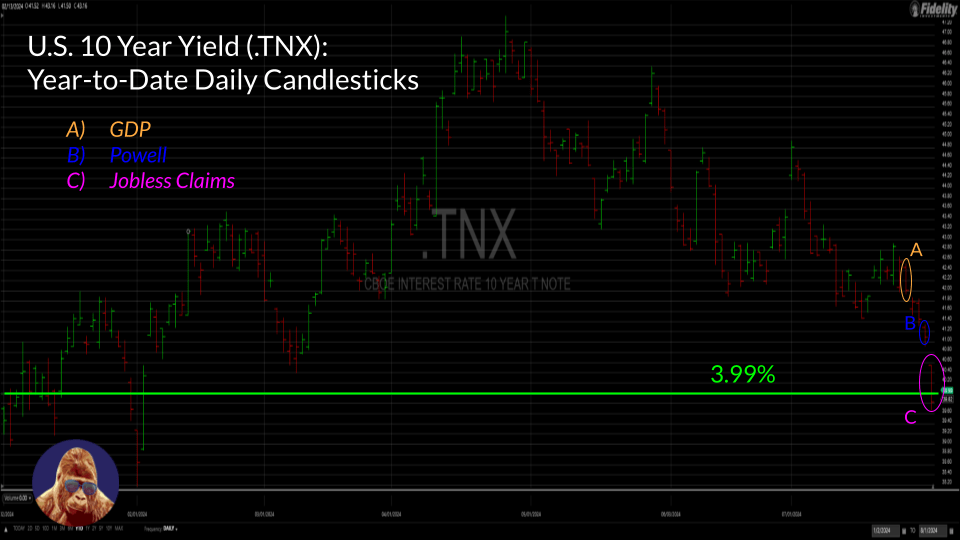

The U.S. 10-year yield is on track to close with a 3-handle for the first time since February. Throughout 2024, the US10Y has served as a proxy for growth expectations. Its decline suggests that the bond market is forecasting weaker economic growth ahead.

What’s behind this damper forecast? Three factors come to mind:

1) Today, initial jobless claims revealed the highest number of newly unemployed this year.

2) Yesterday, Federal Reserve Chair Jerome Powell reiterated the need to better balance inflation risk with economic risk. In other words, the Fed is now just as worried about the economy as it is inflation.

3) Last week, the preliminary reading on Q2 GDP came in below expectations at around 2% if you remove the 0.8-0.9% boost that came from inventories.

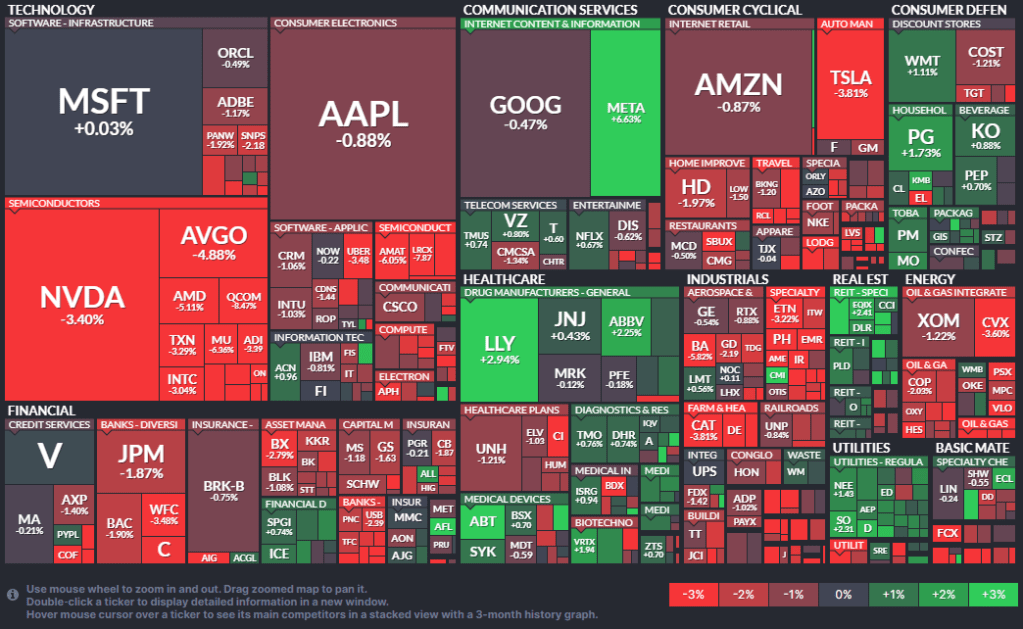

Equities are taking notice.

Aside from select financials and Meta post-earnings, defensive sectors are leading the market: consumer staples, utilities, and healthcare. Even Hershey (HSY) reversed post-earnings losses after a disappointing quarter. Midway through today’s session, money appears to be indiscriminately flowing anything perceived as recession-resistant.

Leave a Reply