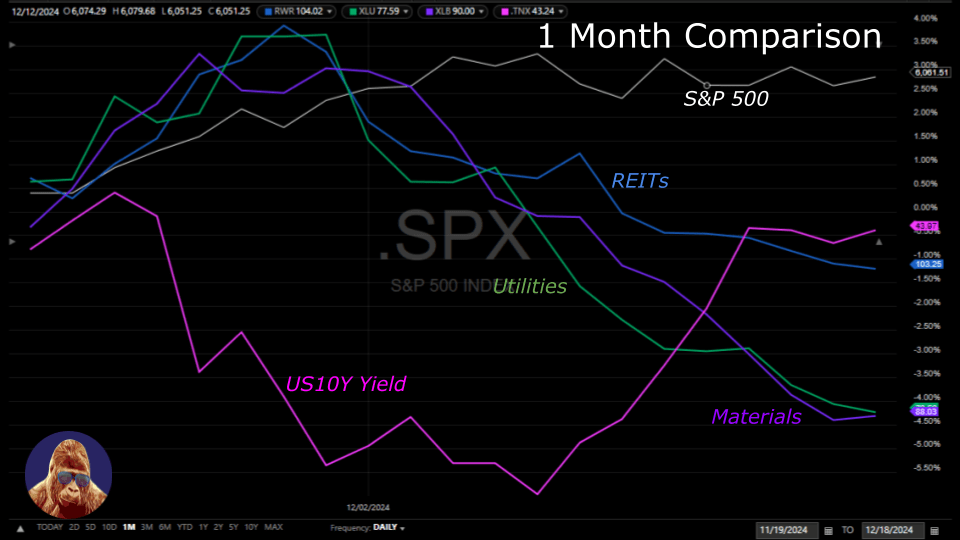

Weekly Performance S&P 500 -0.64% Equal Weight S&P 500 (RSP) -1.91% NASDAQ 0.34% DOW -1.82% Russell 2000 (VTWO) -2.58% Talk of the Tape While the major indices didn’t rollover, market breadth has evaporated as inflation data drove yields higher. The NASDAQ managed to stay flat, buoyed by pockets of strength in technology – most notably…

-

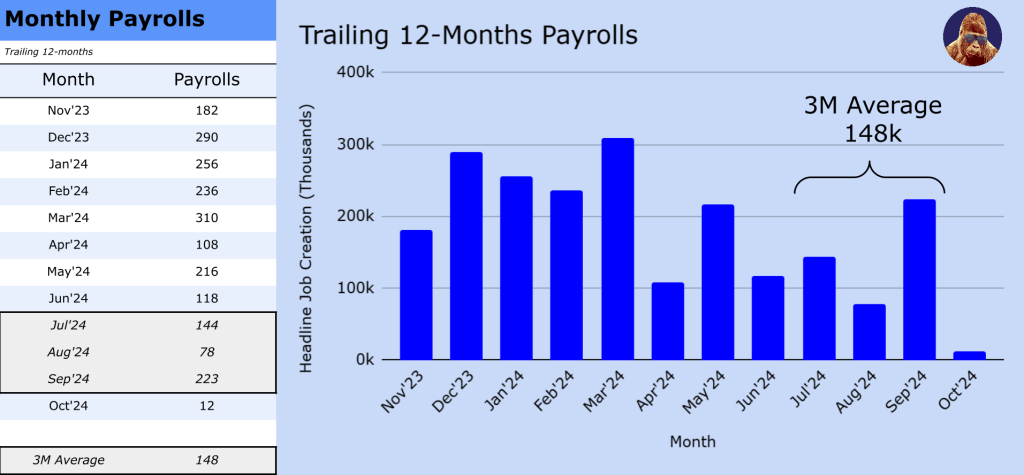

Weekly Performance S&P 500 0.96% Equal Weight S&P 500 (RSP) -1.40% NASDAQ 3.34% DOW -0.60% Russell 2000 (VTWO) -1.06% Talk of the Tape Bitcoin broke 100k. The US10Y took a breather. The NASDAQ woke up. Payrolls for November exposed October’s weakness as an outlier and further solidified expectations for a 25-bps cut at the December…

-

It’s a pretty good economy, as far as the data is concerned: 📈 Headline job creation for November came in at 227k, surpassing the 214k forecast.📈 October’s number was revised up to 36k from 12k. Here’s how I see it: The Economy With November job creation bouncing back well above the trailing three-month average, it’s…

-

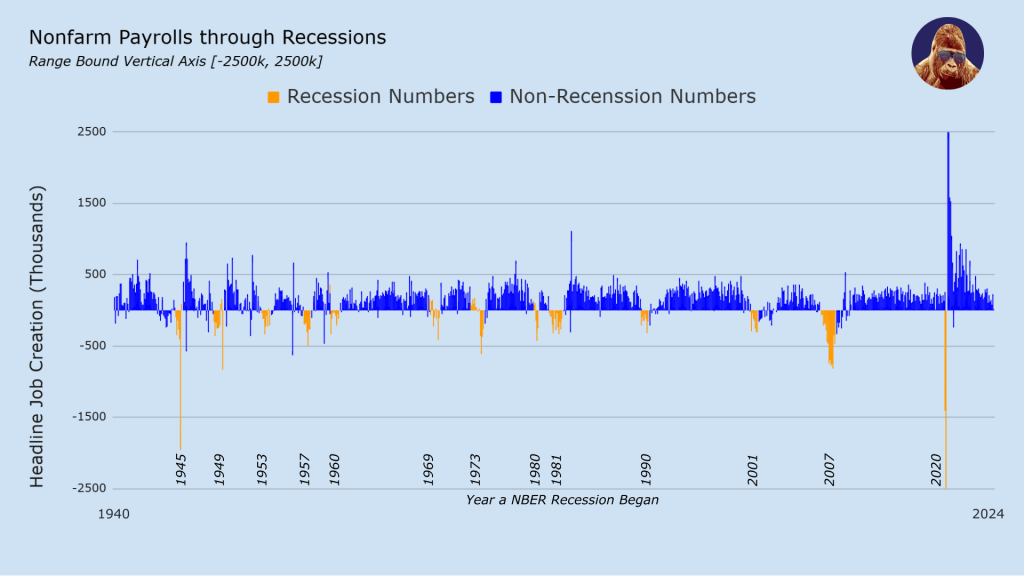

The Importance of Payrolls As the gold standard of economic reports, payrolls carry significant weight. Given their influence on Treasury yields, they indirectly have the power to move the prices of all financial assets. Moreover, payroll data impacts key decision-making bodies: the Fed, Congress (if you believe them—I don’t), and Wall Street strategists and analysts.…