As semiconductor demand continues to rise, the importance of copper – an integral component – has never been clearer. From Nvidia’s Blackwell to my Oral-B Toothbrush, semiconductors are impossible to escape. They’re in everything.

While copper prices remain heavily influenced by China’s economy, the growing global demand for the metal makes it an essential part of any long-term portfolio.

Freeport-McMoRan (FCX), which reports tomorrow, is based in Phoenix and stands as the world’s largest molybdenum producer, a major copper supplier, and operator of the largest gold mine. Despite its diversified operations, FCX is primarily tied to copper, making it a strong play for those looking to benefit from this macro trend.

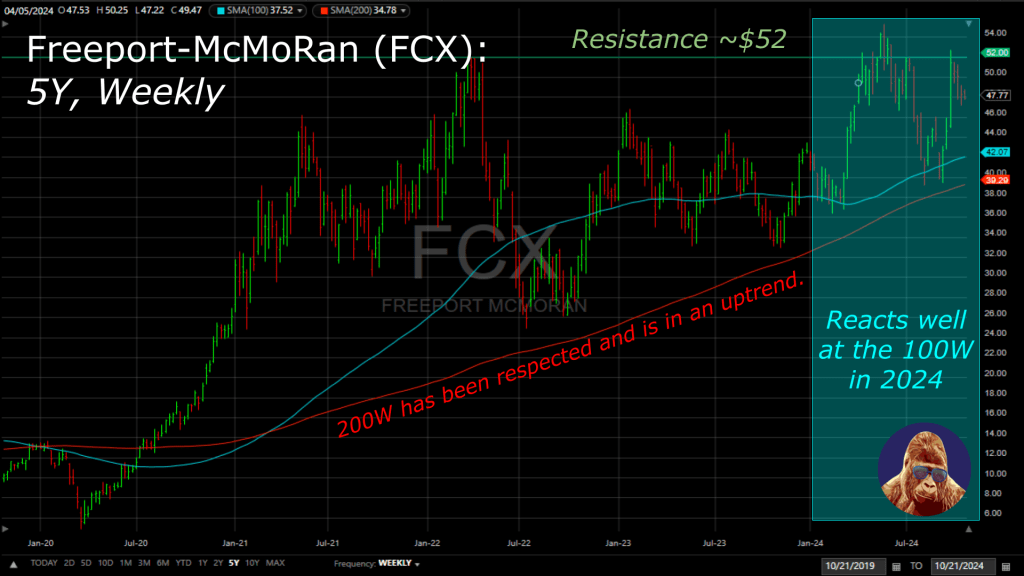

In the short term, the chart is in danger of rolling over, but the long-term chart remains solid. The stock tends to be volatile around earnings, so I’d wait to start or add. Regardless, this is a name investors should keep on their radar.

Leave a Reply