I’ve put together some visuals to help navigate the whirlwind that is earnings season. Here are a few standout insights:

1) Mark Your Calendar for October 28th:

Due to some shuffling of the corporate calendar in the last few days, the week of October 28th will now feature all the mega-caps, making it THE week for S&P 500 earnings.

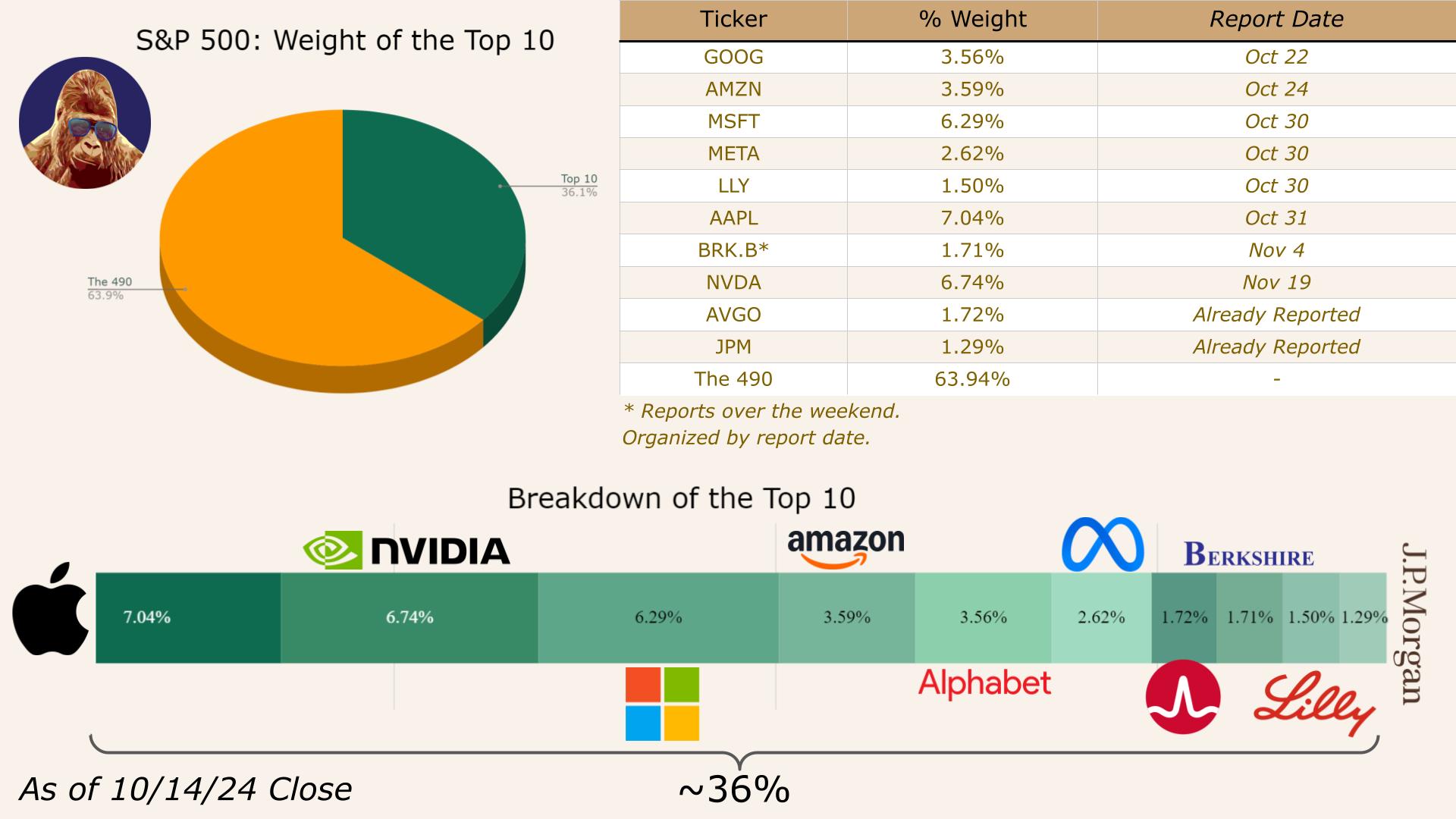

October 30th alone features Microsoft (MSFT), Meta (META), and Eli Lilly (LLY), which together account for 10% of the index. With all the mega caps reporting, it is a sneaky big week for Nvidia. These companies are Nvidia’s biggest customers. We’ll know significantly more about Nvidia’s upcoming Nov 19th quarter with the mega cap quarters already in the bag. Net-net, it will be a critical week for traders, options activity, and overall market sentiment. Plenty of potential for technical breakouts and breakdowns.

2) The Lull

A two week calm in earnings after the week of October 28th creates opportunities for the macro to influence prices, creating buyable dips or breakout tops.

If the macro acts as a rising tide that lifts all boats, I’d use it as an opportunity to offload underperformers and trim positions that have grown too large. On the flip side, a macro-driven pullback could create a buyable dip in stocks that posted strong earnings but are retreating to pre-report levels.

We also need to keep an eye on the U.S. Presidential Election. Ballots will be counted on November 5th, almost immediately after the largest week for S&P 500 earnings. So far, election-related volatility has been muted, but the outcome could create fresh opportunities.

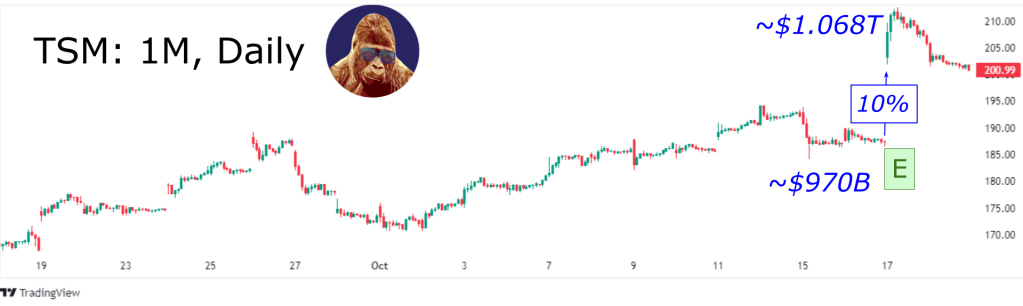

That said, I wouldn’t try to overthink it. By virtue of reporting last, Nvidia’s (NVDA) earnings will have the final word. Taiwan Semiconductor delivered a blowout quarter, which is bullish for NVDA’s quarter and the broader semiconductor space. TSM has earned a spot on my dip-shopping list. The hyperscalers – GOOG, AMZN, META, MSFT – will further reduce uncertainty attached to NVDA. Even so, Nvidia’s report will be a clearing event, as it’s unlikely the market will make any wholesale moves without it in the rearview.

3) Cracked Financials:

Two financial stocks have cracked the top 10, which feels bullish.

The financials are on fire. Banks tend to outperform when the economic outlook is strong, which makes J.P. Morgan’s rise into the S&P 500 Top 10 a vote of confidence from the equity market. While Berkshire Hathaway is technically a conglomerate, I view it primarily as a financial company that invests the premiums from its insurance operations. With rising insurance premiums, Berkshire has more capital to deploy, and as the stock market climbs, the value of its investments rises too—a double tailwind. There’s a chance Berkshire could continue its ascent.

4) Two Too Small

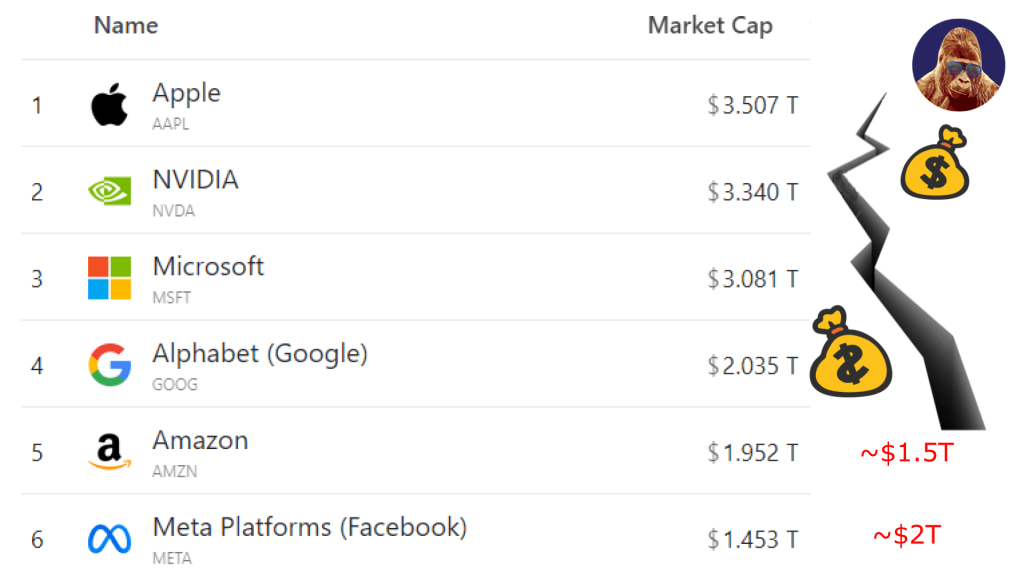

Meta and Amazon still feel too small.

I feel this way every time I look at the data. Apple is $2T larger than Meta and $1.5T larger than Amazon. The gaps just seem too wide.

Don’t get me wrong, I’m not part of the bear camp that circles Cupertino ahead of every major Apple event. The stock and the technology are clearly two different matters. So, let’s discuss technology. After years of lagging behind, Amazon, Google, and Meta have finally built ecosystems that are comparable to, and in some cases superior to, Apple’s.

Meta is positioning itself to become the consumer hardware leader in AI through its collaboration with Ray-Ban, akin to Apple’s dominance of the smartphone through the iPhone. With Apple’s current outsourcing approach to AI, if Zuckerberg’s bet pays off, Meta could very well become the next Apple once AI is ready for prime time at the consumer level.

Amazon, aside from essentially owning the internet with AWS, is finally on track to develop the profitability profile we’d expect from a mega-cap company under Andy Jassy’s leadership. Plus, Amazon has additional recurring subscription businesses beyond Prime. So, why should Apple’s subscription business be valued so much more highly than Amazon’s?

Now, let’s talk stock. Apple’s current valuation has been largely justified by its services business and the sticky ecosystem it has created—and I get that. But the sticky ecosystems Meta and Amazon have built make the current valuation gap between them and Apple seem far too large. I’ll leave Google aside for now due to the DOJ overhang, but it’s worth considering that maybe Apple is just too big while Meta and Amazon are sized more appropriately.

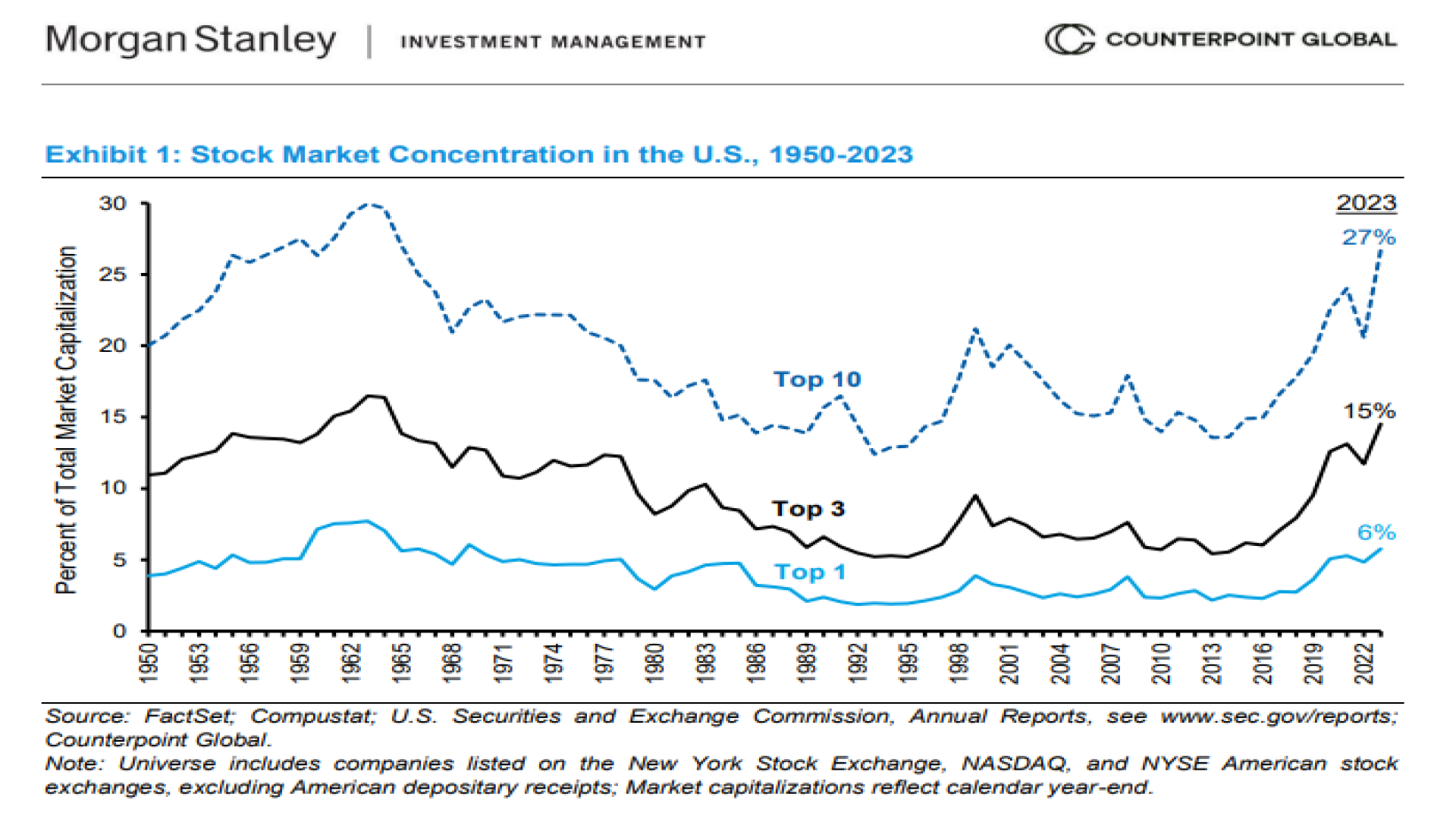

5) Record Concentration:

The top 10 stocks in the S&P 500 now account for nearly 35% of the entire index — this is the highest level for top 10 concentration in the post-WWII era. There is precedent that signals this is a bearish harbinger, but I am not so sure.

Two disastrous analogs are associated with high concentration: the 2000 dot-com bubble, the top 10 accounted for about 20%; the 1960s, top 10 concentration was around 30%. In both cases, the market eventually succumbed to bear markets after the Fed raised rates to combat inflation, popping a valuation bubble.

Sounds familiar, right? Spooky season; scary stuff.

However, I’m not convinced that this level of concentration is necessarily a red flag.

While Wall Street’s skepticism is understandable given these historical analogs, some is self-serving. Outperforming the market is already difficult under normal conditions, but when returns are this concentrated, it becomes even harder due to diversification and risk management rules. Criticizing concentration is a better “business decision” than admitting to missing the biggest winners.

But in reality, the quality and diversity of the companies leading the 2024 market suggest that the concentration isn’t necessarily the effect of deeper, systemic issues:

- Apple: The GOAT of consumer technology.

- Nvidia: The heartbeat of the AI revolution.

- Microsoft: The godfather of enterprise software.

- Amazon: The architect of the cloud.

- Google: The juggernaut of search and advertising.

- Meta: The champion of mixed-reality.

- Broadcom: Okay, some overlap here…

- Berkshire Hathaway: The oracle of insurance and investment.

- Eli Lilly: The miracle worker in medicine.

- J.P. Morgan: The fortress of global finance.

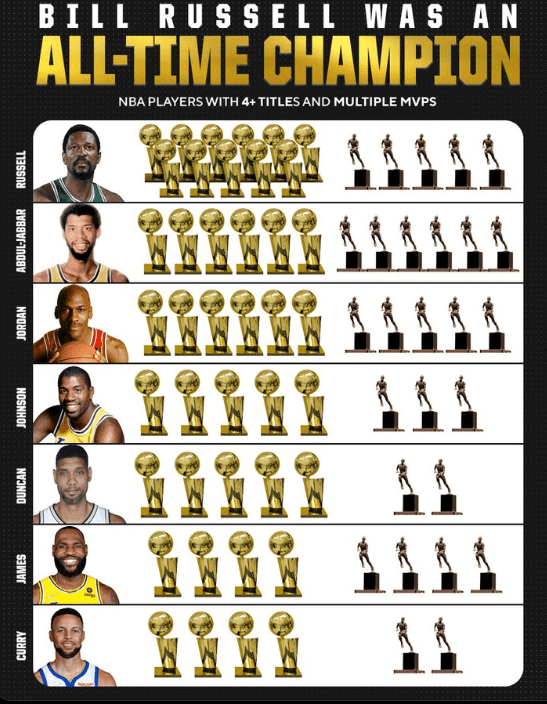

It’s like the Bill Russell Celtics: 11 championships in 13 years. What’s not to like?

Yes, dynasties eventually fall, and while history doesn’t repeat itself, it often rhymes. Just because I view these companies as superior to companies of the past doesn’t mean we won’t see a similar end result.

But let’s consider a critical difference.

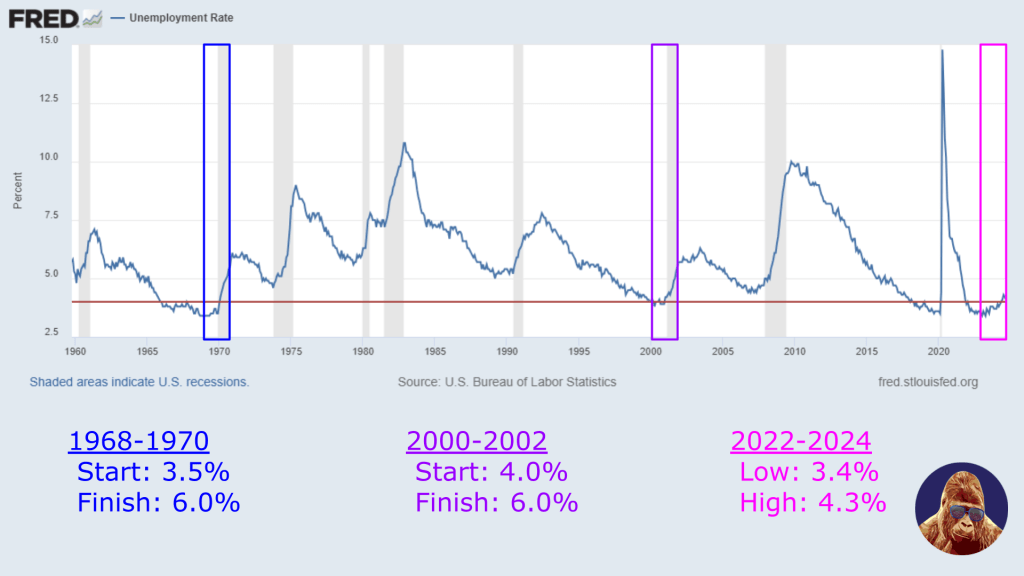

In both the 1960s and 2000s, unemployment surged as Fed hikes produced a wave of bankruptcies and a stagnant job market. From 1968-1970, unemployment climbed from ~3.5% to ~6.0%; 2000-2002, we saw a move from 4% to 6%. This time, from the 2022 low of 3.4% through October 2024, unemployment has stalled at 4.3%. Despite a historically aggressive rate-hiking cycle, this economy is not experiencing widespread bankruptcies and continues to create jobs. Furthermore, the recent uptick can be attributed to an influx of new workers entering the labor force, which is a positive sign for both the economy and inflation.

Maybe this difference will matter.

Leave a Reply