Who doesn’t like Coca-Cola? I tend to prefer the beverage, but the stock (KO) looks tempting.

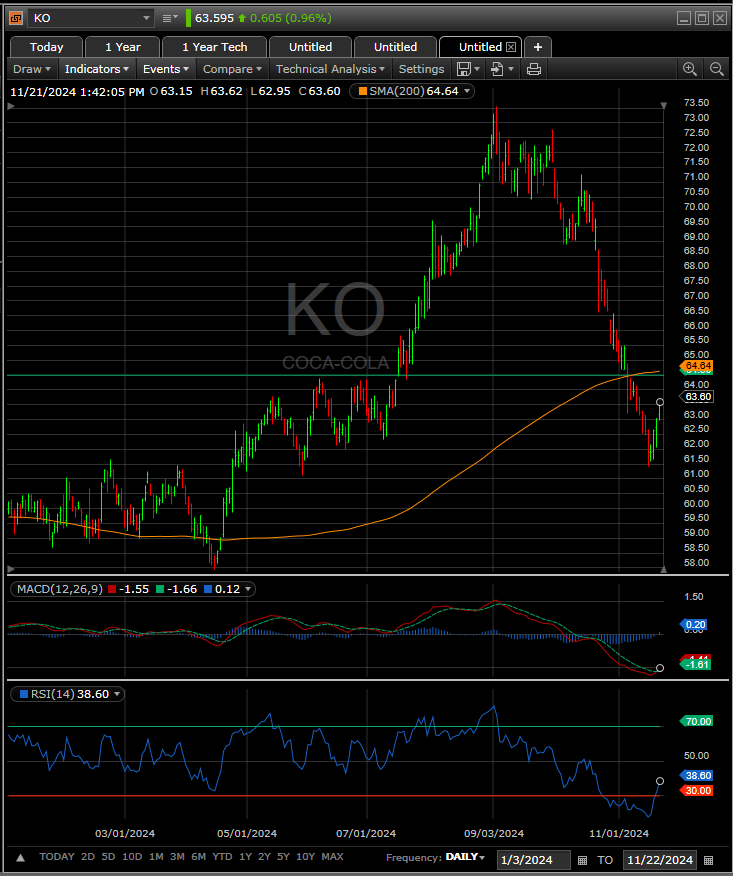

The 16% slide KO finds itself in began in September, marking its worst drawdown since GLP-1 concerns catalyzed a 20% sell-off last year. After nearly three straight months of decline, KO is showing signs of life:

MACD, which has remained in bear-mode since the top-tick in September, has finally experienced a bullish crossover, signaling a shift in momentum.

Coinciding with this crossover, RSI has quickly spiked out of oversold territory, providing further evidence that the bears’ grip on this stock is slipping.

If KO can retake the 200-day SMA and edge back into the trading range it broke out of around ~$64.50, I suspect momentum traders will push the stock higher. While many have heard the age-old adage, “buy low, sell high,” there is a group of nimble, tactic investors who prefer to “buy high, sell higher.”

While it might still be “too early”, I’ve decided to put some money to work here. Bottoms up.

Leave a Reply