Weekly Performance

| S&P 500 | 0.61% |

| Equal Weight S&P 500 (RSP) | 1.39% |

| NASDAQ | — |

| DOW | 1.45% |

| Russell 2000 (VTWO) | 0.79% |

Talk of the Tape

An end of week reversal from the hottest secular growth stocks – Nvidia, Broadcom, Chipotle, Apple, to name a few – that flowed into the rest of the market, allowed for a more balanced weekly performance across the indices.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Fed Speakers | Fed Speakers | – | GDP | PCE |

Macro Movers

As the lull in earnings continues, macroeconomic discussions remain the focus. As a result, Fed speakers have the chance to dominate the tape early. With recent U.S. economic data mostly surprising to the downside and expectations of further disinflation ahead, the market will be watching closely for any clues indicating whether the committee has adopted a more dovish stance than the hawkish dot plot revision and the hesitant tone at the press conference suggested.

That said, GDP and PCE will carry more weight. While the Fed is far from insignificant, stock prices over the last couple of months have been responding more to economic data than to Fed communications (speeches, meetings, minutes). I interpret this as a signal to concentrate on the data because, for the moment, the market is behaving as if the Fed is truly data-dependent.

The 2nd revision to 1Q GDP will be released Thursday morning. Expectations are for 1.3%. Given that retail sales feed into GDP, the downside surprise and subsequent downward revisions suggest that GDP should trend lower as well. The market seems to be on the verge of a growth scare. Ideally, we want a number within 0.1% of the estimate.

To end the week, we’ll get the Fed’s preferred inflation indicator, the Personal Consumption Expenditures (PCE) Index. Expectations for core PCE is 0.1% MoM and 2.6% YoY. We want to make the path to what we call “victory cuts” as straightforward as possible. Victory cuts are those aimed at normalizing financial conditions before the current strict conditions start to erode the resilient economy. In contrast, “oh shit cuts” are those made to save an economy entering recession. To this end, we hope to see the PCE flat month-over-month, similar to CPI. If the PCE shows too much downside, the market may conclude that the strict financial conditions have already damaged the economy.

Gorilla Tactics: iShares 1-3 Year Treasury Bond ETF (SHY)

This one goes out to the new members of the investor class that took money out of zero-yield traditional checking and savings accounts into money market accounts yielding 5%.

It’s time to extend duration.

Why Now?

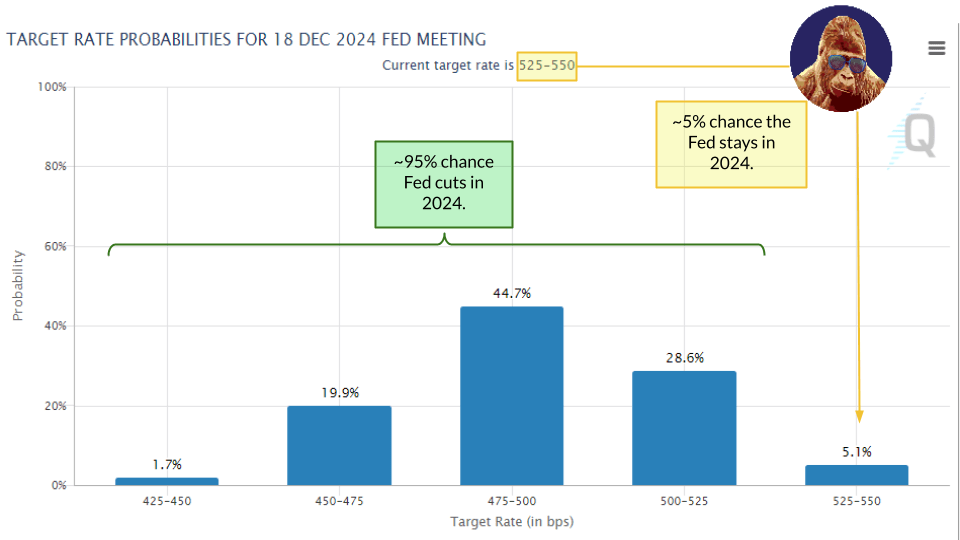

The first Fed cut is coming. Economic data is screaming, “slowdown!”. Inflation is easing. We’re one or two dovish inflation reports away from these cuts actually happening. Central banks in other countries have already begun cutting rates. The CME FedWatch Tool has a 95% probability of a cut within six months.

The 5% yield on cash is going away.

To keep earning money 5% risk-free, you’ll need to invest in treasuries directly.

How to Extend Duration

The answer depends on your situation. The amount of duration depends on your goals and where you are on your financial journey. Talk to your trusted advisor about what makes sense for you. If they haven’t called you about it already, get them on the phone.

Broadly speaking, if you have the money to buy treasuries directly, I would. It is the cleanest way to lock-in those risk-free rates. However, direct bond investments can be cost prohibitive. Treasuries go for about $1000 a bond.

Playing The Rate Cuts: SHY

To be clear: this is a play on rate cuts, not a way to lock-in duration.

A bond fund, such as this one, will not necessarily lock-in an interest rate. The dividend and price of the ETF depend on the bonds it holds. The advantage is upside participation in bond prices once the Fed cuts. As the Fed lowers rates, prices will increase on shorter-duration bonds. The SHY holds 1-3 year treasuries and has a 30-day SEC yield of 4.8%.

We get paid well to wait. While the yield on the SHY will drop once the Fed cuts, there will be a tidy profit from capital appreciation on the shares. Staying in cash provides no capital appreciation, only a lower yield.

Why I Like It:

Monthly Dividend

It is nice to see money come into the account every month as opposed to every quarter.

Expense Ratio of 0.15%

iShares knows how to keep costs low.

Liquidity

As an ETF, the SHY can be bought or sold like a stock. Moving directly in and out of bonds is not as easy.

Low Probability Downside

Through this Fed cycle, the SHY has found support at $80.60. Bottoms are formed when hawkishness peaks. Unless we get to the point where hikes are legitimately back on the table – and, there isn’t: the CME FedWatch Tool has a 0% implied probability of a hike this year – there is no reason to expect a retest.

From Friday’s $81.64 close, $80.60 is 1.27% away. That is the risk and, as of today, the probability we experience it is negligible.

High Probability Upside

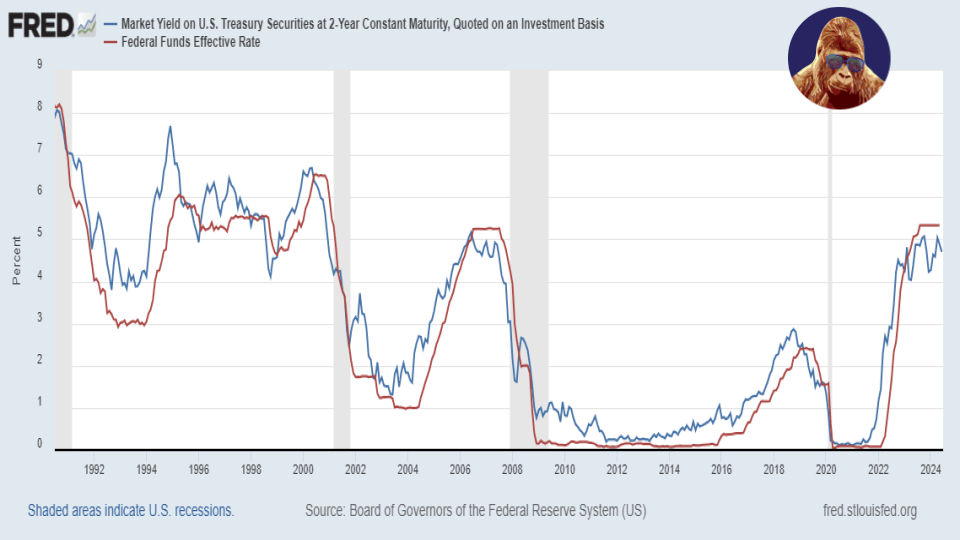

The yield on the US2Y and the Fed Funds Rate are closely tied. Courtesy of the St. Louis Fed, here’s a chart of the two since 1990.

The effective duration of the SHY is 1.82 years. The duration of the US2Y is, you guessed it, 2 years. Given the strong historical correlation between the US2Y and the Fed Funds Rate, we can reasonably expect the US2Y yield to decrease as the Fed cuts, resulting in a price increase. This price increase should be captured by SHY shares. The amount of upside depends on how much the Fed cuts.

Leave a Reply