Weekly Performance

| S&P 500 | 1.11% |

| Equal Weight S&P 500 (RSP) | 1.15% |

| NASDAQ | 1.13% |

| DOW | 1.21% |

| Russell 2000 (VTWO) | 0.98% |

Talk of the Tape

Although CPI was a touch warm, it wasn’t disastrous. The bullish trade following Friday’s earnings, headlined by JPM, is an additional indication of the market’s willingness to prioritize earnings and place inflation concerns on the backburner for the time being.

The Week Ahead

Monday

- Columbus Day: Bond Market Holiday

Tuesday

- Bank Earnings

- Insurance Earnings

Wednesday

- ASML (ASML)

Thursday

- Retail Sales

- Netflix (NFLX)

- Taiwan Semi (TSM)

Friday

- n/a

Macro Movers

Last week, CPI and PPI for September were released. Although CPI was slightly higher than expected (0.1% vs. 0.2%), PPI came in below consensus, mitigating concerns of a mini-inflation flare. Despite initial market weakness following the CPI release on Thursday morning, markets ended the day positive. Net-net, the market seems willing to give the benefit of the doubt on inflation, focusing more on the developing earnings picture.

Retail Sales:

That said, the market often trades on retail sales. While it doesn’t always correlate directly with earnings, investors sometimes adjust their exposure accordingly. The median forecast is 0.3%, with ex-autos at 0.1%. Let’s hope for a slight beat; I believe we get it.

Micro Movers

Earnings season is in full swing. While a strong start doesn’t guarantee follow through, it’s always reassuring to begin with a robust showing from the well-connected money-center banks.

Bank Earnings:

Tuesday, the money centers continue with Citi (C) and Bank of America (BAC) reporting before the open. Schwab (SCHW), Goldman Sachs (GS), PNC (PNC), and State Street (STT) also turn in their quarters on behalf of the financials.

Citi’s struggles are reminiscent of Pfizer (PFE)—despite being on the right track, the market seems unwilling to re-rate the stock. Even though Citi has climbed ~25% YTD, it’s still trading at ~0.5x book value, compared to JPM at ~2x and BAC at ~1.3x. The stock just can’t dispel its bearish curse.

Speaking of BAC, I’ve become more bullish. Berkshire Hathaway has finally sold enough shares that the SEC no longer requires them to disclose the sales. Of the money centers, BAC faced the most risk from its hold-to-maturity bond portfolios, which was dragged further underwater with each Fed hike. Now, with the Berkshire headlines removed and the Fed cutting rates, two key headwinds have subsided, giving BAC a real shot to shine on a strong quarter.

Insurance Earnings:

I’m highlighting insurance stocks because they’ve been on fire—much to the dismay of anyone holding an insurance policy.

Insurance in the U.S. has become increasingly expensive, and it’s trending in the wrong direction. Unfortunately, I’m not sure what the solution is, even theoretically. We’re living in an era where “once-in-a-century” disasters are happening every five years or so. It’s a complex issue, and there hasn’t been enough attention given to finding a solution. While there’s some talk of reform on Capitol Hill, I haven’t heard anything remotely constructive.

Progressive (PGR), Travelers (TRV), and Allstate (ALL) all report this week, and these stocks have been performing well. It makes sense—insurance is a necessity, prices are rising, and there’s no clear fix. In the past, I invested in utilities and telecoms and used the dividends to offset my bills; I may do something similar here.

ASML (ASML):

ASML produces the machinery necessary for mass semiconductor production. I see the entire semiconductor space as primed for a catch-up trade after getting hammered throughout September. Personally, I’ve chosen AMAT as my horse in the race. While AMAT won’t report for another month, I’ll be paying close attention to ASML for an update on the landscape.

Taiwan Semiconductor (TSM):

TSM manufactures the chips that their clients – Nvidia, Apple, AMD, and Broadcom – design. Therefore, TSM’s production volumes provide a direct read-through on the demand for their customers’ products. Higher volumes would boost confidence in the demand for AI-related products and leave bullish tea leaves for their clients’ upcoming quarterly reports.

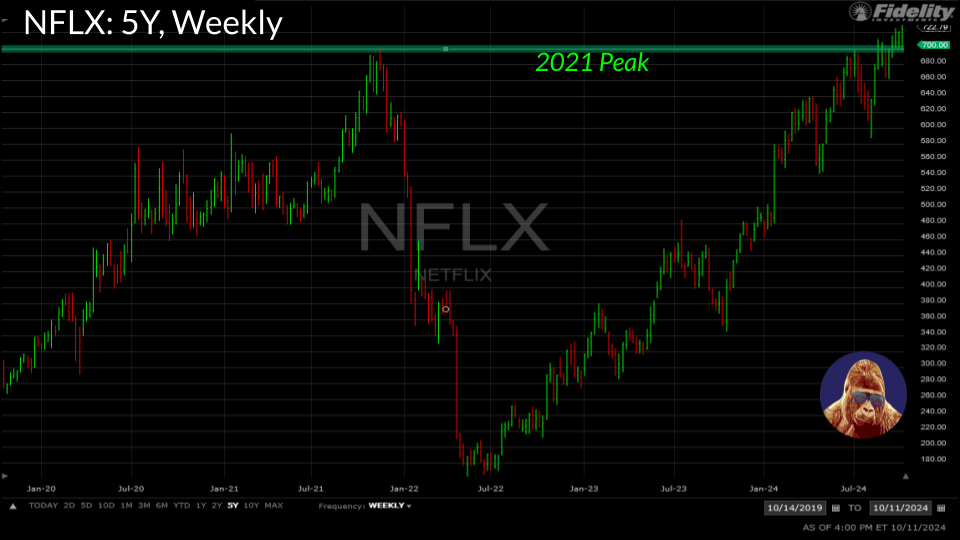

Netflix (NFLX):

The stock has continued to live above the 2021 peak. Recently, it has been the subject of analysts downgrades suggesting that the earnings may not justify the stock’s current price. Despite being long, I don’t completely disagree. The stock has a history of being an earnings mover. So, for those with an oversized position, trimming some wouldn’t be the worst idea. While Netflix remains the undisputed streaming leader, it doesn’t mean the stock is incapable of being overvalued.

Leave a Reply