The economy is crumbling!

So… how did Uber (UBER) report a beat on both the top and bottom lines? A 23% increase in mobility unit gross bookings and a 3Q estimate in line with consensus…

🤔🤔🤔🤔🤔

One company doesn’t define the economy…

but if the U.S. were truly heading towards an imminent recession, Uber couldn’t post these numbers. Recession meteorologists should reconsider their forecasts. One day, they will get it right. A recession will come… eventually; it’s inevitable, like Thanos.

Yesterday’s ISM and PMI data, along with a series of reassuring earnings reports, suggest that Monday’s sell-off was due to the “yen-carry trade”. Many believe there may still be pain ahead as that trade has not fully unwound.

The “yen-carry trade” refers to a popular hedge fund strategy, where they go short (betting on a decrease in value) on the Japanese yen while going long on U.S. technology (AI) stocks. When the Bank of Japan unexpectedly raised its benchmark interest rate, the yen spiked. This sudden increase forced hedge funds to cover their short positions, resulting in a need to sell off their long positions in U.S. technology stocks to raise the necessary funds. The short covering pushed the yen higher, while the liquidation of long positions caused U.S. technology stocks to decline.

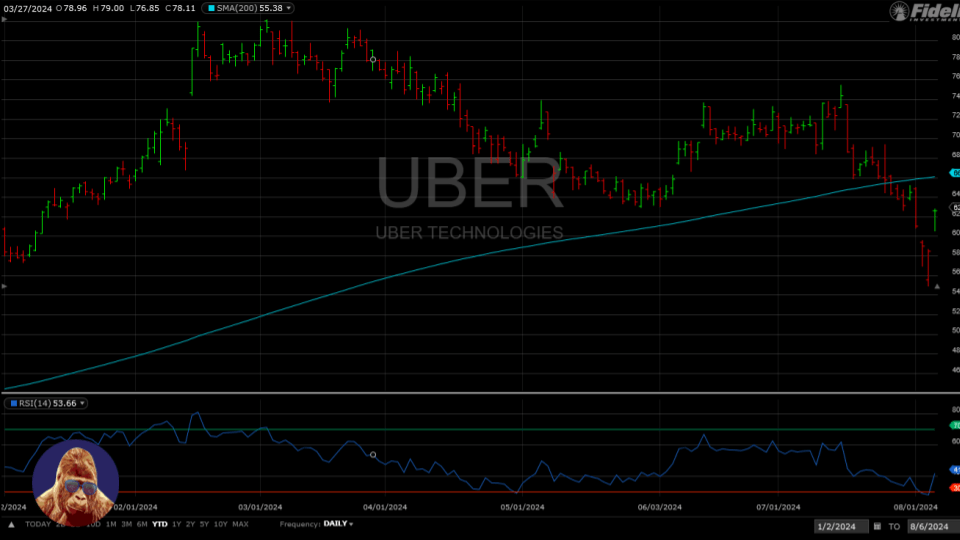

Uber (UBER): A Return To Form in No Man’s Land

As for Uber, this performance marks a return to form after a misstep in the previous quarter. Management even went out of their way to provide reassuring detail concerning their lower-strata customers. They understand what the market wants and are executing accordingly.

That said, the stock remains in no man’s land below the 200d SMA (light-blue line). Although it has moved out of oversold territory (RSI, red bar in the bottom pane), I would wait for the stock to clear the 200d before making a move.

Leave a Reply