Weekly Performance

| S&P 500 | 1.58% |

| Equal Weight S&P 500 (RSP) | 0.10% |

| NASDAQ | 3.24% |

| DOW | -0.54% |

| Russell 2000 (VTWO) | -1.01% |

Talk of the Tape

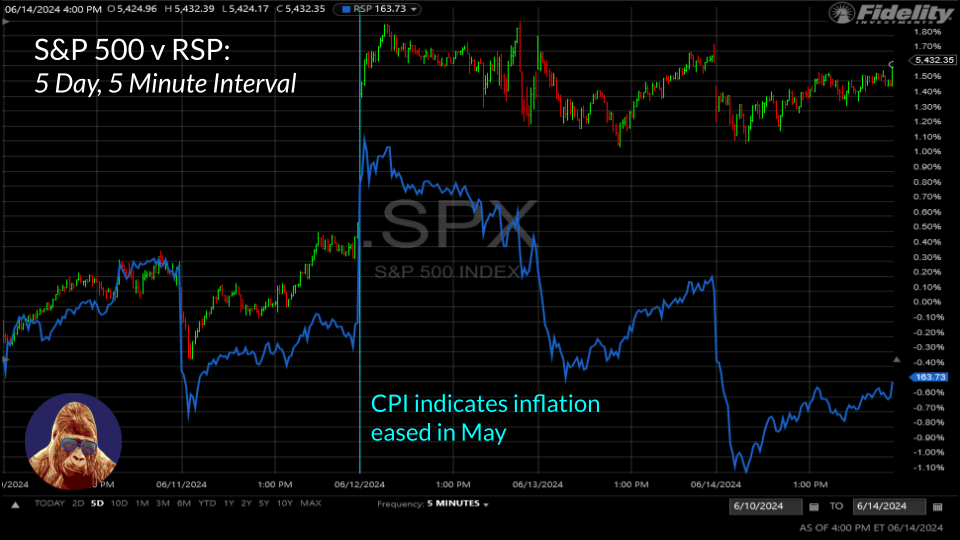

The indices tallied impressive performances behind a light May CPI and an agreeable FOMC. However, the average stock didn’t do as well. Huge moves from Apple (AAPL) and Broadcom (AVGO) propped up the indices as a majority of others struggled to close the week.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Lennar (LEN) | U.S. Retail Sales KB Homes (KBH) | Market Holiday: Juneteenth | Housing Starts Kroger (KR) Darden (DRI) | – |

5 Minutes to the Open

This week, it makes sense to cover the macro and micro together. We’ll be back to the usual format in the next edition.

Good News is Good News

… because Thursday’s and Friday’s sessions showed us the market is worried about bad news. In fact, those sessions revealed just how uncertain the market is.

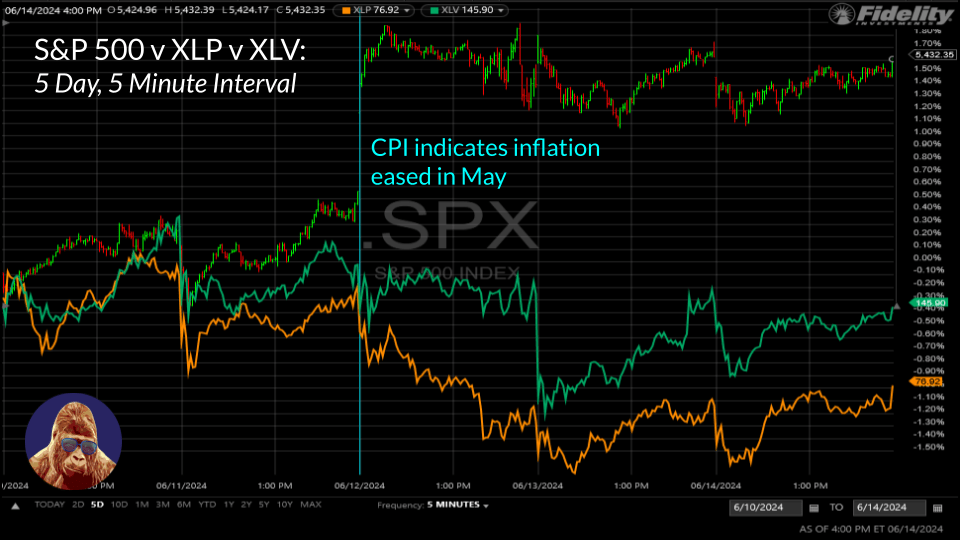

Last week, all the macro reports were weak: CPI was soft, jobless claims were higher, PPI was deflating, and consumer sentiment was declining. All of this screams slowdown. Money should have rushed into healthcare (XLV) and staples (XLP). Well, it didn’t.

The only stocks that performed well were those with unlimited capital and impeccable secular growth drivers: the mega-caps. Mega-cap outperformance tends to shine the brightest when uncertainty is highest. This is why the cap-weighted S&P 500 starkly outperformed the equal-weight S&P 500.

In summary, the stock market is more uncertain than anything. It won’t reward defensive stocks because it is not convinced the economy is slowing. It won’t broaden, despite the pullback in yields, because it is not convinced the economy is strong enough to support earnings for the average stock.

For a while now, the market has been waving pom-poms at bad news. For now, I think we’re past that. I believe the market is finally ready for some good news.

That said, we need retail sales to show us that the consumer, who drives 70% of the U.S. economy, hasn’t stopped spending. Specifically, I’ll be watching retail sales minus autos; the consensus is for 0.2%. We don’t want a number so hot that it contradicts cool readings from CPI and PPI, but we also don’t want a negative number. Ideally, I want to see 0.2% or 0.3%.

Housing Costs: As High as they are Misleading

Housing costs, no matter how you slice it, are too high. But are they as high as inflation data suggests? I doubt it. The government’s method for calculating “owners’ equivalent rent”, which accounts for about ~20% of CPI, deserves scrutiny.

According to Investopedia, “The data used for calculating owners’ equivalent rent is obtained through surveys, which ask members of a household (called a consumer unit) the following question: ‘If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished, and without utilities?’”

Do you think the average person is capable of providing a statistically reliable answer?

Personally, I don’t. Even if you do, at a minimum, you’d probably agree we should be able to come up with a more precise method. But, the data is the data is the data…

Housing starts and the quarterly reports from Lennar (LEN) and KB Homes (KBH) will provide the latest on housing trends. The cost of a home tends to correlate directly with rent, which, as we mentioned, feeds into CPI and PCE. 1.38 million is the forecast for housing starts. The greater the number of houses being built, the greater the downward pressure on home prices. LEN and KBH will also provide data on average home prices and demand at the current mortgage levels.

Food Inflation: Order In or Cook Out?

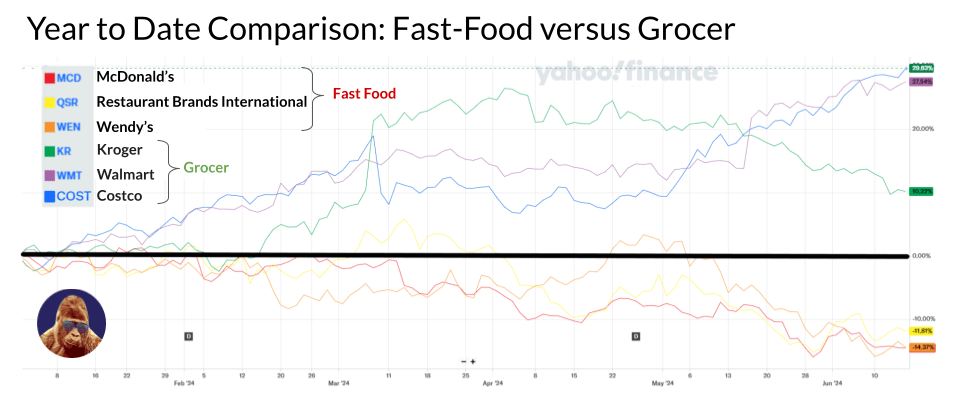

The idea that consumers are abandoning fast food and full-service restaurants to save money has gained notable popularity since McDonald’s (MCD) unveiled its new $5 meal deal in an attempt to regain foot traffic and boost sales. The winners? Grocers such as Costco (COST), Walmart (WMT), Kroger (KR), and Albertsons (ALB).

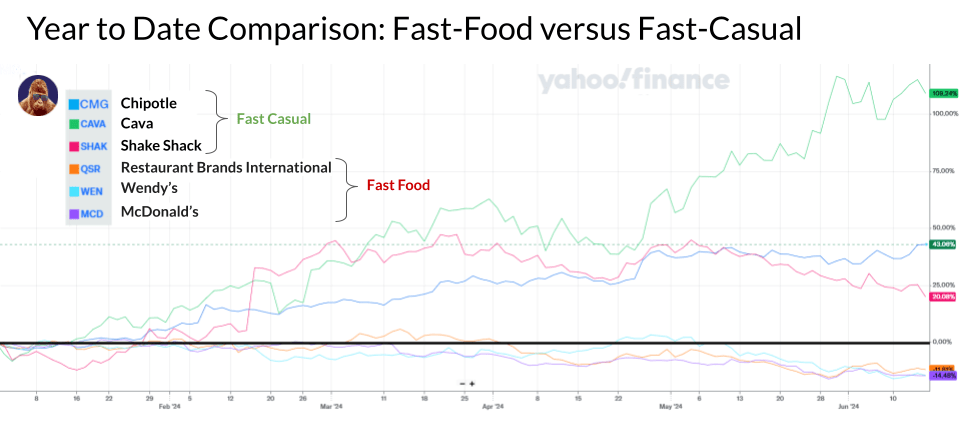

Personally, I believe consumers are simply being more selective. And, they should be. Fast-food restaurants have no business charging full-service and fast-casual prices. In an era of increased health awareness, there was no way consumers would pay the same for each for long. The stocks tell the story. Fast casual – Chipotle, Cava, Shake Shack – are killing it, while fast food – McDonald’s, Burger King, and Wendy’s – are getting killed.

As for the grocers, Costco and Walmart are by far the best, but Kroger’s last quarter got investors’ attention. Although it has given up much of the gain, likely due to their bid to acquire Albertsons (ALB), the relative outperformance of grocers compared to fast food is indicative of Americans voting with their wallets.

Food makes up 13-14% of CPI and PCE. Broadly speaking, it is split into two subcategories: at home and dining out. With more Americans buying groceries and cooking at home instead of dining out, restaurants that have pushed prices will need to slash them to attract customers back. If this trend continues, a stubborn element of CPI and PCE will move lower. Results from Kroger (KR) and Darden Restaurants (DRI) will provide some insight into this potential deflationary trend.

Leave a Reply