Weekly Performance

| S&P 500 | -2.08% |

| Equal Weight S&P 500 (RSP) | -2.12% |

| NASDAQ | -3.15% |

| DOW | -1.24% |

| Russell 2000 (VTWO) | -3.99% |

Talk of the Tape

The market took a breather with yields exerting pressure as both economic data and Powell hinted at a slower pace of easing ahead. Pharma stocks, particularly vaccine-related names, were hit hardest following the nomination of RFK Jr. as Health Secretary – due to his public vaccine skepticism.

The Week Ahead

Monday

- n/a

Tuesday

- Housing Starts

- Building Permits

- Walmart (WMT)

Wednesday

- Nvidia (NVDA)

- TJX Companies (TJX)

- Palo Alto (PANW)

Thursday

- n/a

Friday

- n/a

Macro Movers

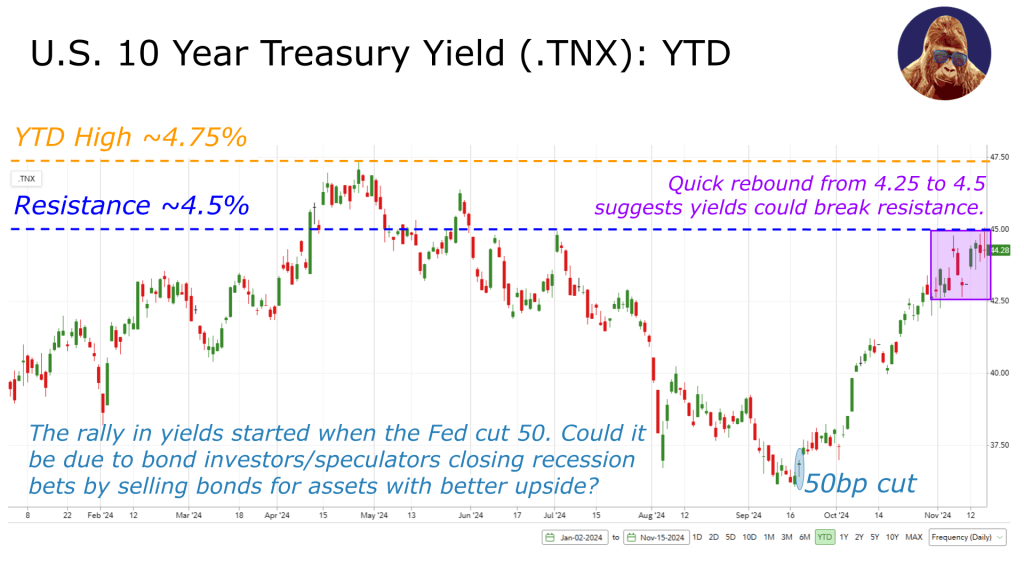

Yields and the USD are on fire. It may finally be dampening stock market enthusiasm.

The US10Y yield’s technical setup suggests the climb isn’t over. 4.5% is often cited as a “pressure point” for stocks. While the absolute level might not be problematic, the velocity of the move – especially if it breaks out – could rattle markets in the short-to-intermediate term.

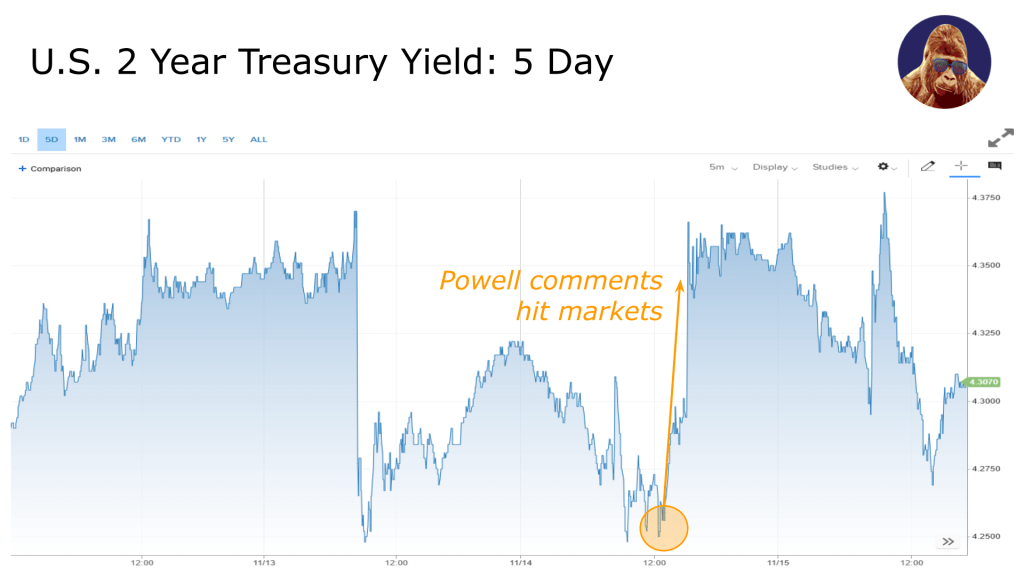

Meanwhile, the short end is reacting to Powell’s unmistakably hawkish tone last Thursday: a remarkably strong economy allows for careful rate reductions. Translation? A December pause is on the table. It wasn’t before. Yields responded accordingly, with the US2Y edging higher.

Overall, I agree with the Fed’s cautious approach. Even without factoring in the incoming administration’s pro-growth policies, recent data supports this stance. Regarding the US10Y, a breakout may reflect pricing-out a recession rather than pricing-in “reflation” fears. After all, the rally in yields started with the 50 bps cut that, theoretically, should make it easier for the economy to put up good growth numbers and avoid recession territory. That’s not to dismiss the impact of tariffs. Of course, if the tariffs implemented match the campaign promises, then inflation will return to the concerns list. However, if his tariff policy is similar to his first, used as a negotiation tool rather than widespread policy, the calculus is different. In short, there’s time for the narrative to evolve, as the scale and scope of any new tariff measures remain uncertain.

Let’s not forget: stocks have had a banner year. A pullback or period of consolidation would be healthy, helping valuations reset and preventing overheating. However, from a momentum perspective, it’s critical for indices and individual names to hold their post-election gap levels. Falling back into those gaps could signal trouble for near-term sentiment.

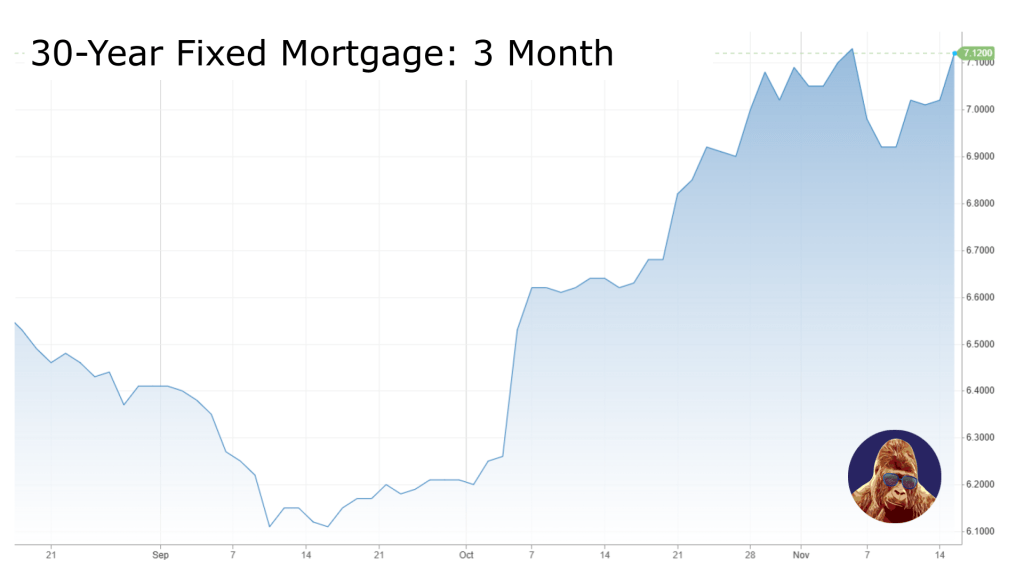

It is a quiet week for economic data. However, housing remains a key theme, and this week’s housing starts and building permits reports are worth watching. To address housing costs, we need progress on the supply side. Beats in both areas would be encouraging, though the recent surge in mortgages might have weighed on activity.

Housing Starts

The forecast is 1.34 million—steady compared to recent months.

Building Permits

Expected at 1.44 million, also in line with previous results.

Micro Movers

Yes, Nvidia (NVDA) is all that matters. But before we preview the main event, let’s shine a light on a few other companies reporting this week that deserve your attention.

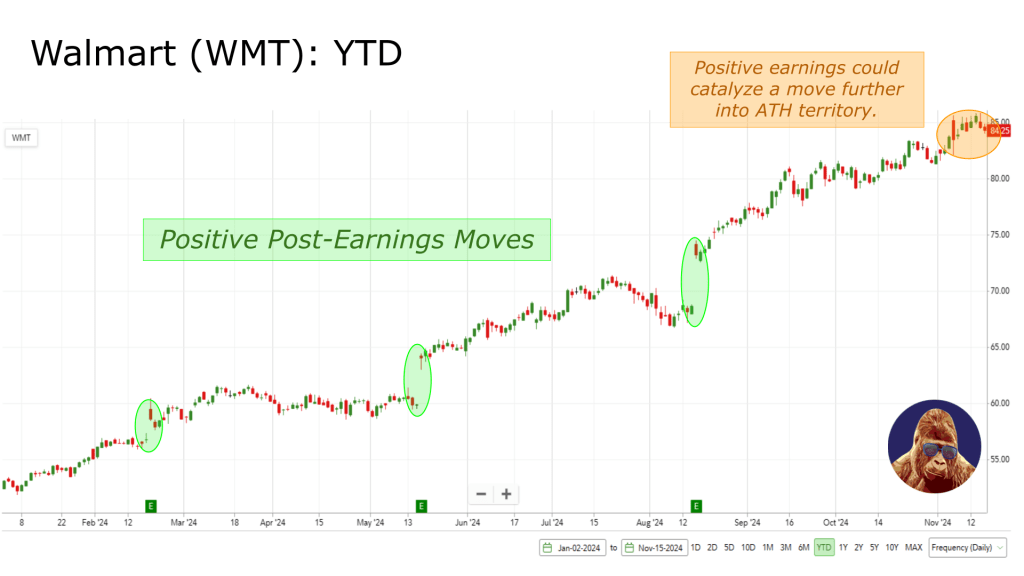

Walmart (WMT)

Trillion dollar companies are becoming the norm nowadays. At least one retailer should join the club. Why not Walmart? At ~$680B, it would take a 47% gain to get there. Not happening this quarter, but stay with me.

This chart – up and to the right – reflects Walmart’s financial success by increasing its consumer base by keeping prices low without completely sacrificing quality. It also reflects their ability to sell (me) oversized $30 duck plushies.

Let’s talk about the app. If you haven’t used it, you’re missing out. It streamlines everything: ordering from local stores, initiating returns, and even finding items in-store. Costco, take notes.

The only issue: WMT trades at 33x forward earnings, well above the peer group median of 21x. Now, this doesn’t mean WMT is doomed to sell-off. Walmart is a premium company deserving of a premium multiple. The last three quarters have been great for shareholders. Just understand, buying it before the quarter is a bet the report will remind us of that. .

TJX Companies (TJX)

A 2020 study revealed that 97% of U.S. apparel is made overseas. In 2023, China accounted for 26.1% of textile imports. Retailers focusing on apparel could face tariff pressures depending on the incoming administration’s trade policies.

However, TJX’s model – sourcing discounted inventory from U.S. retailers – partially insulates it from these risks. The stock is testing its $120 all-time high for the third time since August. Perhaps earnings will be the catalyst for a breakout.

Palo Alto Networks (PANW)

Cybersecurity might eventually surpass AI in market size. Every company needs cybersecurity; not every company will have the resources to leverage AI. I consider PANW a top 3 names in the space alongside Crowdstrike and Fortinet. Speaking of, Fortinet reported last week and was well-received. Though it’s no guarantee for PANW, it creates a more favorable backdrop.

Nvidia (NVDA)

With all due respect to Apple and Microsoft, Nvidia is the market’s most revered general, the heart of the AI revolution. This midweek report will inform investor sentiment on AI’s growth trajectory.

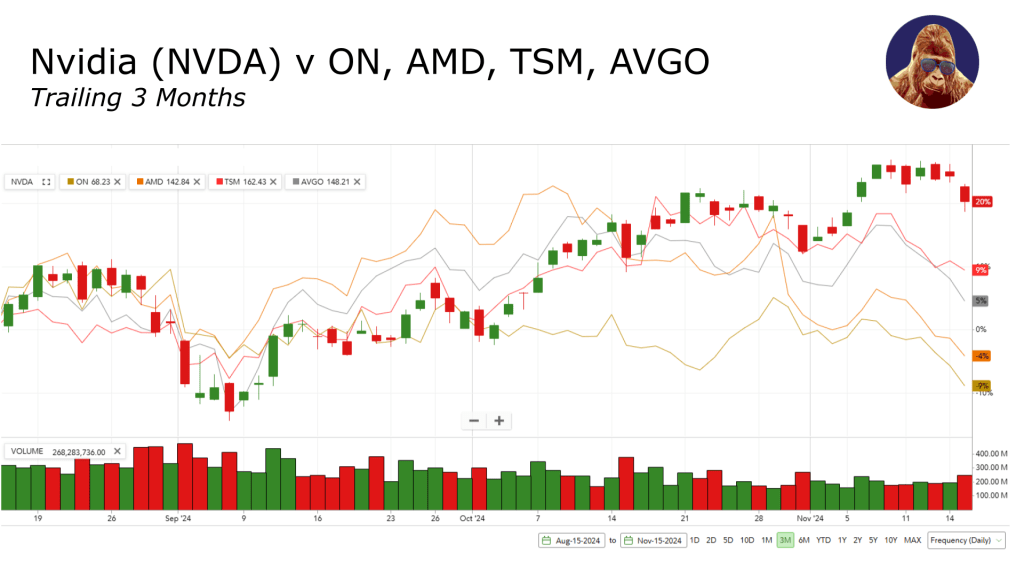

Nvidia has defied the broader semiconductor weakness. It’s up 20% in 3 months, vastly outperforming SMH’s 3-month return of 2%. This disparity is even more pronounced against individual names, some of which are nearing correction territory. It feels like Nvidia is sucking the oxygen out of the semiconductor space. Regardless of NVDA’s stock reaction, I hope this report will be a clearing event for the sector, allowing other semiconductor stocks to gain traction.

As for expectations, Nvidia is unlikely to deliver a “miss” given what hyperscalers have already revealed in their quarters. Exceeding expectations by a record margin, again? That’s a different story. There’s chatter about the beat not being as outsized as in past quarters. No shock there. Eventually, analysts will scribble a number too high for Jensen to blow out. However, the CEO could find another rabbit to pull out of his hat on guidance due to progress on sovereign AI, specifically in Japan.

As for the reaction, let’s not overlook the fact that NVDA is the world’s largest stock. If it delivers, the resulting surge could reignite momentum. Of course, the reverse holds true. If Thursday morning greets us with a sea of red, don’t hit the panic button. That money could find new homes in other names by the afternoon. Stay nimble.

Leave a Reply