May CPI came in softer-than-anticipated this morning:

- Core CPI YoY: 3.4% actual versus 3.5% estimate and 3.6% prior.

- Core CPI MoM: 0.2% actual versus 0.3% estimate and 0.3% prior.

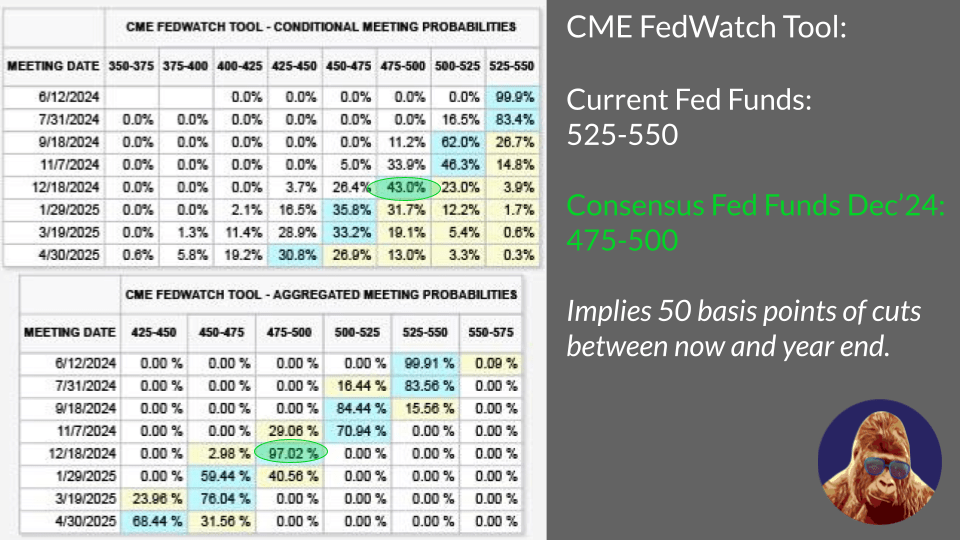

Relief on inflation has mitigated the impact of last Friday’s hawkish Payrolls on interest rate expectations. According to the CME FedWatch Tool, two interest rate cuts this year remains consensus: the first in September and the second in December.

The market is up nicely on the news. For the gains to hold, the Fed will need to stick the landing at today’s FOMC Meeting. This month’s meeting will feature the release of an updated dot plot, which outlines Fed members’ summaries of economic projections (SEPs).

Here is a little preview of the potential outcomes:

- Dot plot shows fewer than two cuts: the market fades.

- Dot plot agrees on two cuts: gains stick.

- Dot plot shows more than two cuts… let’s hope it doesn’t.

More than two cuts with less than six months for the Fed to act would imply the committee sees the economy collapsing. Remember, cuts will only be welcome if they come from a place of strength (by defeating inflation), not from a place of weakness (to combat a recession).

Leave a Reply