Weekly Performance

| S&P 500 | 3.93% |

| Equal Weight S&P 500 (RSP) | 2.42% |

| NASDAQ | 5.29% |

| DOW | 2.94% |

| Russell 2000 (VTWO) | 2.93% |

Talk of the Tape

Soft landing sentiment has made a strong comeback. Dovish CPI report and unexpectedly robust retail sales data have dispelled fears of sticky inflation and an imminent recession. The result? A broad stock market rally, prompting many to call for a retest of the all-time highs. Remarkable how much can change in only a week.

The Week Ahead

Monday

- Palo Alto (PANW)

Tuesday

- Fed Speakers

- Toll Brothers (TOL)

Wednesday

- FOMC Minutes

- Target (TGT)

- Snowflake (SNOW)

Thursday

- Initial Jobless Claims

- S&P Flash PMIs

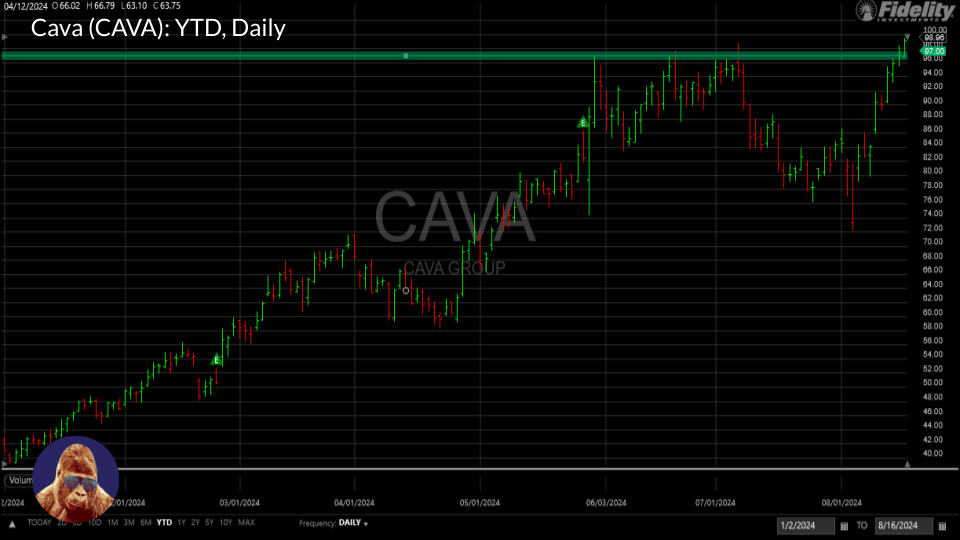

- Cava (CAVA)

Friday

- Fed Retreat: Jackson Hole

Macro Movers

Despite a heavy macro slate, Powell’s upcoming speech at Jackson Hole is all that matters. His words will ultimately shape the market’s interpretation of the recent data and all the reports leading up to September’s FOMC meeting.

Tuesday: Fed President Raphael Bostic and Vice Chair for Supervision Michael Barr are scheduled to speak. The debate has narrowed to whether the Fed should cut rates by 25 or 50bps. While both officials will claim data dependency, it seems that consensus is leaning toward 25. Personally, I believe the decision hinges on which option the Fed believes will best inspire confidence in their policy and the broader economy.

Wednesday: The FOMC minutes are unlikely to hold much weight. While the minutes are backward-looking by nature, these are particularly stale due to the mini-growth scare triggered by two post-meeting data points: initial jobless claims and payrolls.

Thursday: The bullish impact of last week’s lower-than-expected claims, alongside strong retail sales, showcases that jobless claims has retained some of its newfound importance. Expectations for this week are 230k, and a downside surprise would be welcome. As a reminder, 250k seems to be the threshold for labor market worries.

The flash PMIs for August are due before the market opens on Thursday as well. During the yen-carry unwind, the Services PMI put a bottom in the S&P 500. This data will either amplify or counterbalance the impact of jobless claims. While I was unable to access consensus estimates from my usual source, it’s clear bulls are hoping the results surprise to the upside.

Friday: Powell’s Jackson Hole speech at 10 AM is the main event. Unlike post-FOMC press conferences, Powell uses this platform to deliver long-term messages on critical issues. There is no Q&A afterward. With the first rate cut of this cycle expected in September, I anticipate Powell will offer insights on how the Fed views rate cuts within the broader economic landscape, which has the potential to alter how the market interprets both recent and upcoming economic reports as well as Fed actions.

Micro Movers

Palo Alto Networks (PANW): After a rough February earnings call where CEO Nikesh Arora’s mention of “spending fatigue” sent the stock plummeting 30% overnight, PANW has recovered nicely. However, a lot is at stake when they report on Monday. Investors want to see progress on the shift away from product-based solutions and toward a unified platform. Crowdstrike’s seamless Falcon platform, where customers can easily pick and choose desired security products, has set the gold standard. The ease of picking and choosing new products without the hassle of a separate onboarding process gives Crowdstrike a clear advantage by eliminating a major source of that “fatigue”. PANW needs to close that gap to get above $350.

Toll Brothers (TOL): With an average home price of around $1 million, TOL caters to the higher-end consumer. While I don’t follow the company closely, their earnings will provide insight into how the luxury real estate market is holding up as interest rates decline. Typically, lower rates boost home values, but an influx of new supply from owners looking to exit secondary homes could offset this, potentially pushing prices down in the near term.

Target (TGT): The stock got a lift from Walmart’s strong quarter and a robust retail sales report, making it a popular trade idea. However, I’m not buying into the hype. Walmart and Target play a zero-sum game, and Walmart’s continued strength is likely coming at Target’s continued expense. Yes, the stock at 16x TTM earning is cheap, but I believe it deserves that valuation. I doubt this quarter will change that.

SnowFlake (SNOW): Down 50% and abandoned by Buffett, SNOW is in a tough spot. Despite a decent showing last quarter, ongoing competitive concerns continue to haunt the name. It is on track for its ninth consecutive monthly decline and hasn’t closed above its 50-day SMA all quarter.

While none of that inspires confidence, it would seem as though expectations are now so low that even a halfway decent quarter has a real chance to trigger a short squeeze and draw in momentum buyers.

I am still – unfortunately – long the name. Though I am hopeful this quarter will turn the stock around, I won’t be doing anything until after.

Cava (CAVA): Everyone is hunting for the next big growth story, and Cava is positioning itself to be the next Chipotle – minus the abrupt departure of a star CEO. The stock is flirting with a $100 price. Breaking through would mean another new all-time high. Despite technically being a large-cap, sporting a market value above $10 billion, Cava is better characterized as a young, growth stock. Quick 10-20% swings – up and down – are part of the ride. I’ve sized my position smaller to manage that risk, which provides the flexibility to add more on a dip.

Leave a Reply