Weekly Performance

| S&P 500 | -1.37% |

| Equal Weight S&P 500 (RSP) | -1.37% |

| NASDAQ | -1.57% |

| DOW | -0.15% |

| Russell 2000 (VTWO) | 0.10% |

Talk of the Tape

Although eco-data came up “goldilocks”, the mega-caps were met with mixed responses. Despite yield pressures continuing to hamper stocks, the majors remain at relative high levels ahead of the Presidential Election and FOMC meeting.

The Week Ahead

Monday

- Constellation Energy (CEG)

- Palantir (PLTR)

Tuesday

- U.S Presidential Election

Wednesday

- FOMC Meeting

- Arm (ARM)

Thursday

- Vistra (VST)

- Arista (ANET)

Friday

- n/a

Macro Movers

Broadly speaking, last week’s eco-data was more supportive of a soft-landing than we could’ve hoped. GDP showcased resilience, PCE printed in-line, and the payrolls report, albeit affected by hurricanes and strikes, featured a 12k job growth figure, providing balance to the debate that was beginning to conclude that 50 bps last month was an error.

Although meaningful companies report this week, macro easily has pole position. The U.S. Presidential Election unfolds Tuesday but I wouldn’t expect a definitive outcome until Wednesday or Thursday. Election headlines crossing alongside FOMC headlines seems a perfect storm for volatility. That said, markets often act in whichever way makes the most people look foolish. If that proverb holds true, we’ll close the week flat.

As for the election, many prefer Polymarket to pollsters. I tend to agree. That said, Polymarket’s U.S. popularity is at a new peak as indicated by Robin Hood’s new product that leverages the same election contract. Consequently, there is a higher probability today than four years ago that these contracts are being used to hedge rather than to reflect voting intentions, which would skew the odds. As of Saturday, the odds were 60-40, but, to me, it still feels like a coin flip.

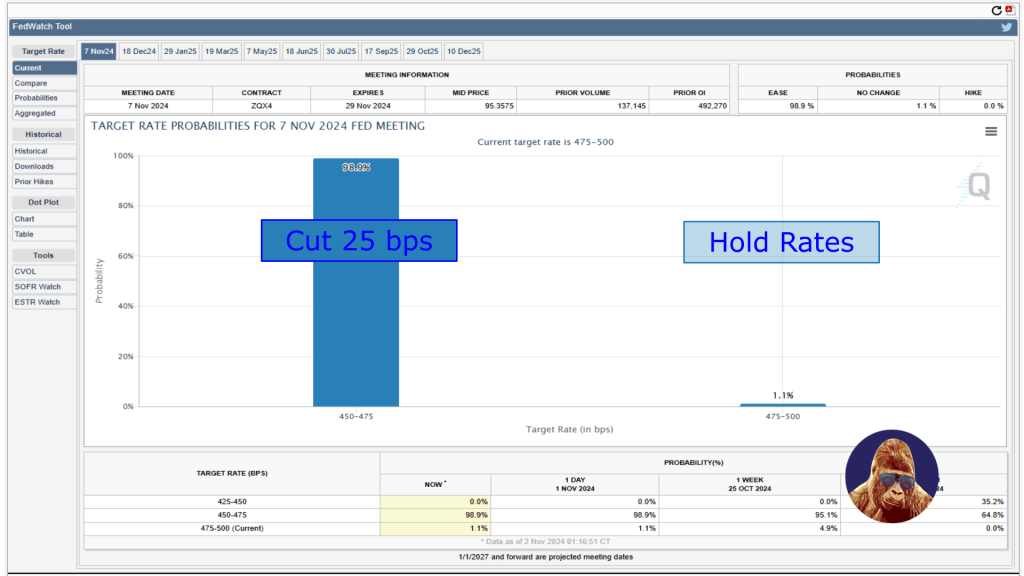

The market appears to be pricing in a 25 bps cut. Expect Powell to face questions on payrolls in light of strike and hurricane effects and on the new White House administration (even if the result is still in question). As usual, expect Powell to answer without giving the market any more than he intends.

Some final words of advice: don’t overreact to price moves this week. With so much happening simultaneously, it’ll be difficult to pinpoint what’s driving prices and whether those moves have staying power.

Micro Movers

Now, onto those meaningful companies. The common thread: AI.

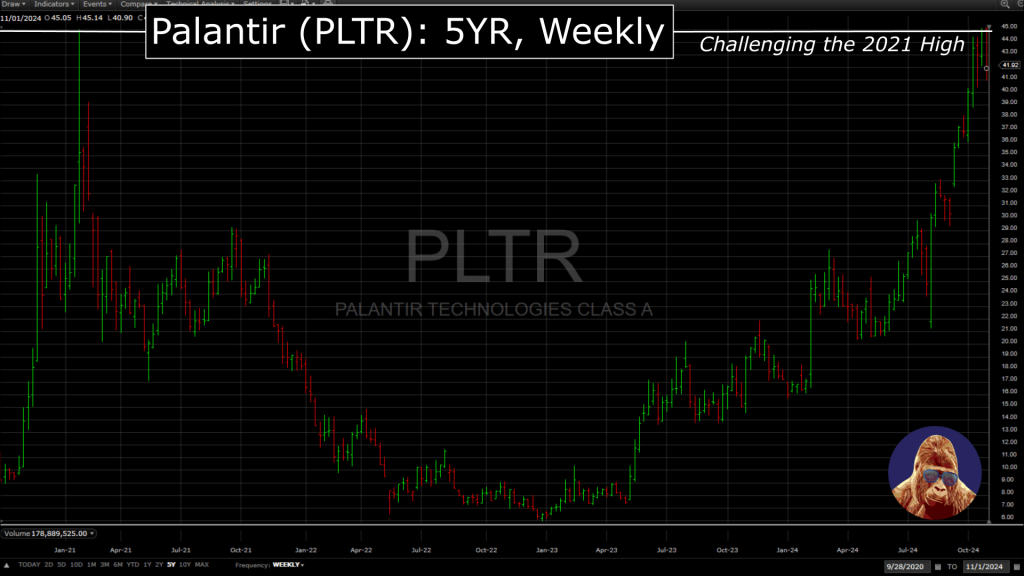

Security AI – Palantir (PLTR)

Palantir is doing a lot right. The chart tells you that much. Their technology helps organize, integrate, analyze, and utilize data for AI and machine learning models. The company is making visible progress on their ambition to become “the default operating system for data across the U.S. government”. They’ve also developed relationships with massive commercial clients and other government agencies. These unique, sticky, and lucrative relationships have created a meaningful moat and scale. In my view, Palantir is the clearest example of a software company that has leveraged AI to deliver outsized fundamental returns.

Powering AI – Constellation Energy (CEG) and Vistra (VST)

These are the hottest utilities stocks because they’re the clearest link to expected spending in nuclear energy necessary to power AI datacenters.

A look at either chart would tell you that the bar for earnings is high. If either decline off a “business as usual” quarter, I’d strongly advise taking a look, especially CEG. Quick math: CEG responsible for ~30% of U.S. total nuclear capacity. Other notable names in the space are Duke Energy (DUK), Entergy (ETR), and Southern Company (SO).

On a related note, you may have heard of “small modular reactors” or SMRs. Names in that space are NuScale (SMR), Oklo (OKLO), and Nano Nuclear Energy (NNE). Full disclosure, I’m not familiar with these companies beyond their name and what they do.

Enabling AI – Arm (ARM)

If not for regulatory scrutiny, ARM would’ve been acquired by Nvidia and never IPO’d. ARM licenses their chips designs. Their bread-and-butter is smartphone CPUs. Most notably, Apple uses ARM architecture for iPhone, iPad, and Mac chips. ARM’s future revolves around AI at the edge – AI computing on your device rather than in the cloud. While it is a promising future, a future so promising that Jensen Huang wanted to buy it, there is risk: if the smartphone market doesn’t inflect higher, the company will not be able to deliver the growth necessary to justify the stock’s price at the current valuation.

Datacenter AI – Arista Networks (ANET)

AI requires quick, precise, and efficient transfer of massive data. Arista provides the networking equipment that makes it all possible while being compatible with existing systems. They work with high-profile financial institutions and cloud providers, like Amazon’s AWS, that remain committed to spending on the technology. This is another name worth picking up on a solid quarter that gets unjustly sold.

Leave a Reply