I’ve put together some visuals to help navigate the whirlwind that is earnings season. Here are a few standout insights:

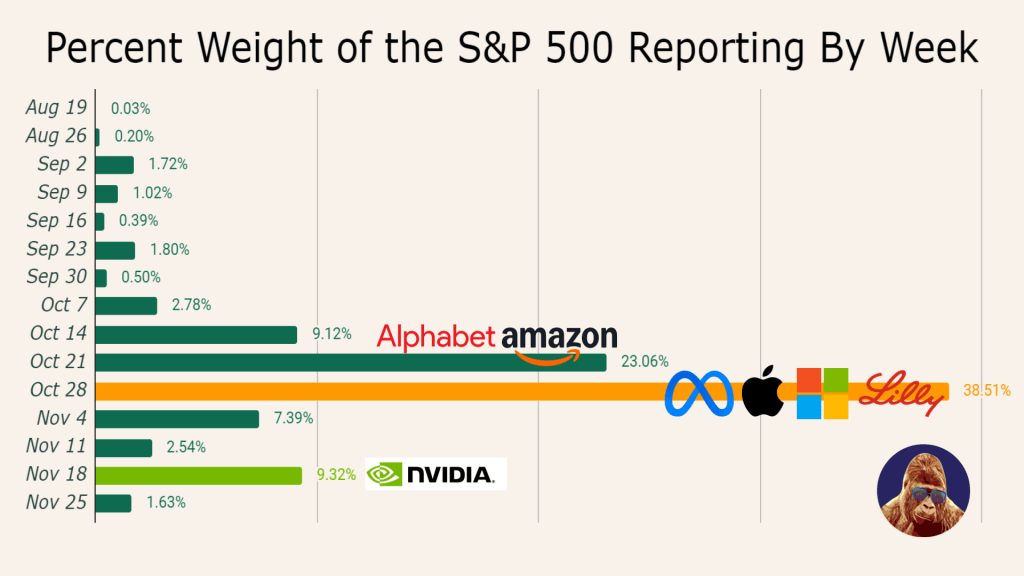

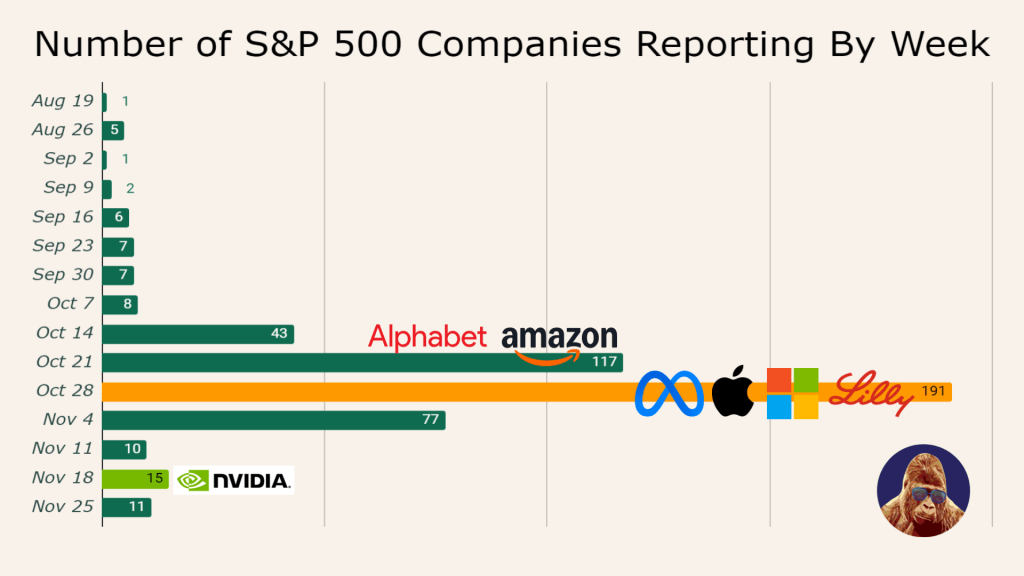

1) Mark Your Calendar for October 28th:

119 constituents making up a 38.5% weight of the index report, making it the most consequential week of earnings season.

2) The Lull

Two weeks of relative calm follow that pivotal week. Potential exists for the macro to influence prices, creating buyable dips or breakout tops.

3) Cracked Financials:

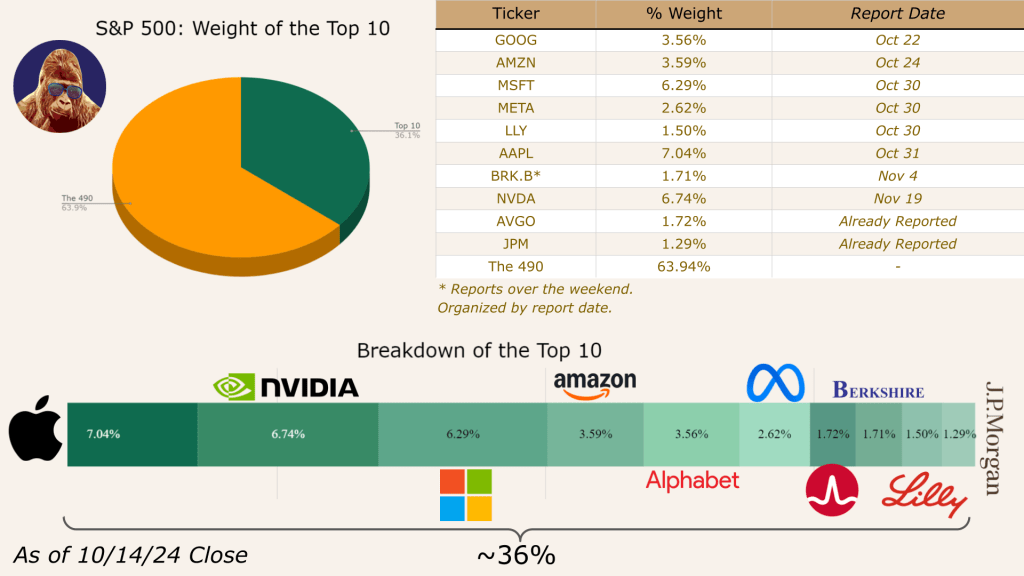

Two financial stocks have cracked the top 10, which feels bullish.

4) Two Too Small

Meta and Amazon still feel too small.

5) Record Concentration:

The top 10 stocks in the S&P 500 now account for nearly 35% of the entire index — this is the highest level for top 10 concentration in the post-WWII era. There is precedent that signals this is a bearish harbinger, but I am not so sure.

I’ll update each point with greater insight throughout the week. Keep it bookmarked throughout earnings season!

Leave a Reply