Weekly Performance

| S&P 500 | -2.06% |

| Equal Weight S&P 500 (RSP) | -2.02% |

| NASDAQ | -3.35% |

| DOW | -2.10% |

| Russell 2000 (VTWO) | -6.67% |

Talk of the Tape

Although Powell teed up a rate cut for the next FOMC meeting in September, convincingly soft labor data created a narrative that the Fed may already be too late in normalizing financial conditions to preserve a “soft landing”. The unexpected weakness caused stocks to slide into the weekend.

The Week Ahead

Monday

- S&P PMI

- ISM Services

- Simon Property Group (SPG)

Tuesday

- Uber (UBER)

- Reddit (RDDT)

Wednesday

- Consumer Credit

Thursday

- Initial Jobless Claims

- Eli Lilly (LLY)

- Cheniere (LNG)

Friday

- n/a

Macro Movers

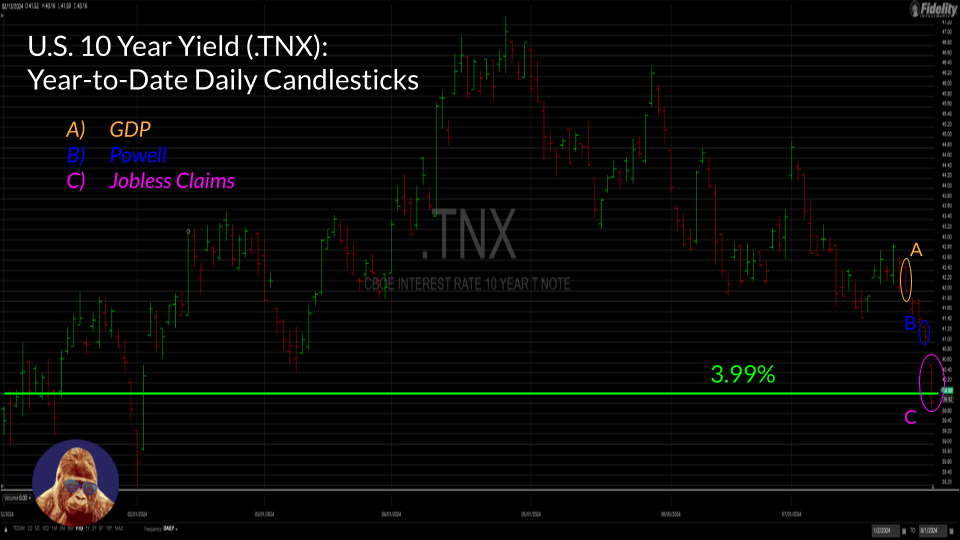

It appears the yield on the U.S. 10-Year Treasury (US10Y) has retook the mantle as key indicator for the foreseeable future, acting as the lead proxy for the state of the economy. The lower the yield, the more negative the outlook. Last week, the highest initial jobless claims of the year and the unemployment rate climbing to 4.3% have created the narrative that the Fed should have already cut rates.

For what it’s worth, if you followed my advice and extended the duration on your cash by buying a bond fund or bonds themselves, that part of your portfolio is working wonderfully. That aside, this sell-off seems much like a panic. After spending much of the year as a teenager, the VIX gapped up and raced to 30. A 60% move in the VIX indicates panic: an environment that often creates opportunities.

There is plenty of data scheduled between now and the Fed’s next meeting in September, including another Payrolls report. If the data firms up – even marginally – I expect Friday’s narrative to get rewritten and prices to notably recover. From here on out, it is clear what the market wants: good news. No more of this “hot, but not too hot” or “cold, but not too cold”. Close the book on Goldilocks and the Three Bears numbers. We need data that showcase economic strength to justify the Fed’s patience.

- S&P final U.S. Service PMI: The estimate is 56.0, with a prior reading of 55.3. A result above the estimate would be bullish; however, a reading above the previous number will likely provide relief.

- ISM Services: The consensus is 51.4, up from 48.8 previously. Interpret this indicator similar to PMI, with a higher reading being positive.

- Consumer Credit: This report measures the change in the total value of outstanding consumer credit requiring installment payments. Typically, a more confident consumer spends more using credit. The estimate is for $11.5B, up from the previous $11.35B. An in-line report would allow the market to breathe. If the Fed were really too late, this number would plummet as consumers cut spending ahead of harder economic times.

- Initial Jobless Claims: The consensus estimate is 245k, down from last week’s 249k. Given last week’s data, this metric has taken on new importance. Most economists consider 250k-300k as a threshold for concern. Let’s hope we pull back from that threshold this week.

Micro Movers

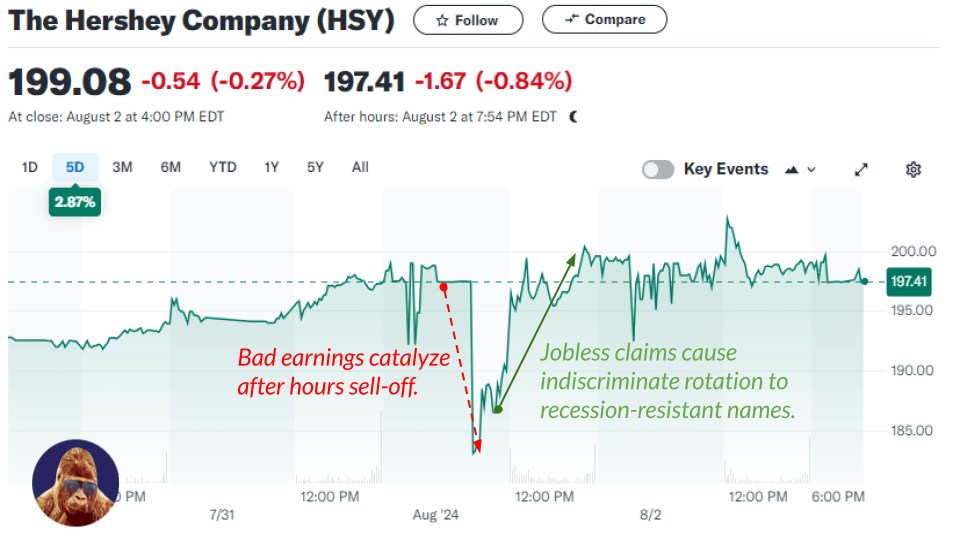

When panic is high, investors sell indiscriminately, causing the good to get thrown out with the bad. This creates opportunities. Economic concerns have led investors to flee growth for non-cyclical, regardless of quality.

For example, Hershey’s (HSY) reported earnings on the same morning as the jobless claims data. The quarter was bad: declining sales volume, persistent pressure from cocoa prices, and a price increase despite competitors lowering theirs. Initially, HSY traded down 5%. However, as jobless claims shock investor confidence in the economy, money indiscriminately sought out defensive stocks like Hershey.

As a result, Hershey ended the day flat and closed the week up around 3%.

Given this context, I think it could be of value to highlight a few high-quality companies that could be unfairly punished. Listen to the quarters, watch how the market treats them, and see if any still peak your interest.

Simon Property Group (SPG): Arguably the best REIT in the business, run by David Simon, who owns some of the world’s finest luxury shopping malls, outlet centers, and lifestyle centers. Catering to high-income consumers, SPG is less sensitive to economic cycles. The stock was only down 1% last week, but the upcoming quarter may present an even better entry point. With a 5.3% yield and consolidating at all-time highs, this is one to watch.

Uber (UBER): I believe Uber has the potential to become a top-five advertising company by leveraging its rideshare platform. It has clearly won the ride-share war, and I’m not concerned about Tesla’s self-driving threat. Last week, Uber’s stock dropped 10%, losing its 200-day SMA and all of 2024’s gains. The stock’s recent weakness is understandable, given its reliance on consumer strength. Technically, the stock is in a precarious position. Wait for the earnings before making any decisions.

Reddit (RDDT): Known as a unique social media platform, Reddit recently inked a lucrative deal with OpenAI, allowing ChatGPT to train its AI models using Reddit content. I hope this quarter sheds light on that arrangement and updates us on the state of their advertising business. Advertising is often one of the first areas to see cuts during economic slowdowns, so strong guidance from Reddit would challenge the narrative that the Fed is too late.

Cheniere (LNG): Currently consolidating at new all-time highs in the $175 range, LNG’s performance is based on volume, not the price of natural gas. As the world demands more energy without a nuclear base load, natural gas remains essential. LNG’s flat week suggests the market understands its value. The upcoming quarter might offer an opportunity to buy if it provides “an excuse” to take profits.

Eli Lilly (LLY): Although the stock was flat last week, it has fallen 10% since mid-July. Eli Lilly has become famous for its GLP-1 medication. I believe the short-term future of the stock hinges on Donanemab (Kisunla™), their Alzheimer’s treatment approved on July 2nd. If the next quarter is business as usual and the stock slides further – say into the $725-$750 range – it would be hard to argue against buying at those levels.

Leave a Reply