This morning’s weak BLS payrolls survey reinforced the notion that the Fed may already be too late in cutting rates.

Is it possible to act in a timely manner when relying on lagging data? Once this economic cycle is behind us, especially with the advent of real-time/alternative indicators developed during the COVID-era, the Fed will need to seriously reconsider its approach. A discussion for another time.

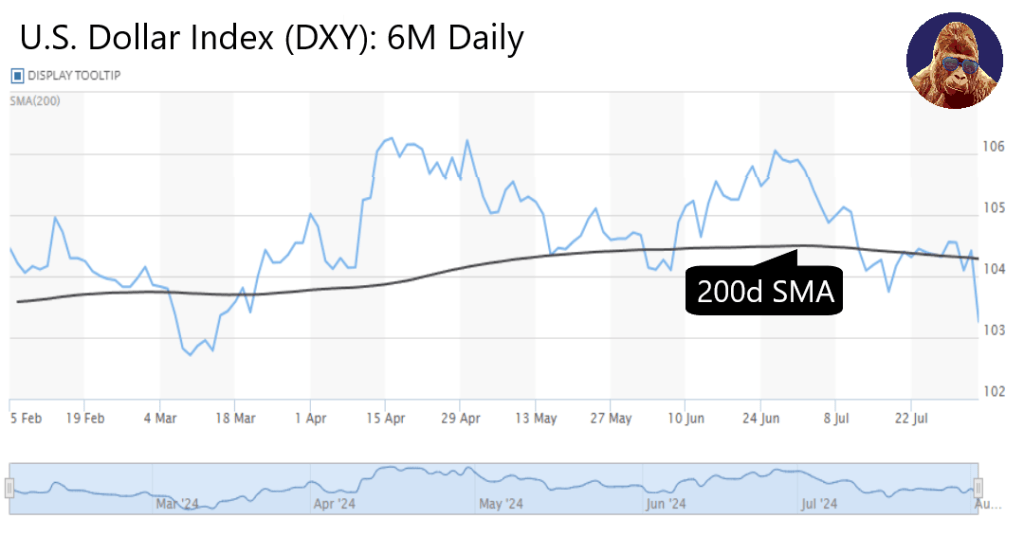

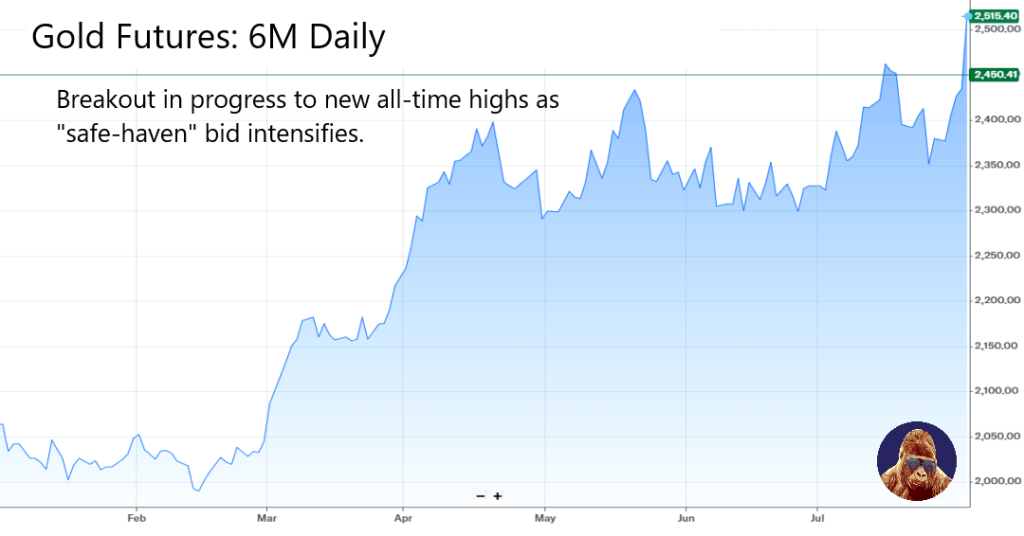

As for equities, defensive sectors are leading once again. Gold and high-dividend stocks have also joined the winner’s circle. With the U.S. dollar and U.S. 10-year yield continuing to slide, it’s no surprise that investors are seeking out investments inversely related to the USD (primarily gold) and yield-substitutes.

Dollar down; Gold up

In the meantime, I feel opportunities are being made in tech. The NASDAQ is down 550 points, ~3%. Closing here would put the NASDAQ in correction territory (down 10%). In my opinion, the quarters from tech’s best and brightest weren’t perfect but don’t warrant a sell-off of this magnitude. The macro is exacerbating the negativity.

Hard to say when the bleeding will stop. Not much to do until it does. Haven’t we all been waiting for a correction? Well, here it is. Don’t panic. Be patience. Stay long.

Leave a Reply