Weekly Performance

| S&P 500 | 0.85% |

| Equal Weight S&P 500 (RSP) | 0.86% |

| NASDAQ | 0.80% |

| DOW | 0.96% |

| Russell 2000 (VTWO) | 1.87% |

Talk of the Tape

Retail sales beat expectations, and Taiwan Semiconductor’s strong quarter eased demand concerns. The market drifted higher on a steady flow of positive news, growing comfortable with a 25 bps cut at the November FOMC.

The Week Ahead

Monday

- n/a

Tuesday

- 3M (MMM)

- Freeport McMoRan (FCX)

Wednesday

- Tesla (TSLA)

- NextEra (NEE)

- CME Group (CME)

- General Dynamics (GD)

- Lam Research (LRCX)

- Fed Beige Book

Thursday

- Nasdaq (NDAQ)

Friday

- n/a

Macro Movers

Last week’s retail sales came in at 0.4%, slightly above the 0.3% consensus. This upside surprise further solidifies the idea that the economy is not in immediate danger of recession. However, if data continues to exceed expectations, the market will need to grapple with the possibility of a Fed pause on the way down.

While I would see that as a positive development – inflation declining while the economy remains strong enough for the Fed to hold off on additional stimulatory action – the market may not react well. With valuations as high as they are, it’s tough to say what stocks today are pricing-in about the future, but I’d bet the implied scenario is so bullish that any deviation from our current course would be met with selling… at least initially.

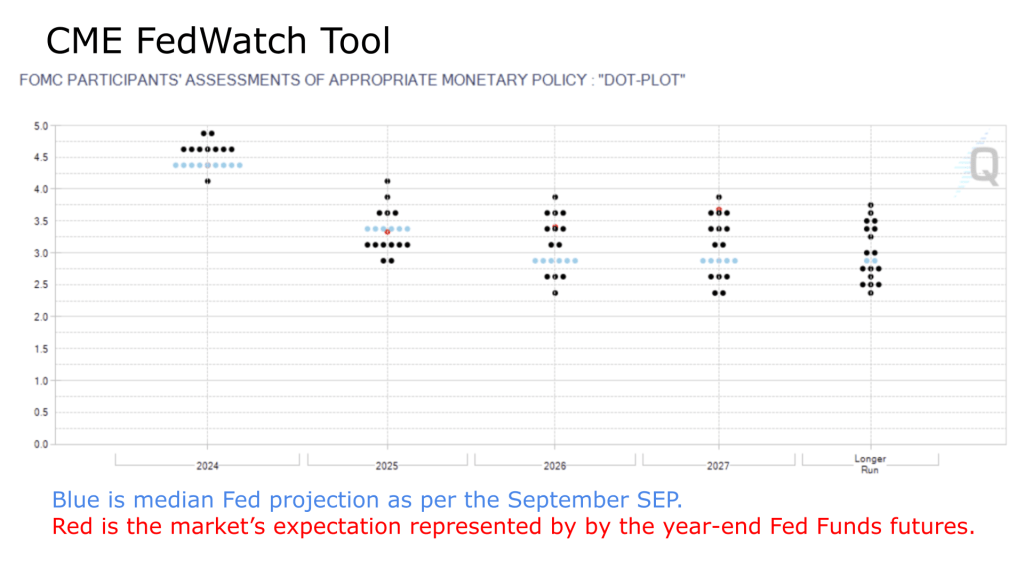

Currently, the Fed’s SEP and futures market are projecting Fed Funds between 3.25-3.50% by the end of 2025. If the Fed skips a few cuts, it would disrupt that outlook, breaking from the “goldilocks” scenario the market seems to be banking on.

As for this week’s business, we’ve got the Fed’s Beige Book dropping on Wednesday. This qualitative report offers economic anecdotes and observations from each Fed District and is often scrutinized for clues about the economy and the Fed’s next move.

Micro Movers

As the title suggests, business is about to pick up. While the mega-caps don’t report until next week, there are a handful of names on the brink of significant moves higher that are central to broader market themes. I have positions in a handful and am excited to share them ahead of their reports.

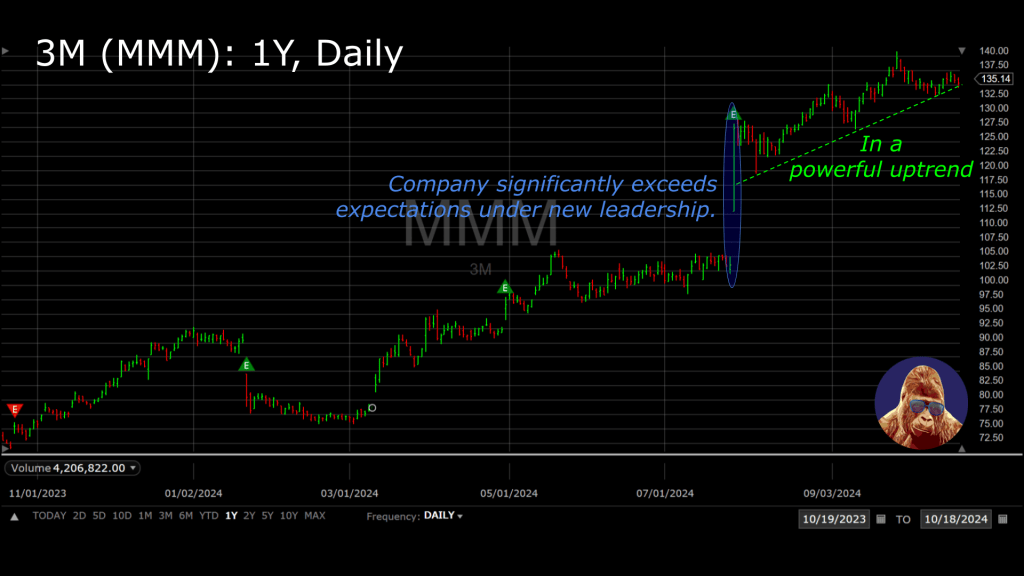

3M (MMM):

After a rough stretch marked by lawsuits and missteps, 3M, under new CEO William Brown, is finally starting to put the pieces back together. Last quarter, the bar was low, and when Brown’s quarter as CEO saw the guide unchanged, the stock found new life.

This quarter will focus on margins and the potential spin-offs of various business units. In a way, this could turn into a deconglomeration story similar to GE’s, which has been incredibly lucrative for investors. The stock has strong momentum with a solid narrative to back it up.

If you’re trading the stock, a tight stop at the 50-day SMA would work, but earnings could lead to a gap down below it. That said, last quarter provided a gap higher. I’m already in the stock and won’t be adding more before the report. If you’re not in yet but interested, consider starting with a quarter of your position ahead of the print and then let the earnings decide your next move.

Freeport-McMoRan (FCX):

While copper prices are still heavily tied to China’s economic health, the growing demand for semiconductors, which all require copper, makes exposure to the commodity essential for any portfolio. I got in FCX in the low $40s last month. A quick look at the chart shows the stock trades erratically around earnings, so I’d wait until the quarter before calling this stock’s name from the bullpen.

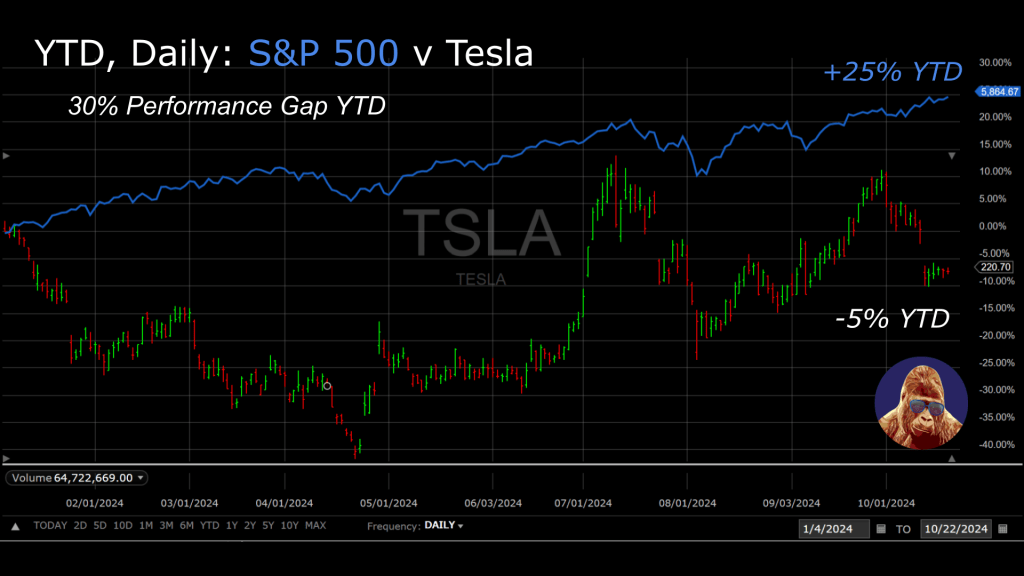

Tesla (TSLA):

Despite a sell-off following the disappointing robotaxi event, the uptrend for TSLA remains intact.

Personally, I believe TSLA works best when its auto business is working. Given the pricing pressure both at home and abroad, especially in China, I don’t see the auto segment working this quarter.

I’ve never invested in TSLA, but for what it’s worth, I’m more bullish on Elon Musk than I am bearish. Hot take, I actually like the aesthetic of the cybertruck. TSLA could benefit from a Trump win, given the administration’s stance on China and the constructive Musk-Trump relationship. That said, the stock has been left behind by both the rest of the Magnificent 7 and S&P 500.

You could make the argument that a 30% performance gap is ripe for reversion, but I’m not so sure. However, I’d never tell anyone to bet against Elon. So, if you are long TSLA, might I suggest hedging with a name that will also benefit from full-self driving (FDS): Uber. Uber will be the aggregator of demand for autonomous taxis and FDS, meaning they will likely see profitable dollars from these future businesses before Tesla.

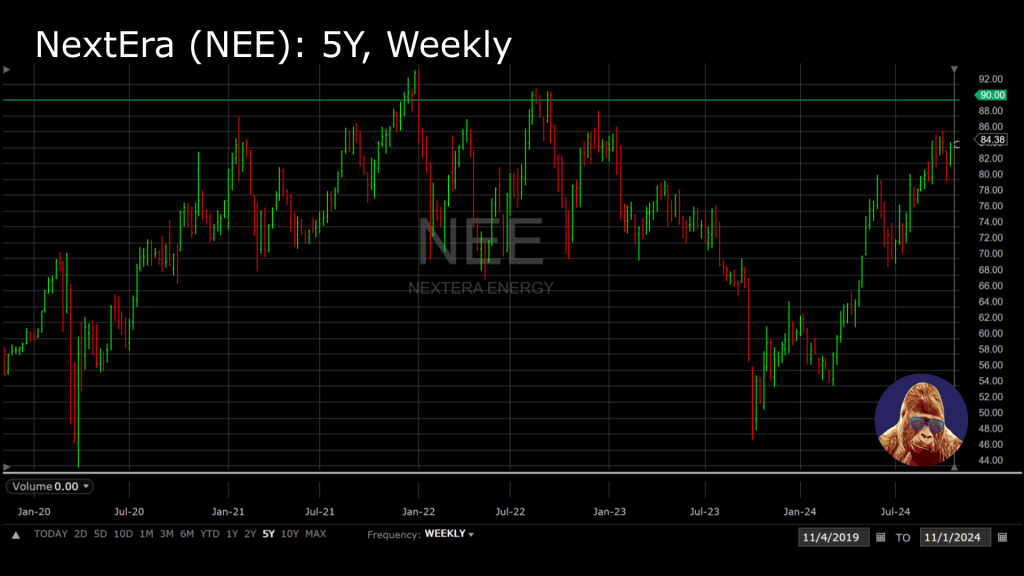

NextEra (NEE):

This utility with a strong solar energy portfolio is well-positioned to benefit from the fiscal tailwinds associated with the misleadingly named Inflation Reduction Act (IRA). There are concerns that recent storms could drive up repair and maintenance costs, but as the anchor stock in the XLU, NEE will be a key beneficiary of AI-infrastructure spending. For years, I have been in NEE. As it approaches its three-year high this time, I expect NEE to break through it.

CME Group (CME) and Nasdaq (NDAQ):

These capital market plays will benefit from a renewed IPO calendar and increased trading activity (options). The strong fundamental stories have charts to match in these stocks. Breakouts in either name are likely contingent on their earnings. While CME is a solid choice, I prefer (and am long) NDAQ. CME reports first. I expect NDAQ to trade in sympathy.

General Dynamics (GD):

This traditional defense company has been consolidating near its all-time high for months. I expect this quarter to provide the catalyst needed for a breakout. GD is one of the few companies qualified to produce NATO-approved ammunition, which remains in short supply due to the ongoing war in Ukraine. Their private security and jet business should also be performing well in the current geopolitical environment.

Lam Research (LRCX):

ASML’s recent quarter – dampened by weakness tied to Intel and China – sent a shockwave through the semiconductor sector. A blowout quarter from Taiwan Semiconductor stabilized things. If Lam Research (LRCX), which generates 46% of its revenue from China, reports similar demand weakness and the market doesn’t overreact, it would be a promising sign that this issue is priced-in.

I believe semiconductors, as per the SMH are currently 13% off their all-time high, will provide the NASDAQ with the final push needed to reach its own ATH. The S&P 500 and Dow have already done so this quarter. If the NASDAQ follows suit, remaining skeptics will be forced to put more respect on this rally’s name.

Leave a Reply