June’s FOMC Meeting was a non-event. The data suggests the FOMC Meeting hasn’t been an event for a while. This is bullish.

Some Statistical Context

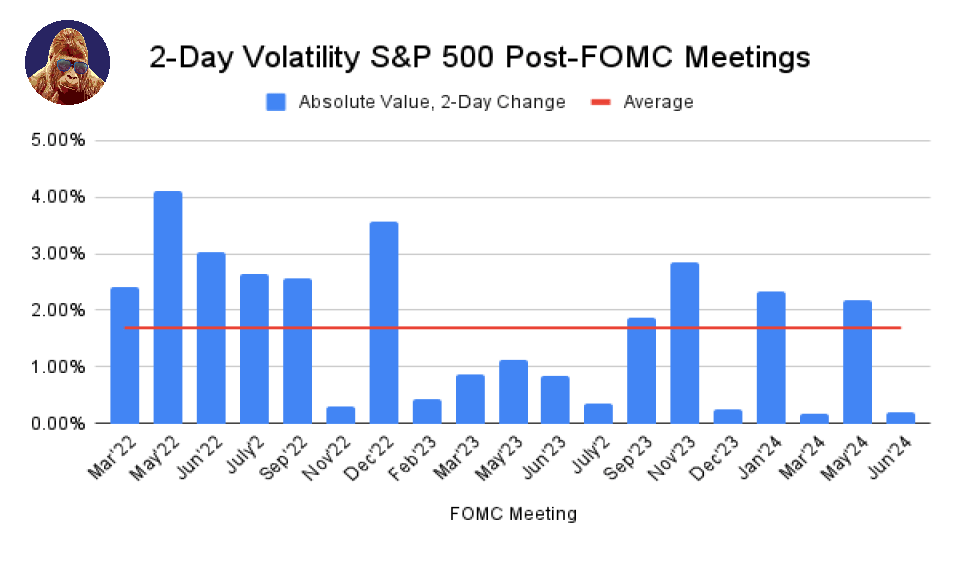

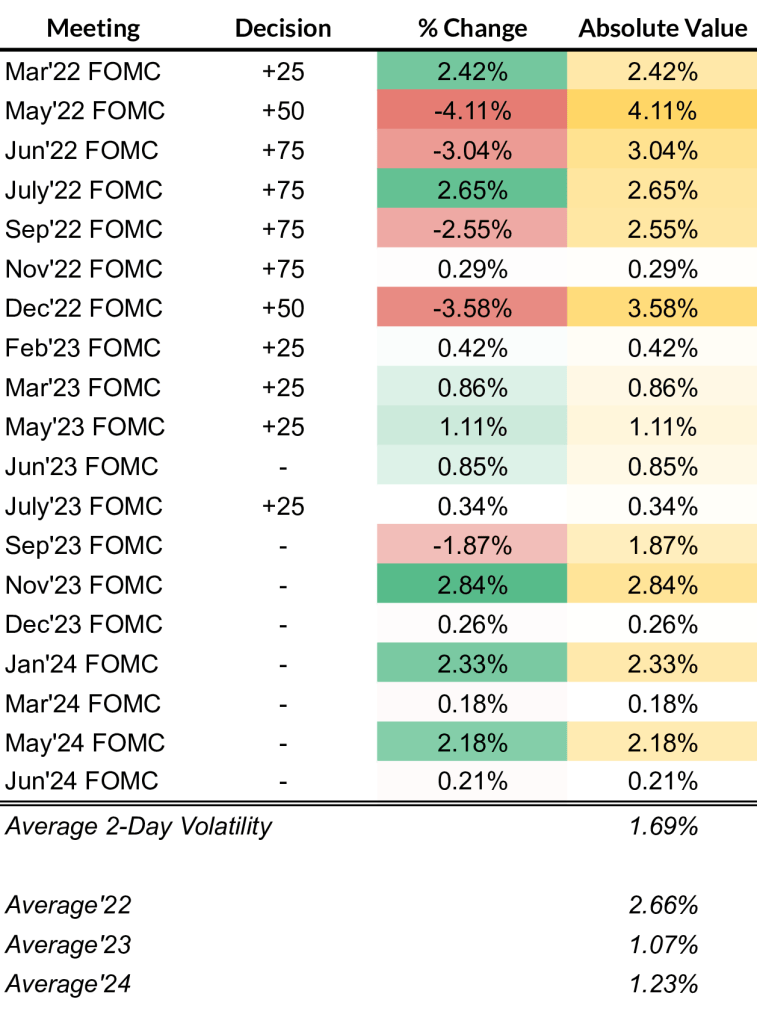

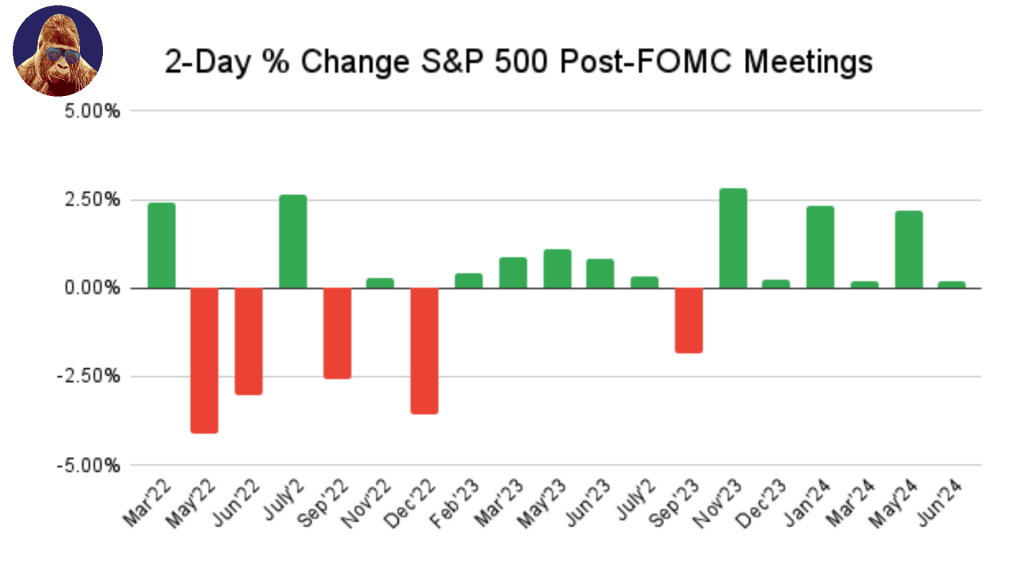

In 2022, the FOMC Meeting held the market hostage. Without accounting for the absolute intraday insanity during Powell’s conference, in the two sessions following the meeting, the S&P 500 moved 2.66% on an absolute basis. What a 2.66% move on the S&P 500 in two days could mean for the average stock made it an event.

The data shows FOMC volatility in 2023 was markedly lower, but, in the moment, it didn’t feel that way. There were lots of sweaty palm moments on those fateful Wednesday afternoons.

While 2024 is on track to be a more volatile year, in a welcome contrast to 2022, the volatility has been skewed to the upside. The AI halo at work.

Moving Forward

The FOMC is no longer a market event to make investment decisions (buy, sell, hold) around, and that is a good thing for investors. It shows the market is comfortable with the risks posed by inflation and interest rates, which increases the probability of positive outcomes.

The only way making investment decisions around the FOMC hurt you was if it kept you out of the market. Had you bought the S&P 500 at the beginning of the hike cycle in March ‘22 and stayed invested through the 20% decline into the October ‘22 bottom, today, a little more than two years later, you’d be rewarded with a 22% gain (11% annualized).

It isn’t easy to stay invested, and while past performance isn’t indicative of future results, history shows it is often worth it.

Leave a Reply