A Proactive Approach

The Fed is often – and rightly – criticized for being too late. Relying on backward-looking data will do that to you. This iteration of the Fed, however, appears to be taking a more proactive stance.

During the Q&A, Powell remarked, “The U.S. economy is in a good place. Our decision today is designed to keep it there. The economy is growing at a solid pace. Inflation is coming down closer to the 2% objective. The labor market is still in a solid place.”

Our decision today is designed to keep it there.

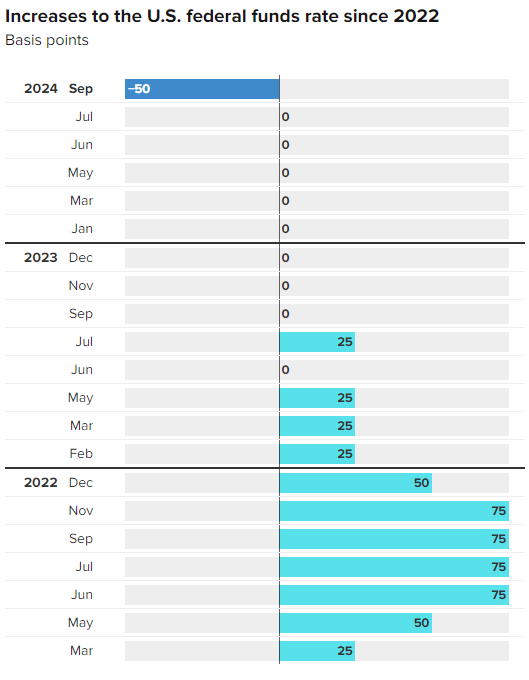

This isn’t the language of a reactionary organization. Cutting by 50 bps shows that this Fed is willing to respect data trends, integrate alternative and real-time data (that past iterations didn’t have), and skate to where they believe the puck is going, rather than fixating on where the puck currently is.

Contextualizing the Reactionary Decline

Broadly speaking, after a brief rush higher, stocks closed incrementally lower. The market got what it wanted (according to the CME FedWatch Tool) but then realized that an “oversized” (greater than a quarter point, 25 bps) cut has always preceded a negative economic outcome. In the past, “oversized” moves have been reserved for economies that looked far worse than today’s. Put another way, we have never seen a soft landing begin with a 50 bps cut.

Achieving a soft landing after a 50 bps cut would be unprecedented. Luckily, over the past half-decade, we’ve all become accustomed to living through unprecedented periods. Perhaps we’re built different

Is This Time Different?

I don’t know, but a few things certainly are.

- Proactive Fed: If we take the FOMC at their word that frontloading the first cut is a proactive measure to maintain the economy, rather than a response to some unknown big economic boogie man, then we have a Fed committed to being on time (or at least less late).

- Fiscal Stimulus: There is still a significant amount of earmarked money that hasn’t been spent. Companies involved in infrastructure and renewables have predictable tailwinds through 2025. As for consumers, previous cycles didn’t include a pandemic that injected an unprecedented amount of stimulus into their pockets. While consumers aren’t as flush as they were post-COVID, that stimulus has left them in a better position today than they would have been in prior cycles.

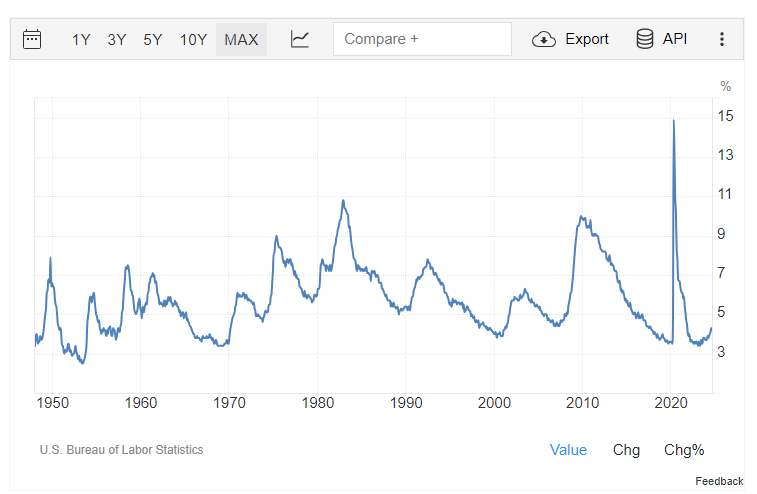

- Low Unemployment: If you zoom out on a chart of U.S. unemployment, you’d wonder why the market fixates on it as much as it does.

Yes, rising unemployment is typically a concern because, once it starts climbing at a certain rate, it usually doesn’t stop. However, some of the recent uptick in the unemployment rate is due to new entrants into the labor force – not from mass layoffs or job losses due to bankruptcies.

My Thoughts

I’m surprised. I thought they’d go 25.

That said, I did mention in my newsletter (the 9:25, please subscribe) that if they went 50 bps, I’d justify it as a quicker path to neutral. That rationale was echoed during the presser. Now that the market has the cut it wanted, it doesn’t seem to know what to do with it. If this is the start of another correction, I’ll be a buyer. Of course, now that I’ve said that, the market probably won’t give me the chance.

Leave a Reply