Freeport-McMoRan (FCX) delivered a strong quarter this morning. The headline everyone expected but needed to see: copper demand will increase as data center construction continues to rise.

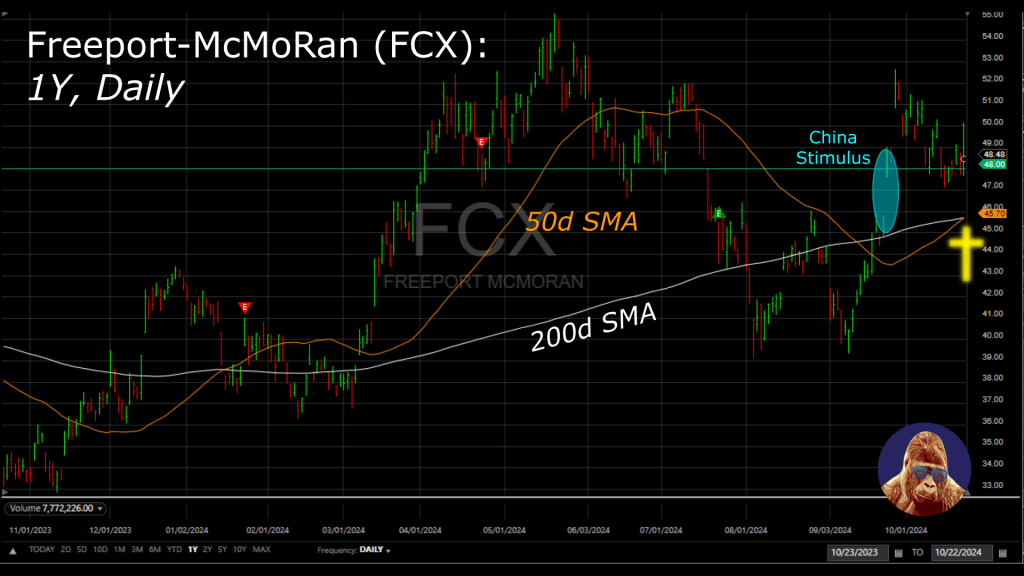

The stock is holding at $48, the same level it jumped to on the China-stimulus news. For those unfamiliar, copper and China’s economy are closely correlated

I stand by my statement from yesterday:

Copper is a must-have for any long-term portfolio.

The secular tailwinds for copper are almost as compelling as those for cybersecurity. If you can’t tolerate single-stock risk, consider ICOP. This ETF offers exposure to a basket of copper miners and currently sports a slightly cleaner chart than FCX. However, a bullish golden-cross is emerging on FCX’s chart as the ascending 50d SMA attempts to eclipse the ascending 200d SMA.

Leave a Reply