Weekly Performance

| S&P 500 | 0.62% |

| Equal Weight S&P 500 (RSP) | 0.95% |

| NASDAQ | 0.95% |

| DOW | 0.59% |

| Russell 2000 (VTWO) | -0.14% |

Talk of the Tape

Despite both GDP and PCE supporting the bullish soft-to-no landing narrative, the market reaction was relatively muted. The subdued response was largely attributed to anticipation for this week’s Payrolls report, which is a more reliable source of insight on the economy.

The Week Ahead

Monday

- n/a

Tuesday

- JOLTs

- Mfg. PMIs

- Paychex (PAYX)

Wednesday

- ADP Report

- Conagra (CAG)

Thursday

- Services PMIs

Friday

- Payrolls

Macro Movers

The second revision for Q2 GDP met the elevated 3.0% forecast, and monthly core PCE was 0.1% lower than expected. Despite positive news on both growth and inflation, stocks didn’t do much. To me, this signals that multiple expansion from the goldilocks macro has taken the market as far as it can go. Now, earnings need to confirm what the macro data suggests is possible.

While there are no significant earnings this week, labor market clues could shape earnings expectations. Positive labor results tend to support strong earnings since employed consumers spend more than unemployed consumers. Negative results, of course, could spell trouble.

The key metric to watch this week is the unemployment rate within the payrolls report. A material uptick beyond the 4.2% forecast could trigger a “shoot first, ask questions later” selloff, driven by fears of a growth scare. However, if it becomes clear that the increase in unemployment is due to new labor force entrants rather than layoffs or bankruptcies, prices should recover.

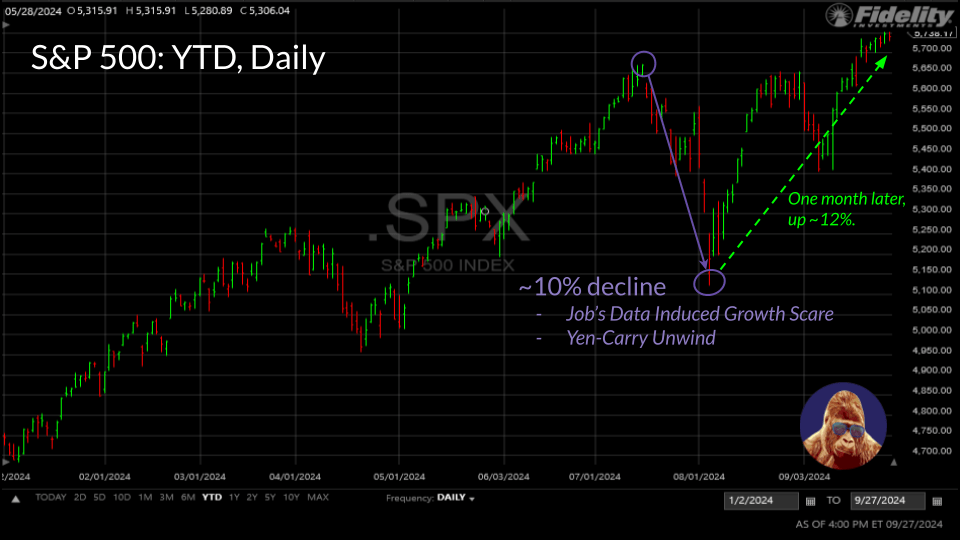

We’ve played this “growth scare” game before. In fact, the last time we played it was with last month’s payroll report, which was aggravated by the yen-carry unwind that spooked markets and sent the VIX to 65. While I don’t expect the market to play the same stupid game again, be ready to take advantage if it does.

Back to the week ahead, we want this week’s data to confirm the consensus of a steady economy by either meeting or slightly beating expectations:

JOLTs:

Job openings are expected to print 7.640 million, continuing the gradual decline since the May 2022 peak.

S&P and ISM Manufacturing PMI:

Projected to come in at 47.0 and 47.6, respectively.

ADP Employment:

Headline job creation is forecast at 124k. Normally, I’d mention the Pay Insights report, but wage data is de-risked for now, as the Fed doesn’t view the labor market as a source of inflation. One data point won’t shift that view.

S&P and ISM Services PMI:

Expected to come in at 55.4 and 51.6, respectively. Since the U.S. economy is service-heavy, I’ll be paying more attention to these PMIs than Tuesday’s manufacturing numbers.

Payrolls:

As I mentioned earlier, unemployment — projected to remain steady at 4.2% — will be the most crucial figure. While wage data is de-risked, job creation — forecast at 144k, up 2k from last month — remains important now that we’re on growth watch.

Micro Movers

Not much on the corporate earnings front this week, which is just as well since the jobs data will dominate the tape. That said, there are two companies worth listening to for their unique insight on important economic trends.

Paychex (PAYX):

Much like my wrap on Cintas, which reported a solid quarter, Paychex is another company that offers insight into the health of small and medium-sized businesses in the U.S. PAYX handles payrolls and benefits for its clients, so if they’re doing well, it points to positive trends in business formation and hiring.

Conagra (CAG):

You might not know the name, but you’ve definitely snacked on their products. With a diverse portfolio of classic brands, Conagra reaches a wide range of consumers. Aside from providing a snapshot of the snacking industry — which has come under fire due to GLP-1s — their report will also shed light on supply chain trends and food inflation.

Gorilla Tactics: Dump Your Losers

The major indices are at all-time highs. The market is broadening, inflation is cooling, and the economy isn’t in a recession. If you have a stock that isn’t working in this environment, that’s a problem. In my view, it means the market sees something so fundamentally wrong that it’s not even worth taking a speculative bet on.

This doesn’t feel like the time to go bottom fishing. Stocks near 52-week lows likely have material, complicated problems that even a benign macro backdrop can’t fix or cover up. Dump your losers. If they can’t perform in a strong environment like this, the odds they’ll perform in any environment are lower than you think. Free up that capital and reallocate it to a potential winner.

There are plenty of companies with great technical setups and solid fundamentals right now:

If you follow my work, you’ll know I’m bullish on the capital markets: NDAQ, SPGI, TW. All three have strong long-term growth prospects thanks to expectations of increased market activity.

3M (MMM) may no longer be in the early innings, but this turnaround story still has legs. General Dynamics (GD) is knocking on the door of an all-time high: a solid play in traditional defense that doubles as a hedge against further geopolitical turmoil.

Momentum is returning to the semiconductor space. For most of the year, everyone wanted to buy these names. Now, after a yen spike and some negative Wall Street notes, appetite is nonexistent? In my view, they’ve just gotten cheaper. Over the last two weeks, I’ve added to my positions in AMD, AMAT, and AVGO.

In a market as good as this one, there is no reason to hold on to dead weight. Reallocate to stocks with momentum and strong fundamentals.

Leave a Reply