August 2024

-

The options market was pricing in a 10% move on Nvidia’s (NVDA) earnings. It is early, but with NVDA down just 2-3%, this relatively muted reaction suggests the results were largely as expected. The rest of the market is either slightly higher or sideways. Looks like rotations: money leaving Nvidia for other opportunities in an…

-

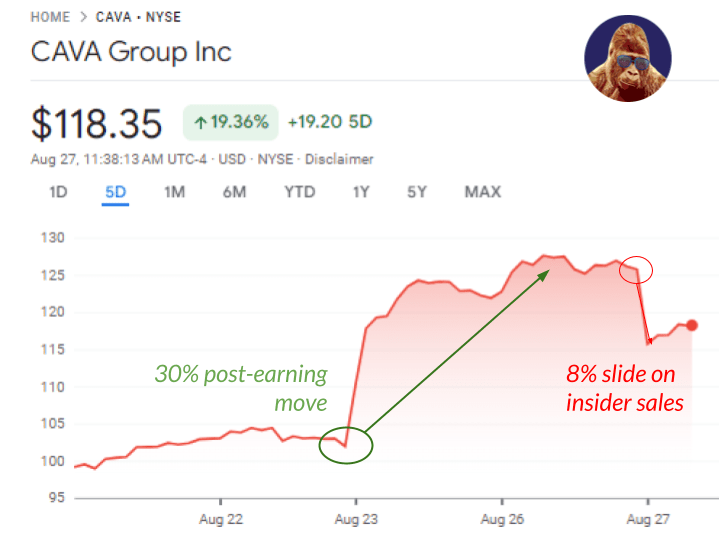

Cava (CAVA) was down as bad as 8% on news that insiders and major shareholders are taking substantial profits after the blockbuster quarter: 💲Artal International is looking to offload 6 million shares.💲The CEO sold 210,000 shares.💲The Chief Concept Officer and Co-Founder sold 5,000 shares. For reference, the 90-day average trading volume is 3 million shares.…

-

Weekly Performance S&P 500 1.45% Equal Weight S&P 500 (RSP) 1.97% NASDAQ 1.40% DOW 1.27% Russell 2000 (VTWO) 3.58% Talk of the Tape Powell’s Jackson Hole address was a masterclass in subtlety. Without providing new insights to move markets, the tone and intent projected a genuine confidence in the soft landing. Unlike in 2022, where…

-

Powell delivered a Jackson Hole classic. You can find a transcript here, but here are some key quotes that stood out to me: On Inflation “My confidence has grown that inflation is on a sustainable path back to 2 percent.” The risks associated with inflation are no longer the primary focus. On Employment “It seems…

-

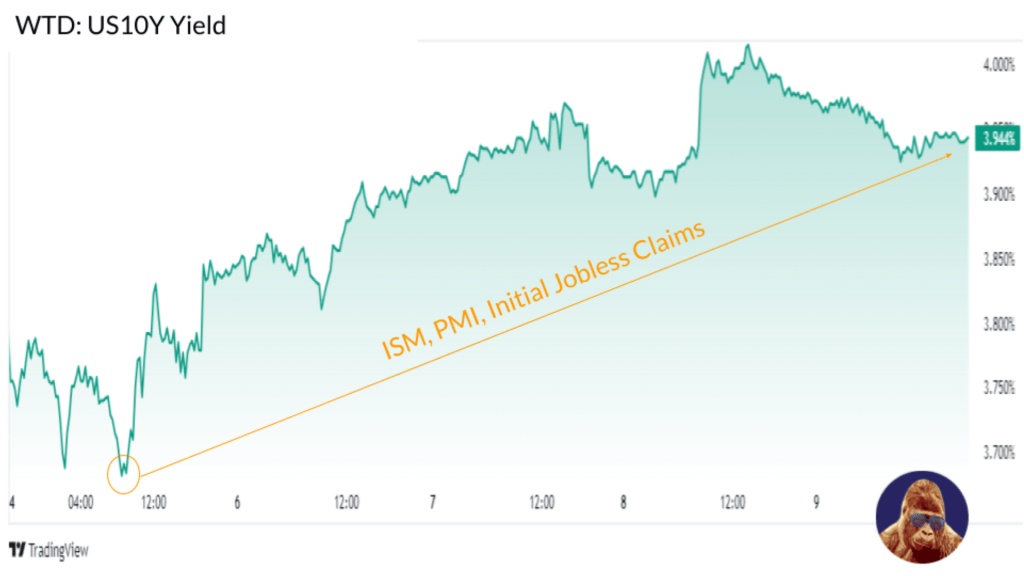

Weekly Performance S&P 500 3.93% Equal Weight S&P 500 (RSP) 2.42% NASDAQ 5.29% DOW 2.94% Russell 2000 (VTWO) 2.93% Talk of the Tape Soft landing sentiment has made a strong comeback. Dovish CPI report and unexpectedly robust retail sales data have dispelled fears of sticky inflation and an imminent recession. The result? A broad stock…

-

Recap In a word: mixed. For their fiscal fourth quarter, the parent company of Chili’s and Maggiano’s reported mixed results, beating revenue expectations but missing on EPS. Guidance for fiscal year 2025 mirrored the quarter as revenue beat and EPS fell short. In Between the Top and Bottom While expenses at Chili’s have increased compared…

-

This is the wildest C-suite move I’ve ever seen. Starbucks (SBUX) poached Chipotle’s (CMG) all-star CEO, Brian Niccol. CMG is down 12%, shedding $10 billion in market cap. SBUX is up 22%, adding $16 billion in market cap. While this may seem like flattery, I believe Brian Niccol is worth every dollar. Brian is a…

-

Weekly Performance S&P 500 -0.04% Equal Weight S&P 500 (RSP) 1.92% NASDAQ -0.18% DOW -0.60% Russell 2000 (VTWO) -1.35% Talk of the Tape After a flash panic caused by the yen-carry trade unwind, market prices and sentiment recovered nicely as economic data and earnings alleviated economic concerns. Although Monday’s panic had little to do with…

-

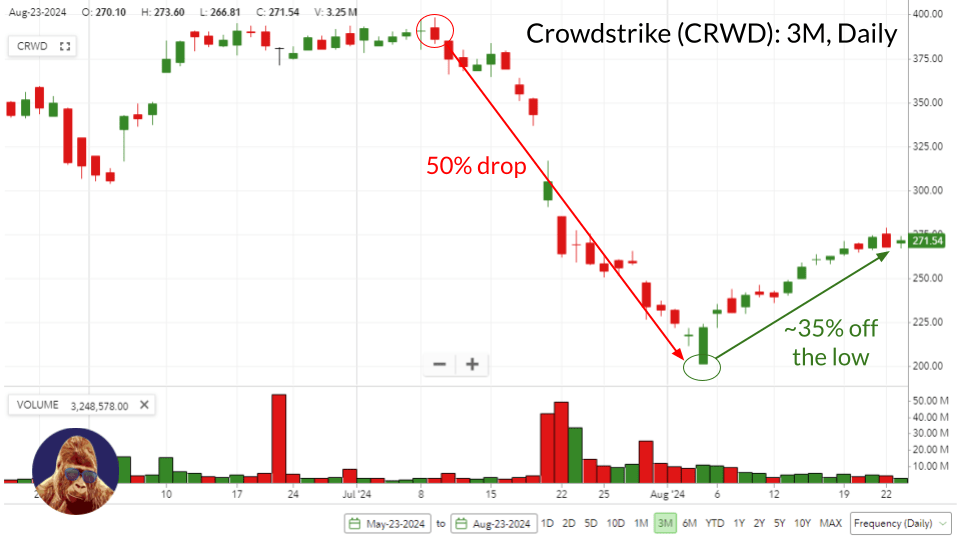

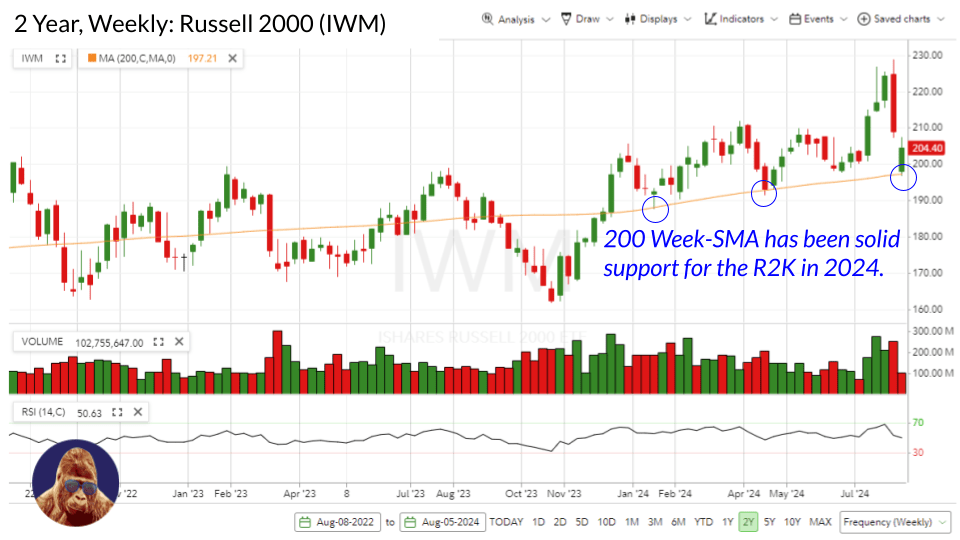

What Are You Looking At Given the context of the sell-off – with tech at the epicenter of the yen-carry trade unwind – it is not a surprise that recovery in the tech-heavy NASDAQ looks the least convincing. The S&P 500, with its 32% allocation to tech, isn’t faring much better. I view the recoveries…

-

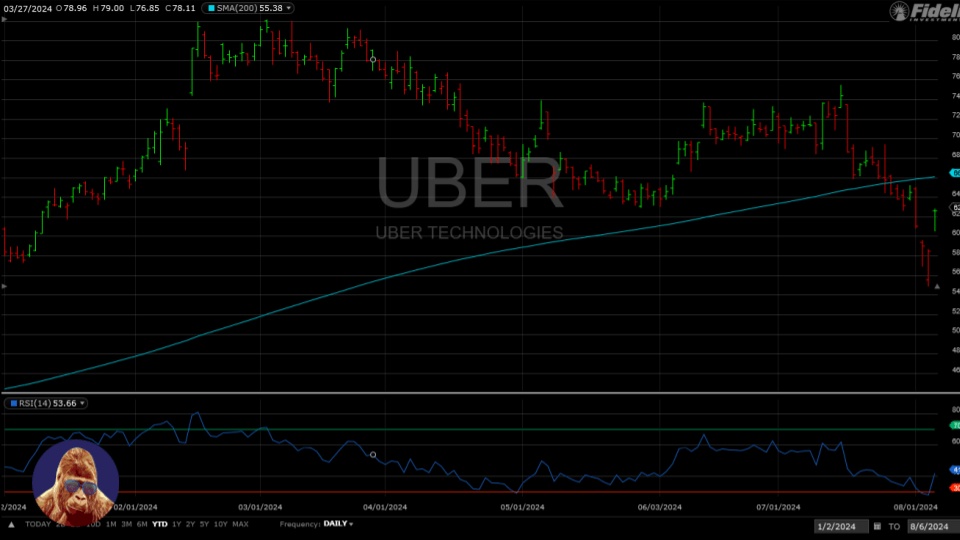

The economy is crumbling! So… how did Uber (UBER) report a beat on both the top and bottom lines? A 23% increase in mobility unit gross bookings and a 3Q estimate in line with consensus… 🤔🤔🤔🤔🤔 One company doesn’t define the economy… but if the U.S. were truly heading towards an imminent recession, Uber couldn’t…