Weekly Performance

| S&P 500 | -0.96% |

| Equal Weight S&P 500 (RSP) | -1.92% |

| NASDAQ | -0.16% |

| DOW | -2.68% |

| Russell 2000 (VTWO) | -2.99% |

Talk of the Tape

Despite solid earnings throughout the week, pressure from a rising U.S. 10-year yield kept a lid on stock prices. However, on Friday, yields eased, allowing many stocks to end the week on a positive note.

The Week Ahead

Monday

- n/a

Tuesday

- Advanced Micro (AMD)

- Alphabet (GOOG)

- Chipotle (CMG)

- First Solar (FSLR)

- McDonalds (MCD)

- Pfizer (PFE)

Wednesday

- ADP Report

- GDP

- Eli Lilly (LLY)

- Microsoft (MSFT)

- Meta (META)

- Starbucks (SBUX)

Thursday

- PCE

- Uber (UBER)

- Amazon (AMZN)

- Apple (AAPL)

Friday

- Payrolls

Macro Movers

Try not to blink—between PCE, Payrolls, and a heavy slate of corporate earnings, you might miss something. But before diving in, let’s first address the recent action in the U.S. 10-year yield.

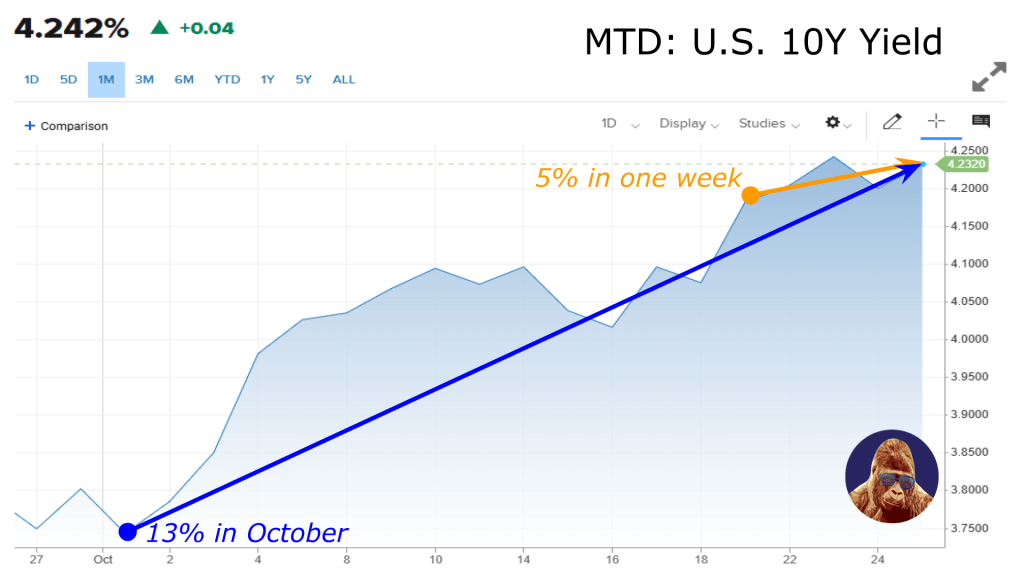

Month-to-date, the yield has risen from ~3.7% to ~4.2%. In absolute terms, that’s only a ~0.5% increase, but in percentage terms, it amounts to a 13.5% jump – 5% of which came just last week. The U.S. 10-year is one of the most liquid markets on Earth. A move of this size requires significant capital. Typically, such a shift would follow a major economic report or a Fed Chair speech, but that wasn’t the case here.

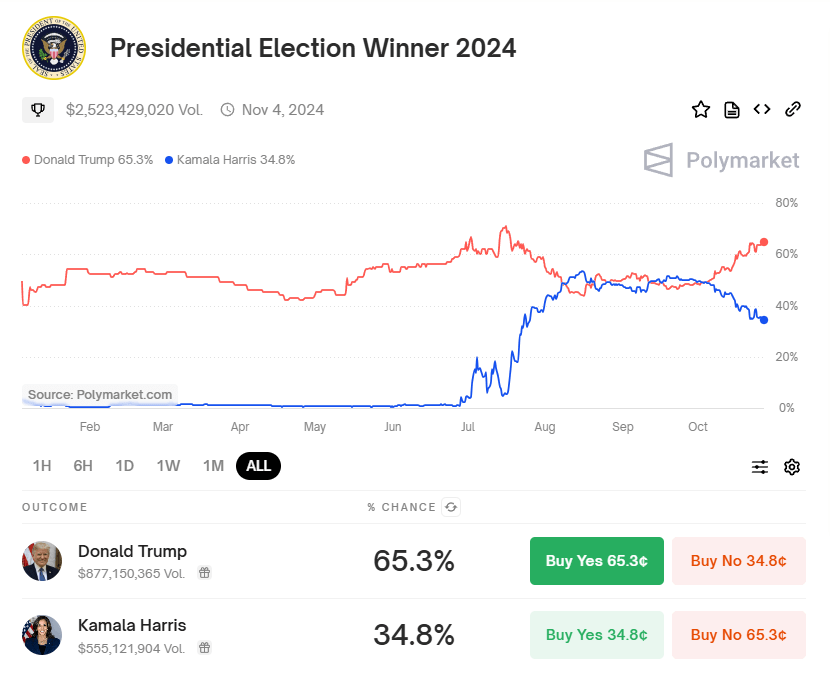

The most compelling theory behind this shift points to the election. Currently, Polymarket suggests Donald Trump has a 65.5% chance of becoming president. The premise is that if Trump wins and implements the advertised tariffs, inflation would increase. Bonds are moving up in anticipation of tariff-driven “reflation.”

This raises a good question: why hasn’t the stock market adopted a similar view?

The stock market still views Trump-era tariffs positively. It’s worth noting Biden campaigned to repeal those tariffs, yet didn’t. So say what you will about the Trump administration’s approach, its negotiation and implementation strategy proved effective enough that even the opposition kept it intact.

The theory suggests that both stock and bond markets are pricing-in a Trump win but with distinct expectations: bonds are taking Trump at his word, while stocks expect policies more in-line with his first term.

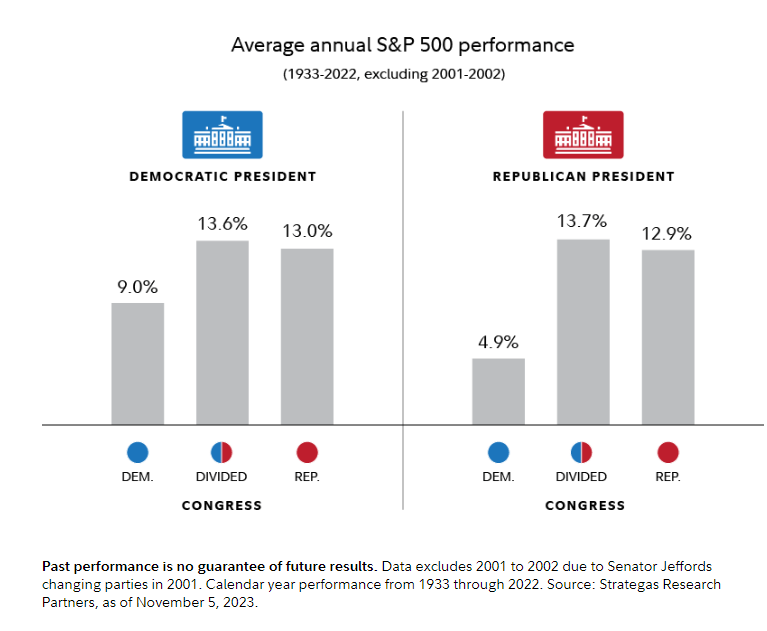

Meanwhile, Harris’s approach – expanding government support and incentives for special interests – also stirs inflation but not as much as full blown tariff warfare. Now that I’ve taken shots at both agendas, here’s a chart from Fidelity to remind us that political biases can misguide investment decisions. Stocks are perfectly capable of rising (or falling, but generally rising), no matter who’s in the Oval.

The election is worth discussing here because I think it has distorted yields: our gauge for reading PCE and Payrolls. Despite the distraction, the desired results remain the same: PCE trending toward 2%, steady economic growth, and stable unemployment.

ADP Employment:

ADP has correlated with the Payrolls number over the past two months, and I anticipate the market will latch onto that, right or wrong. Headline job creation is expected at 113k. An in-line result would be embraced, while an overly hot number stokes inflation fears, and an outright cold number raises recession concerns.

GDP:

The consensus forecast is 3.2%. Ideally, the result lands around this figure. Same as ADP; too hot will stoke inflation fears, while too cold will raise recession concerns.

PCE:

Core PCE is expected to come in at 0.3% month-over-month, higher than last month’s 0.1%. Year-over-year, core is forecasted to print 2.6%, down from the prior month’s 2.7%. The Fed’s target is 2%.

Payrolls:

- Consensus is 110k for job creation; look for a beat.

- Unemployment is forecasted at 4.1%; we want this to stay in this range.

- Hourly wages are expected to rise 0.3% month-over-month; lower is better.

Micro Movers

This the busiest week for S&P 500 earnings. With countless reports to cover, I’ll focus on the key points investors are watching in important names that I am familiar with.

Advanced Microdevices (AMD):

Given Taiwan Semiconductors robust quarter, I expect AMD to deliver a positive report. AMD’s acquisition of ZT System last August is clearly a sign they’re seeing demand for their AI-chipset, the MI300 series. Demand for that chipset and Lisa Su’s competitive product roadmap are the major sticking points.

Alphabet (GOOG):

The market loves to find reasons to fade GOOG: Strong cloud performance? They nitpick search. YouTube outperformance? Who cares—they’re behind on AI. DOJ scrutiny adds a new layer of sellable uncertainty. In short, despite what I anticipate will be a solid quarter, I’m not sure how the stock will react.

That said, for the first time in recent memory, GOOG is the “value” mega-cap, trading at 20x forward earnings, taking the mantle from META, which now trades at ~24x forward. Perhaps this is a sign that the market is overlooking GOOG’s recent strides in AI integration: Gemini provides AI-generated answers to Google searches with sponsored links (that pay for the privilege) for more information.

Chipotle (CMG):

Due to Cava’s continued strength, I expect CMG is performing well too. For the stock to build on its recovery since the surprise departure of Brian Niccol (the previous CEO), management will need to reassure Wall Street about their succession plan, direction without Niccol, and that the smaller bowls issue is in the rearview. If they can achieve that, I see the stock clearing $60 with sights set on the ATH.

McDonalds (MCD):

Addressing the E. coli scare is priority one. Many compare this to CMG’s ordeal, which took over a year to overcome. With improved tech and crisis management since then, I expect a quicker resolution, but estimate it will take more than a quarter.

First Solar (FSLR):

The U.S. utility-scale solar leader has traded down on hurricane delays impacting earnings, fewer rate cuts slowing financing for the projects, and possible policy shifts with a Trump win. Nonetheless, I view solar’s role in the U.S. grid as clear, and FSLR remains a top play. If the stock dips on earnings, it could eventually become a buying opportunity.

Pfizer (PFE):

Beyond updates on cost-cutting, the board’s response to Starboard’s activist interest and an update on their oncology pipeline are pivotal. The CEO bet the farm with a $43B acquisition of Seagen to make PFE an oncology mainstay. If Seagen doesn’t pay off, then PFE will find itself in a precarious financial and competitive position. I believe PFE has traded sideways for what feels like an eternity because management has been unable to convince the market that it will see a return on its Seagen acquisition. Until PFE can do that, it’s dead money.

Eli Lilly (LLY):

Eli Lilly is widely seen as the premier GLP-1 medication play. Beyond an update on GLP-1 capacity, the market will be listening closely for details on what I view as the company’s future: donanemab, their Alzheimer’s treatment. Currently approved in the U.S. and Japan, donanemab recently received MHRA approval in the U.K., though NICE and the NHS have ruled it too costly to meet current cost criteria.

Though the stock has been choppy, Eli Lilly remains, in my view, the most innovative healthcare company globally. Its high multiple reflects this, but with that high valuation comes inevitable volatility.

Microsoft (MSFT):

The mega-caps need to justify their AI-capex. As such, Azure performance with the addition of Co-Pilot, their AI-companion, is the money metric. A related matter investors will listen for is any update on the relationship with OpenAI.

Meta (META):

Investors will first be focused on adoption of Meta’s new AI-marketing suite. Once core business performance is covered, the spotlight will shift to Zuckerberg’s vision for Meta’s substantial AI investment. I’d like to see him outline a strategy for establishing Meta as the leader in consumer AI hardware through the Meta Ray-Ban glasses.

While I don’t own a pair, I tested them at a local Best Buy, and they exceeded my balanced expectations. Here’s my tinfoil hat theory: Zuckerberg hasn’t gone all-in on production or advertising because he knows they’re not quite ready for primetime. He’s playing a long game here, aiming to dethrone Apple’s hardware dominance, and he won’t move until he’s ready.

Starbucks (SBUX):

This quarter marks Niccol’s first at Starbucks, though it reflects only a few weeks under his leadership. As such, these results, which contributed to the previous CEO’s exit, are likely to be overlooked. Instead, attention will focus on Niccol’s strategy going forward, previewed in a recent video message. I don’t expect significant stock movement, as the Street will likely give Niccol’s plan the benefit of the doubt for a few quarters.

Uber (UBER):

CEO Dara Khosrowshahi is great at preempting concerns. Given the attention on Tesla’s Robotaxi, he’ll likely reiterate Uber’s profitable role as an aggregator for such services, similar to the Waymo partnership.

Amazon (AMZN):

AWS, say less. It is the profit engine of the company. Ad revenue, bolstered by their partnership with Thursday Night Football, will also be highlighted. The retail business remains a tertiary concern, but I expect positive results there due to Big Prime Days and increased convenience-store purchases being made through their online platform (RIP Walgreens and CVS).

Apple (AAPL):

Investors will be looking closely for updates on iPhone 16 orders. AI features have the potential to spark a replacement cycle, but recent reports from Ming-Chi Kuo indicate Apple cut orders by 10 million units, casting reasonable doubt on that prospect. While Apple’s highly profitable services business isn’t at risk, there is a segment of investors primarily interested in the stock for the substantial returns tied to a replacement cycle. If it becomes clear this cycle isn’t materializing, I don’t expect that group to stick around.

Leave a Reply