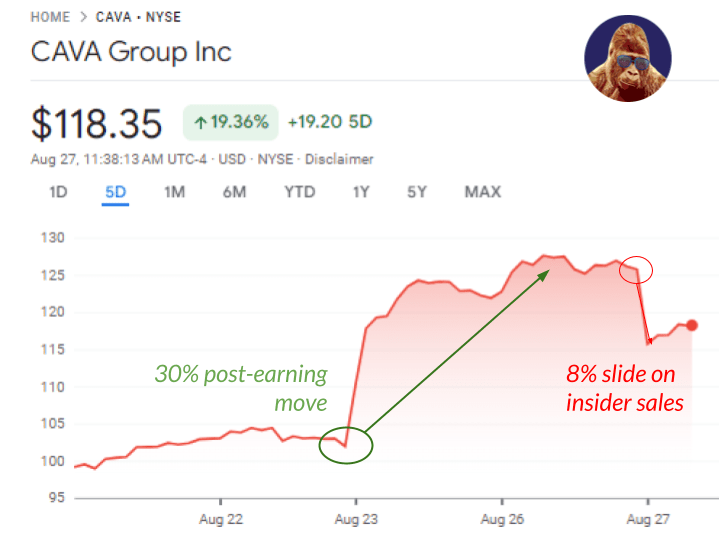

Cava (CAVA) was down as bad as 8% on news that insiders and major shareholders are taking substantial profits after the blockbuster quarter:

💲Artal International is looking to offload 6 million shares.

💲The CEO sold 210,000 shares.

💲The Chief Concept Officer and Co-Founder sold 5,000 shares.

For reference, the 90-day average trading volume is 3 million shares.

Some may interpret these sales as an indication that insiders feel differently about the direction of the business, shares, or the broader market. I wouldn’t read that much into it.

The stock rocketed 🚀 30% 🌕 to a new all-time high after their recent quarter rewrote expectations. We’re about to enter the high-stakes gauntlet of Nvidia and PCE. If you were sitting on these chips, you’d take some off too. Today’s decline feels more like the start of a buyable dip (pending Nvidia and PCE) than the end of Cava’s glory days.

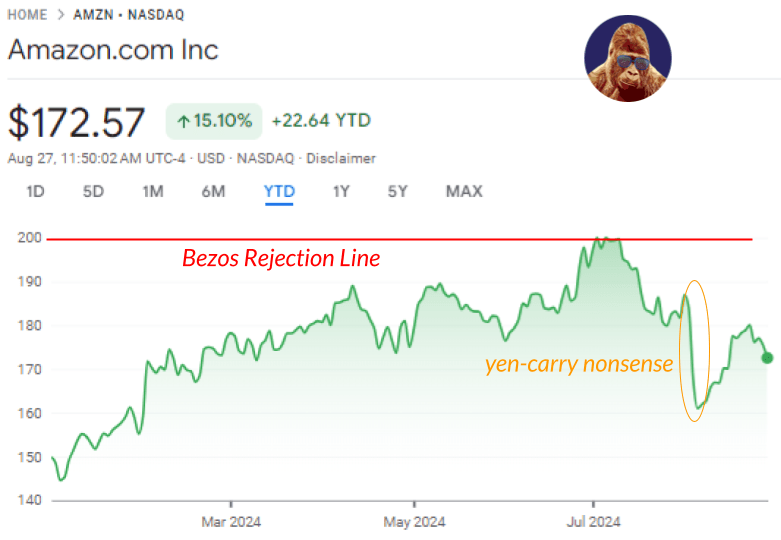

It wasn’t that long ago that in July, every time Amazon hit $200, a Form 4 appeared revealing Jeff Bezos was selling more shares. It single-handedly stalled each breakout attempt. The quarter that followed was solid. Ignore the negative reaction; it was distorted by the mini-growth scare and yen-carry unwind. AWS accelerated. AWS drives the stock. On any other day, the stock would’ve gapped higher.

All this to say that insider selling isn’t always an indication of declining fundamentals, and it shouldn’t affect your fundamental view. However, the technical headwinds often create a short-term ceiling that is hard to overcome.

Leave a Reply