Retail sales for May appear to have validated the popular idea that consumers are getting more selective.

📍 Retail Sales: 0.1% actual vs. 0.2% estimated.

📍 Retail Sales Minus Autos: -0.1% actual vs. 0.2% estimated.

📍 Revisions lower to prior months.

The report indicates consumers aren’t spending as much, implying that inflation (and growth) will continue to slow. Thus, to reflect the increased likelihood that the Fed cuts, interest rates are falling.

This will only add more fuel to the “growth scare” fire, but I am not convinced it’s even been lit yet. The charts tell a nuanced story.

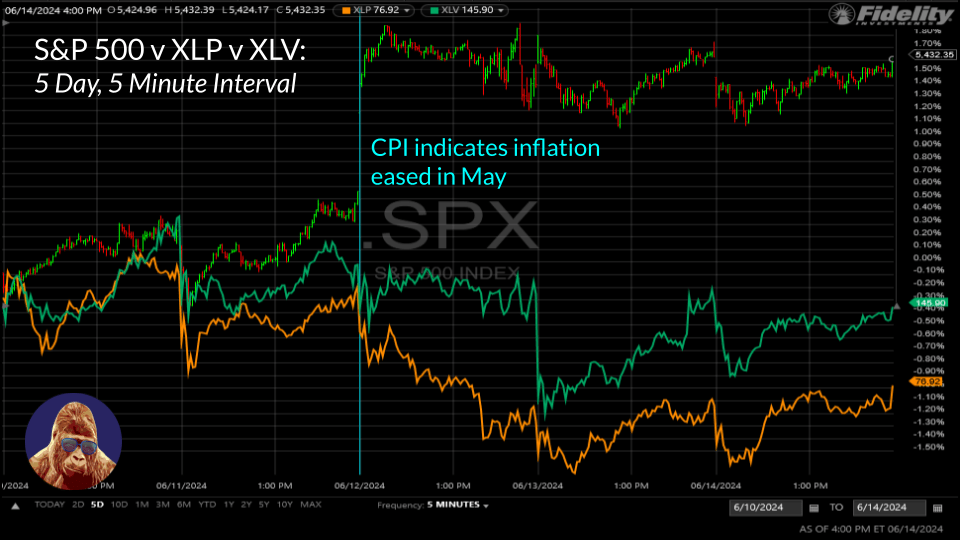

❌ Convinced of a slowdown –> Defensive sectors rally.

Didn’t happen. Healthcare and staples lagged the index.

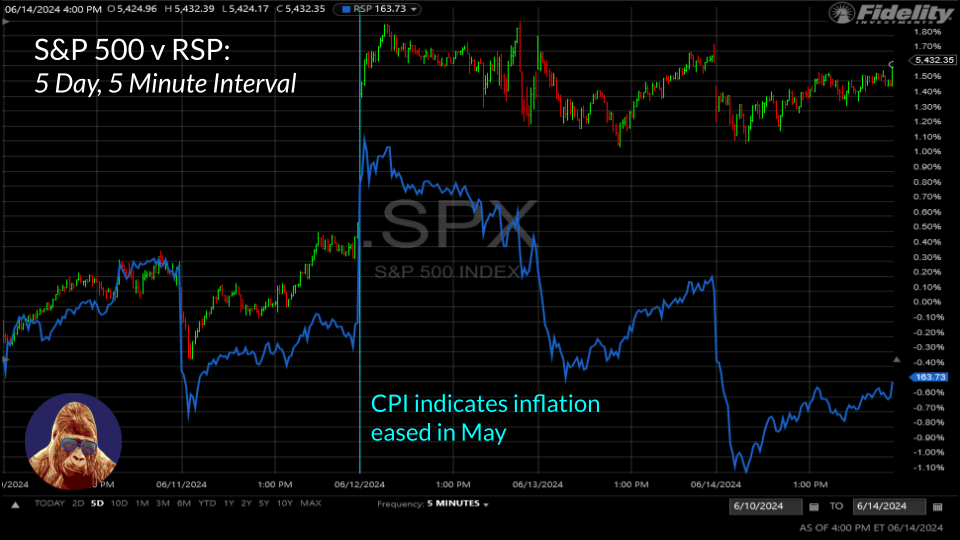

❌ Yields retreat, resilient economy –> Market broadens.

Nope. The equal-weight S&P markedly lagged the cap-weighted version.

✔️ When in doubt –> Buy mega-caps.

No one loses their job buying more Apple, Nvidia, and Microsoft. Mega-cap outperformance shines brightest when uncertainty is highest. The market is in a state of doubt. That is what the money is telling us.

Leave a Reply