Weekly Performance

| S&P 500 | 1.45% |

| Equal Weight S&P 500 (RSP) | 1.97% |

| NASDAQ | 1.40% |

| DOW | 1.27% |

| Russell 2000 (VTWO) | 3.58% |

Talk of the Tape

Powell’s Jackson Hole address was a masterclass in subtlety. Without providing new insights to move markets, the tone and intent projected a genuine confidence in the soft landing. Unlike in 2022, where he candidly discussed the pain associated with tightening, this year’s speech felt like a final chapter in the battle against inflation – a shift towards optimism.

The Week Ahead

Monday

- n/a

Tuesday

- n/a

Wednesday

- Nvidia (NVDA)

- Crowdstrike (CRWD)

Thursday

- Initial Jobless Claims

- GDP Q2 2nd Revision

Friday

- PCE

Macro Movers

The Fed has called their shot. It is time “for policy to adjust” and “the direction of travel is clear”. The Fed no longer “welcome[s] further cooling in labor market conditions,” signaling a pivot to prioritize economic stability.

With downside risks to the economy taking precedence over inflation concerns, we can expect rate cuts. Simply put, good news for the economy is good news for stocks.

Initial Jobless Claims and 2nd Revision Q2 GDP: The Chair said it himself, further deterioration in the job market is not desirable. Ideally, initial jobless claims will come in slightly below the 234k forecast.

Another key takeaway from Jackson Hole is that good news is good news. The consensus for Q2 GDP remains at 2.8%, consistent with the previous month’s preliminary read. While this consensus might be adjusted before Thursday’s release, robust retail sales increases the probability of a reassuring GDP figure. A strong GDP print would reinforce the view that this cutting cycle is more about “normalizing” interest rates rather than “rescuing” the economy.

While I expect both releases to be well-monitored, I would not expect any significant moves to sustain themselves. The market has a habit of reverting to a neutral stance ahead of major economic releases, and with PCE data set to release on Friday morning, it’s likely traders will keep the market in a tight range going into Thursday’s close.

Personal Consumption Expenditures Index (PCE): At Jackson Hole, Powell expressed growing confidence that inflation is on a sustainable path back to 2%. This confidence will be validated or challenged when the Fed’s preferred inflation measure, the PCE, is released Friday morning. Core is expected to come in at 0.2 MoM and 2.7 YoY. A result in line or below expectations would affirm Powell’s outlook. A higher-than-expected print would cast doubt on the Chair’s confidence. That said, I do not believe a single data point, unless remarkably bad, would meaningfully affect Powell’s stance.

Micro Movers

Nvidia (NVDA): On Wednesday after the bell, all eyes will be on Nvidia as it reports earnings, with CEO Jensen Huang leading the call. The stakes and expectations couldn’t be higher. Here’s why:

- Crowded traded: Active managers, retail investors, and speculators all have positions in Nvidia. Even if you don’t hold shares directly, your mutual fund or ETF likely does. This widespread exposure means everyone has skin in the game, which means everyone will be watching.

- Sentiment: Nvidia is a significant holding in many ETFs and mutual funds. A big move in Nvidia’s price will influence the price of other indices and stocks, affecting broader market sentiment. If Nvidia reports strong earnings, it could fuel a market rally and push indices past their July peaks. Conversely, a miss could drag down the broader market, pouring cold water on market sentiment.

- Earnings Powerhouse: Nvidia’s outsized earnings have made it a key driver of index-level EPS. Investors are willing to pay a higher multiple for higher growth. Part of the reason indices can support the current high-valuations is because of Nvidia’s large contribution to EPS growth. A reduction in Nvidia’s contribution will shrink EPS expectations, resulting in valuation compression.

- AI Narrative: Nvidia is the AI bellwether. A weak report will be seen as a sign that demand for the technology is waning, which would undermine the bullish narrative that AI will drive S&P 500 earnings growth over the next 2-5 years. Market confidence in these earnings projections hinges on Nvidia’s ability to deliver.

Here’s why I believe Nvidia will rise to the occasion:

The core of my thesis is the commitment of hyperscalers to AI. Hyperscaler capex is reaching unprecedented levels. According to Barclays, the five major U.S. hyperscalers—Alphabet, Amazon, Meta, Microsoft, and Oracle—are projected to spend $251 billion on capital expenditures by 2025, excluding Tesla.

These companies have resources comparable to or exceeding those of sovereign nations. They refuse to fall behind in the AI race and are writing massive checks to ensure they stay ahead. Nvidia is cashing these sovereign-nation sized checks. That’s why I’m confident Nvidia will meet or exceed expectations.

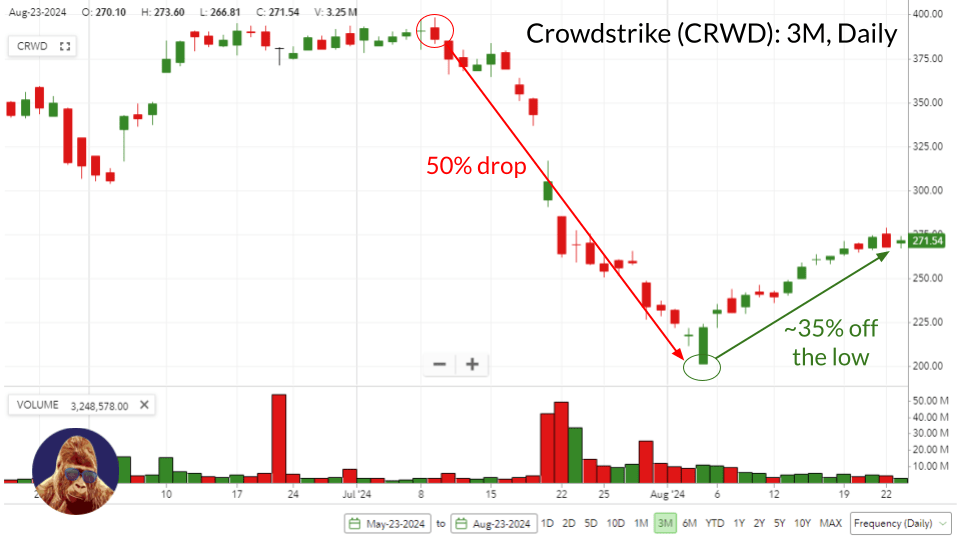

Gorilla Tactics: Crowdstrike (CRWD)

While Nvidia will be first in the headlines after Wednesday’s session, Crowdstrike’s earnings will be a close second. This is the first real opportunity for the company to provide clarity following its highly damaging outage — an event that halved the stock price from its all-time high of $400 to $200 in just one month.

Since hitting its low at $200, Crowdstrike has managed a 35% recovery, thanks to bullish analyst notes and technical momentum. As I mentioned in a previous note, I initiated a half position between $240 and $250 and plan to assess the earnings before committing further.

For those considering a position, entering now, so close to what many consider a binary event, feels like more of a gamble than a strategic trade or long-term investment. The company’s future hinges on its ability to address the outage fallout convincingly, and there are too many unknowns to predict market reactions with any degree of confidence.

Part of my strategy was to wait and see. That would be my advice now. Let the earnings make the decision easier.

Leave a Reply