Weekly Performance

| S&P 500 | -0.04% |

| Equal Weight S&P 500 (RSP) | 1.92% |

| NASDAQ | -0.18% |

| DOW | -0.60% |

| Russell 2000 (VTWO) | -1.35% |

Talk of the Tape

After a flash panic caused by the yen-carry trade unwind, market prices and sentiment recovered nicely as economic data and earnings alleviated economic concerns. Although Monday’s panic had little to do with those concerns, it has left the market more sensitive to macro indicators.

The Week Ahead

Monday

–

Tuesday

- PPI

- Home Depot (HD)

Wednesday

- CPI

- Brinker (EAT)

Thursday

- Initial Jobless Claims

- Retail Sales

- Walmart (WMT)

Friday

–

Macro Movers

A series of consecutive negative events cascaded into an avalanche of panic, disturbing the complacency of 2024. That is how I would sum up last week.

The trigger was the yen-carry trade – borrowing against the yen to buy U.S. tech – which unwound (at least in part) after the Bank of Japan unexpectedly hiked interest rates, causing the yen to spike. This resulted in what can be described as a market-wide margin call. Major players who had borrowed the yen were forced to sell assets to buy back the yen and cover their shorts.

This forced liquidation, not economic concerns, caused stocks to fall. In my view, this makes stocks cheaper: lower prices, same earnings. While that’s bullish, these events tend to increase the market’s sensitivity (volatility).

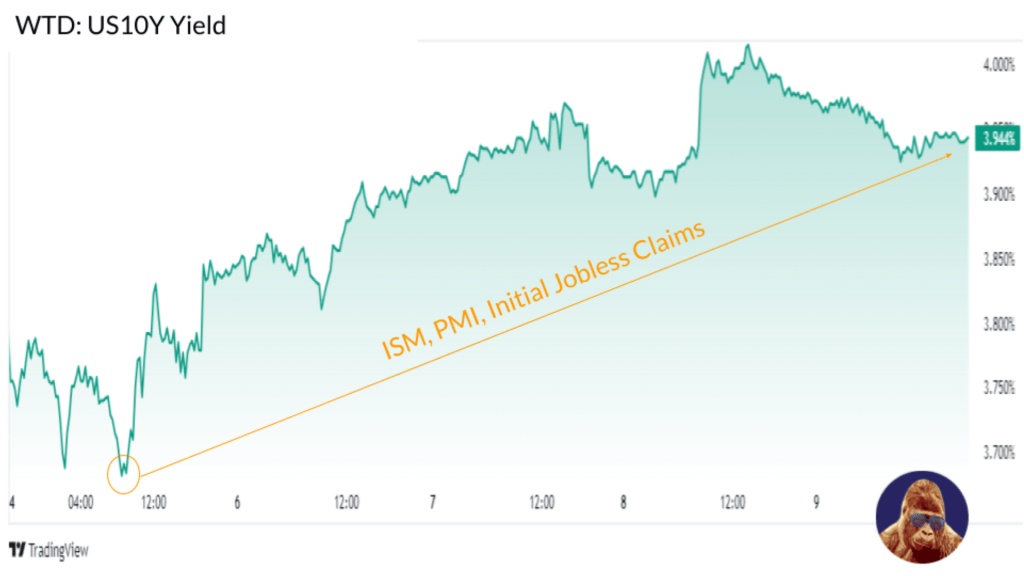

Last week, the market needed reassurance about the economy. ISM, PMI, and initial jobless claims reports provided that reassurance. Typically, these reports aren’t “market movers,” but they still managed to push the yield on the U.S. 10-Year Treasury from 3.7% to 4%. A 30 bps move in a single week usually requires more significant data like Payrolls, CPI, or PCE as a catalyst. The fact that these relatively overlooked reports had such an impact highlights just how sensitive the market was at the start of the week.

This week, the market needs reassurance on inflation. The worst case for stocks is a scenario where the Fed cannot cut rates to support a slowing economy because inflation is too high. Downside surprises in PPI and CPI would take this doomsday scenario off the table. Without this concern, market sensitivity should return to levels more typical of 2024.

Additionally, it will be important to monitor initial jobless claims and retail sales. Lower jobless claims and higher retail sales will reinforce the notion that the economy is not in a perilous position.

- PPI: Consensus of 0.2% headline and 0.2% core on a monthly basis.

- CPI: Consensus of 3% headline and 3.2% core year-over-year. Core estimate on a monthly basis is set at 0.2%.

- Initial Jobless Claims: Forecast is 235k.

- Retail Sales: Forecast is for 0.3% minus autos.

Micro Movers

Micro factors also contributed to the recovery. Strong results from consumer-facing companies like Uber and Sweetgreen improved sentiment, offering anecdotal evidence that consumer behavior hadn’t suddenly shifted due to a hedge fund trade gone spectacularly wrong.

Home Depot (HD): Trading at ~22x forward earnings, Home Depot’s numbers may be too low if Fed rate cuts trigger a new housing cycle. Despite the potential, the stock is only up ~1.4% on the year, making expectations for the quarter manageable. However, with its earnings coinciding with CPI, expect heightened volatility. If you’re considering purchasing before these events, size it accordingly.

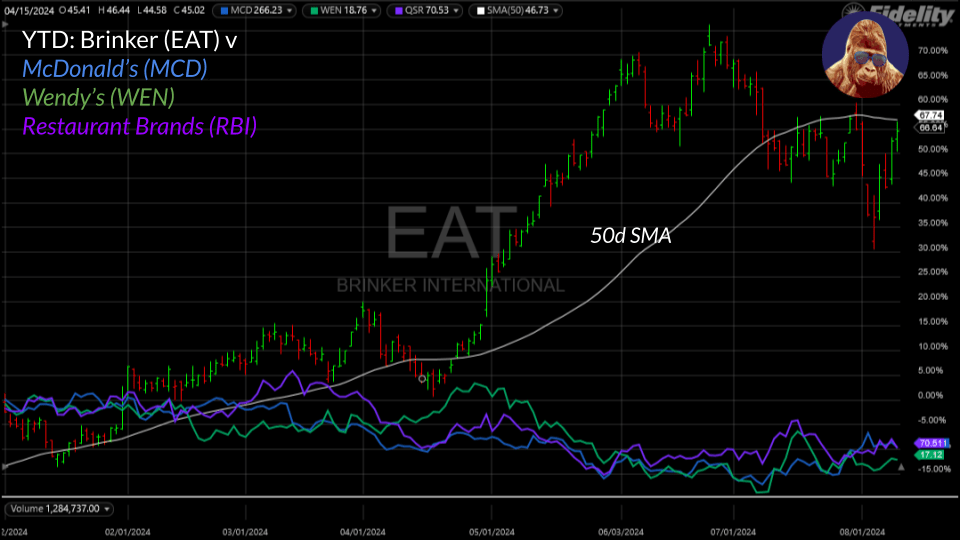

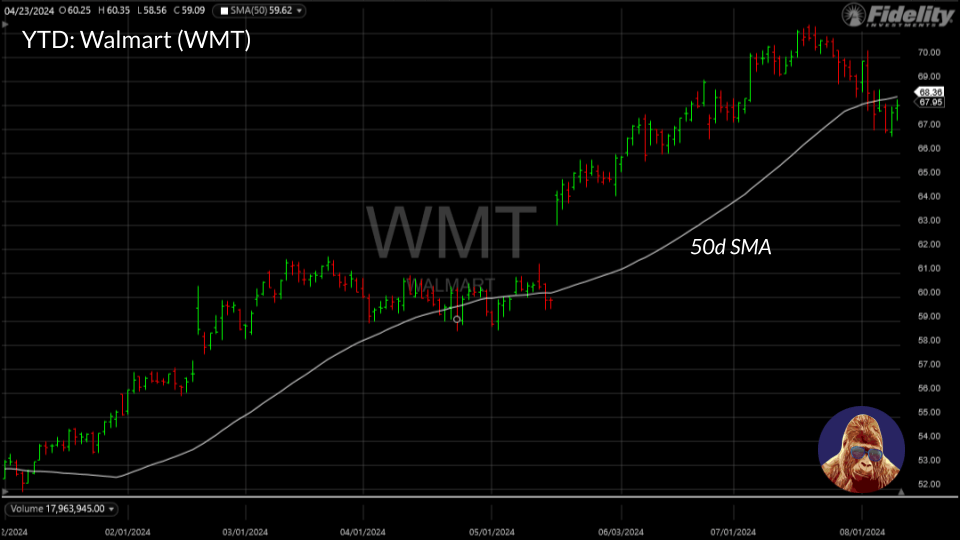

Brinker International (EAT) and Walmart (WMT): Although belong to different industry groups, these companies share a key commonality driving their outperformance: offering low-cost options that deliver high perceived value.

Since April, Chili’s—one of Brinker’s franchises—has been running a “3 for Me” deal, where customers get an appetizer, entrée, and beverage for $10.99. This price point offers a compelling alternative for consumers who might otherwise pay more for a similar or inferior combo meal at fast-food chains like McDonald’s or Wendy’s. The stock market has taken notice

Walmart and Costco are the only grocers with the scale to challenge vendors on price. Both have leveraged this advantage, pushing vendors to reduce prices as pandemic-related factors wane. This strategy has allowed Walmart to maintain prices well below those of smaller competitors, successfully attracting more customers to their stores.

My favorite opportunities are those where the technical setup aligns with the fundamental story, and Brinker and Walmart fit this description perfectly. Both are currently battling their 50-day SMAs, and strong quarterly results could provide the fundamental justification for a breakout.

Gorilla Tactics: CrowdStrike (CRWD)

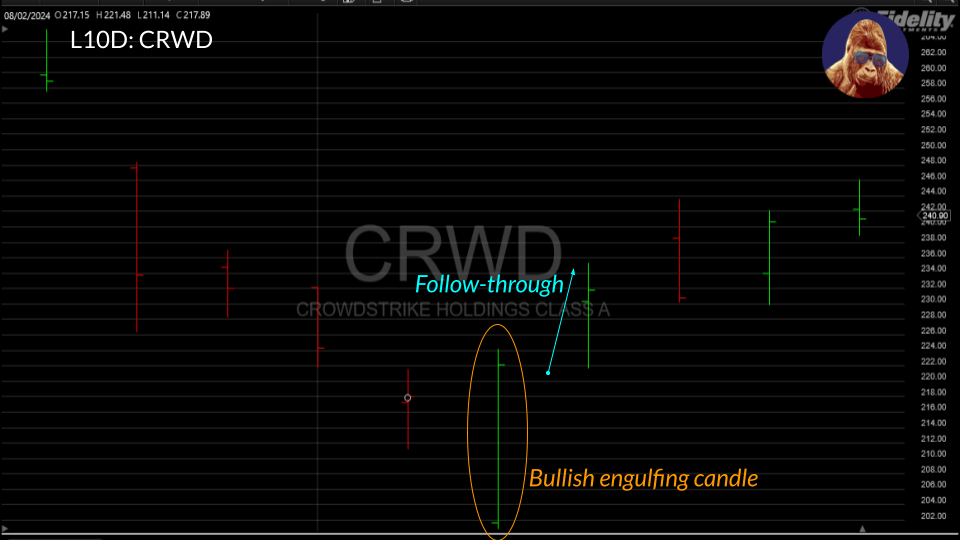

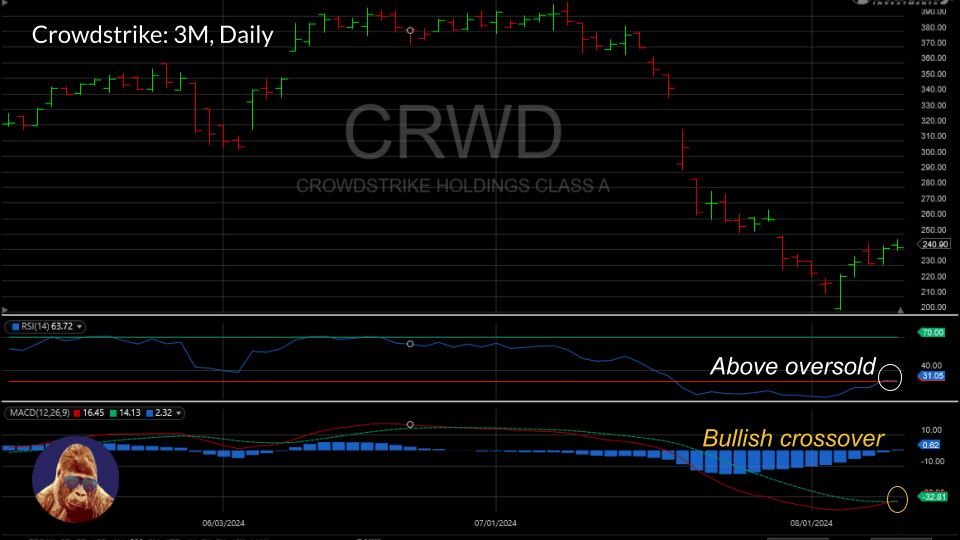

Throughout last week, I have been accumulating CrowdStrike shares. I outlined my perspective on the stock in a previous article and am highlighting it again now due to a shift in the technicals that suggests a durable and/or tradeable bottom may be forming.

- Bullish engulfing candle: After opening lower than the prior red candle’s close and low, the stock rallied and closed above the prior candle’s high. This action indicates that while bears attempted to push the stock lower, the bulls decisively regained control.

- Follow-Through: A bullish engulfing candle typically signals a reversal of a bear trend, but follow-through is crucial to confirm a conviction low or tradeable bottom. Wedbush’s reiteration of an “outperform” rating the following morning provided the catalyst for the stock to open and close higher, reinforcing the reversal.

- Momentum Indicators Align: The MACD experienced a bullish crossover, and the RSI crossed out of oversold (30) territory. Individually, these indicators suggest the stock has been sufficiently punished and is gaining positive momentum. The fact that both turned almost simultaneously adds further confirmation of a conviction bottom.

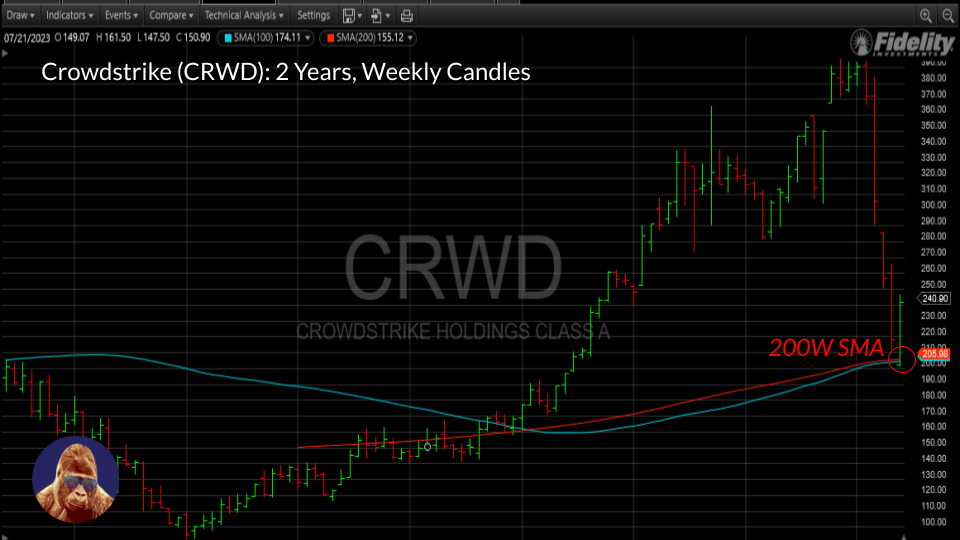

- Support at the 200 Week SMA: This is just a bonus. The bullish engulfing candle’s low coincided with the 200-week SMA, a powerful indicator. This level has the influence to help create a durable low. For reference, the 200-week is where the S&P 500 bottomed in 2022.

I’ve used this opportunity to add to my long-term position in CRWD. For those starting a position, I recommend buying half now and waiting for the upcoming quarter to allocate the rest. The fundamental concerns surrounding the recent outage can only be addressed then. However, the convergence of technical indicators suggests the market believes the 50% drop from the $400 high has adequately priced in the potential damage from the outage. Otherwise, the stock would have continued to fall.

Leave a Reply