Weekly Performance

| S&P 500 | 1.36% |

| Equal Weight S&P 500 (RSP) | 1.03% |

| NASDAQ | 1.49% |

| DOW | 2.62% |

| Russell 2000 (VTWO) | 2.08% |

Talk of the Tape

Retail sales showcased resilience, and the Fed delivered a 50 bps cut. Despite some initial uncertainty, stocks ultimately embraced the decision as the US10Y yield firmed, signaling an incrementally positive economic outlook from both the bond and stock markets.

The Week Ahead

Monday

- S&P PMIs

Tuesday

- KB Homes (KBH)

Wednesday

- Cintas (CTAS)

- Micron (MU)

Thursday

- GDP

- Costco (COST)

Friday

- PCE

Macro Movers

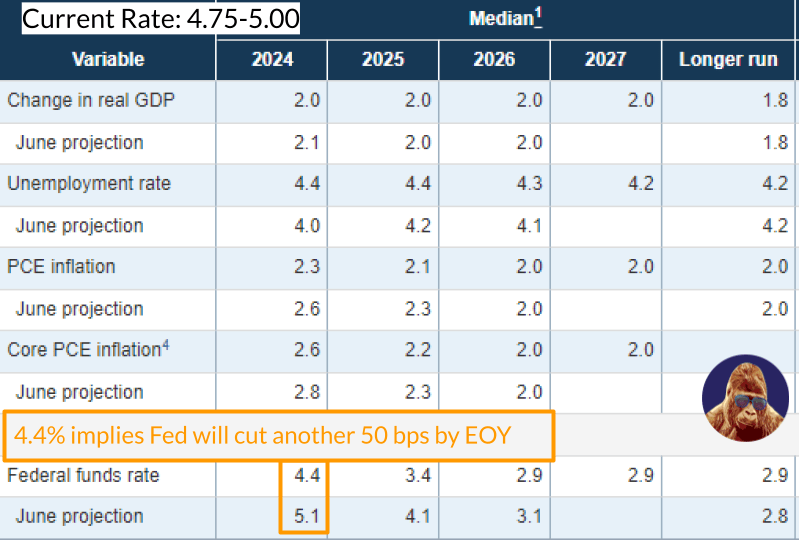

Powell framed the “oversized” rate cut as the start of a policy “recalibration” toward neutral. Holding all else equal, the revised dot plots suggest that markets should anticipate another 50 bps in cuts by year-end. However, as of yesterday, the FedWatch Tool indicates a 50.1% probability of 75 bps.

While Fed commentary (not listed in “The Week Ahead”) will make headlines throughout the week, the real action comes at the end with GDP and PCE data. I’d recommend holding off on any major decisions until then.

This is a “good news is good news” market. We want the economic data to show the economy is holding steady, with in-line numbers or slight upside surprises. For inflation, we’re looking for continued movement toward the 2% target.

PMIs:

Forecast for services and manufacturing is 55.4 and 48.4, respectively.

GDP:

2.9% is the consensus. Given the better-than-anticipated retail sales, which feeds into GDP, I believe this print is de-risked.

PCE:

Month-over-month, core is expected to print 0.2%, in-line with the prior month. Year-over-year, 2.7% is penciled in, slightly higher than the prior 2.6% reading.

Micro Movers

As we approach the final earnings season of 2024, markets will increasingly focus on corporate results. I’ve chosen four key companies that will incrementally affect sentiment on stocks and the economy.

KB Homes (KBH):

In their latest quarter, the average selling price of a KBH home rose to $483k from $479.5k, a modest 0.07% increase. I’ll listen-in for an update on pricing and insight on demand now that mortgage rates have slid.

Cintas (CTAS):

CTAS provides uniforms, first-aid, and janitorial services for small and medium-sized businesses across the country. If CTAS is performing well, it’s because small and medium-sized businesses across the country are too. A solid result from CTAS would reinforce the notion of a steady U.S. economy.

Micron (MU):

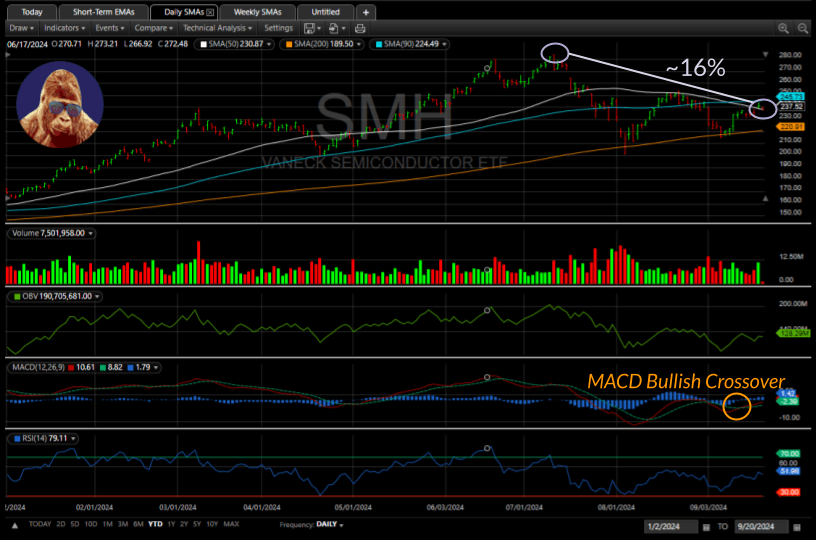

Last week, I mentioned the market might move sideways until we get confirmation that this new record high is sustainable. While both the Dow and S&P 500 hit new highs, Dow Theory suggests we look for confirmation from another index. The NASDAQ is an obvious candidate, but I’d prefer to see the semiconductors—the backbone of the AI revolution—lead the way.

Micron holds a 3.3% weight in SMH but has lagged behind other major semis. If Micron’s quarter can ignite a rally, it could disproportionately reinvigorate the SMH.

Costco (COST):

Each quarter, Costco provides a solid read on both the consumer and inflation. Although I am a satisfied customer and shareholder, at these levels, I’m not looking to add to my position. However, I’ll be listening closely for their economic update.

Leave a Reply