Weekly Performance

| S&P 500 | 4.02% |

| Equal Weight S&P 500 (RSP) | 2.19% |

| NASDAQ | 5.95% |

| DOW | 2.60% |

| Russell 2000 (VTWO) | 4.36% |

Talk of the Tape

Confidence in AI ROI recovered, driven by Oracle’s earnings, and financials stabilized after JPM rattled the sector with NII concerns. The in-line CPI report did nothing to challenge the case for normalization cuts. As a result, stocks were able to rebound sharply off of the worst single-week declines in months.

The Week Ahead

Monday

- n/a

Tuesday

- Retail Sales

Wednesday

- FOMC Meeting

- Housing Starts

- Building Permits

- General Mills (GIS)

Thursday

- Initial Jobless Claims

- Existing Home Sales

- Darden (DRI)

- FedEx (FDX)

- Lennar (LEN)

Friday

- n/a

The Only Question That Matters

The time is finally upon us.

The tightening cycle that began over two years ago, in March 2022, is set to conclude this week, with the Fed expected to begin an easing cycle aimed at normalizing rates. Coinciding with this, the 2s10s has returned to a healthy posture after a record period of inversion – six months longer than the previous record set in 1978. Heading into this week, a lot of commentary has warned investors that the market historically performs poorly following both events.

The data, and those citing it, aren’t lying. The numbers are bearish but lack context. The negative returns associated with these events are typically the result of the recession that the Fed didn’t act fast enough to avoid. Rapid rescue cuts to save the economy would correct any inversion because the Fed can move the short end of the yield curve faster and lower than the bond market could, or would, move the long end.

So, what about the bullish cases where future returns are positive? Those periods align with times when the U.S. avoids a recession. It just so happens there are fewer instances of the Fed executing perfectly than there are of it making a mistake. This leaves us with the only question that matters for markets:

Does the U.S. enter a recession?

Yes, and the market won’t perform well.

No, and the market will be just fine.

Right now, leaning too heavily on historical analogs and their statistics will skew your investment view more bearish than it should be. Recession is the question. You can use the 2s10s and the Fed to help inform your answer, but don’t let that be the entire answer.

Macro Movers

I’m aware the FOMC isn’t the only macro event this week, but it is by far the most important. That said, retail sales deserve attention because recession is the key question. The U.S. is a consumer-driven economy, so reports that gauge consumer behavior should carry more weight in recession analysis than those focused on industrial activity. Ideally, retail sales (excluding autos) will hit or slightly exceed the 0.2% forecast, providing a more stable footing for the FOMC meeting.

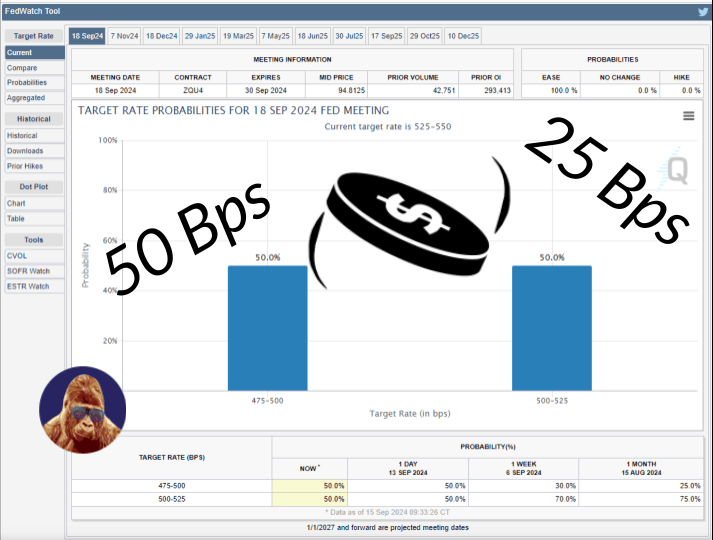

Probabilities for a 25 or 50 bps cut swung wildly last week. Post-CPI, the chances of a 50 bps cut dropped below 20%. Starting this week, the CME FedWatch Tool shows a coin flip. Here’s why I’m placing my bet on the 25 bps side of that coin:

Consistency:

The Fed has made it clear they want the normalization process to be gradual. Starting with a 50 bps cut would contradict that approach.

The Most Boring Approach:

The Fed aims to avoid unnecessary market disruption. If they go with 50 bps, two outcomes seem likely. Either the market sells off sharply as the FUD crowd assumes the Fed “knows something [bad] we don’t,” or small caps and lower-quality names rally 7%, expecting to benefit from easier monetary policy. In my view, a 25 bps cut features a lower probability of outsized moves.

Independence:

Starting with a 50 bps cut, especially when the odds are even, could be seen as a political move to prop up the economy ahead of the presidential election in November. The Fed doesn’t want to unnecessarily add any fuel to that fire.

Now, if we do get 50 bps, here’s how I’d interpret it:

In August, core PCE for July came in at 2.6%. Let’s assume the neutral rate is 100 bps above inflation, setting a target of 3.6%. It probably isn’t, but stick with me. At 5.25-5.50%, rates are 150-200 bps too restrictive, which is a significant gap. A 50 bps cut would simply bring us closer to neutral more quickly. It’s not an admission that the Fed thinks things are worse than anyone expects – it’s just mitigating recession risk by moving rates toward neutral faster.

That said, my base case remains a 25 bps cut.

Micro Movers

I’m not long on any of these names, but each will offer insight into different areas of the economy. This anecdotal evidence should factor into how we gauge the economy and assess recession probabilities alongside economic data.

General Mills (GIS):

Known for many American kitchen staples, spanning breakfast items, snacks, treats, and even dog food, GIS has a close pulse on the U.S. consumer. I know it sounds odd, but I’ll be paying particular attention to their Blue Buffalo brand. While dog-owners, myself included, want to get the best for their pets, dog-owners know that dogs are generally happy with whatever you give them. Consequently, if consumers aren’t feeling financially secure, they’re less likely to spend on “premium” dog food. Strength in this segment would be an undeniable signal of consumer resilience.

Darden (DRI):

As the hitmaker behind Olive Garden, LongHorn, Yard House, Ruth’s Chris, Seasons 52, and more, Darden’s 2,000+ U.S. locations will give us a clear picture of consumer appetite for dining-out versus cooking-in. Typically, higher dining-out rates align with better economic conditions. Financially stretched consumers don’t dine-out as often as financially confident consumers.

FedEx (FDX):

After years of underperformance, FedEx has pulled ahead of and separated from UPS over the last two years. As a logistics juggernaut, their earnings report is a litmus test for broader economic activity, which has the influence to change recession calculus.

Lennar (LEN):

Another homebuilder at an all-time high, LEN could extend its rally if a new housing cycle takes shape, which tends to happen during rate cycles. The stock is red hot, making expectations hard to pin down. If you’re looking to add exposure that will benefit from a new housing cycle, considering how far homebuilders have already moved, I’d suggest looking at secondary or tertiary derivative plays like Home Depot, Lowe’s, or Stanley Black & Decker that haven’t priced-in as much upside as the primary/pure plays.

Gorilla Tactics: The Japanese Yen (FXY)

Remember the yen-splosion in early August? Of course, you do. Just over a month later, the Japanese Yen is now stronger than it was back then.

There’s a saying: “Nothing is everything; everything is something.” That sums up my view here. The Yen isn’t the only factor at play, but it would be unwise to dismiss it. In context, the upward move makes sense: the Fed is cutting, which weakens the USD, while the BoJ is hiking, which strengthens the Yen. My theory on the potential negative impact of the Yen’s strengthening is that it could raise the bar for stocks and the broader economy to keep large institutions invested… maybe. Again, this is just a theory.

If we see another Yen-related episode, having exposure to the Yen – as I do through FXY – can help insulate your portfolio. The tricky part is sizing. Currencies don’t move as much as stocks, meaning the Yen’s upside might not fully offset the downside in your stock portfolio.

Even if you’re not interested in hedging against a second yen-carry episode, I’d recommend keeping an eye on it. Adding it to your watchlist or trading screen could give you some extra context on broader market moves.

Leave a Reply