Weekly Performance

| S&P 500 | 1.32% |

| Equal Weight S&P 500 (RSP) | -0.95% |

| NASDAQ | 2.38% |

| DOW | 0.29% |

| Russell 2000 (VTWO) | -2.10% |

Talk of the Tape

Although the major indices exhibited resilience, Payrolls for May were indisputably strong, fueling legitimate concerns that upcoming inflation data will be higher than expected.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Hot Stocks Apple WWDC Nvidia Split Eli Lilly – FDA | – | Hot Data CPI FOMC Meeting | – | – |

Macro Movers

Stocks have performed well during this period where the Fed has remained on pause, and the U.S. economy has held up. We aren’t fighting the Fed or the tape. Last Friday’s Payrolls didn’t change that. Stocks can keep working.

That doesn’t mean the market is invulnerable. If the Consumer Price Index (CPI), forecasted at 3.5% year-over-year and 0.3% month-over-month, comes in as hot as last week’s Payrolls, and if the Federal Open Market Committee (FOMC) meeting has an overly hawkish tilt, then we should expect a bunch of red arrows.

Personally, I believe any weakness created this month should be bought. The macro remains mixed – if not contradictory at times – providing no clear reason to position for a change in Fed policy. Furthermore, and perhaps more importantly, 2024 has seen a pattern where initially hot data has been consistently revised cooler the following month, which reduces the weight of these data points as they’re initially released.

Micro Movers

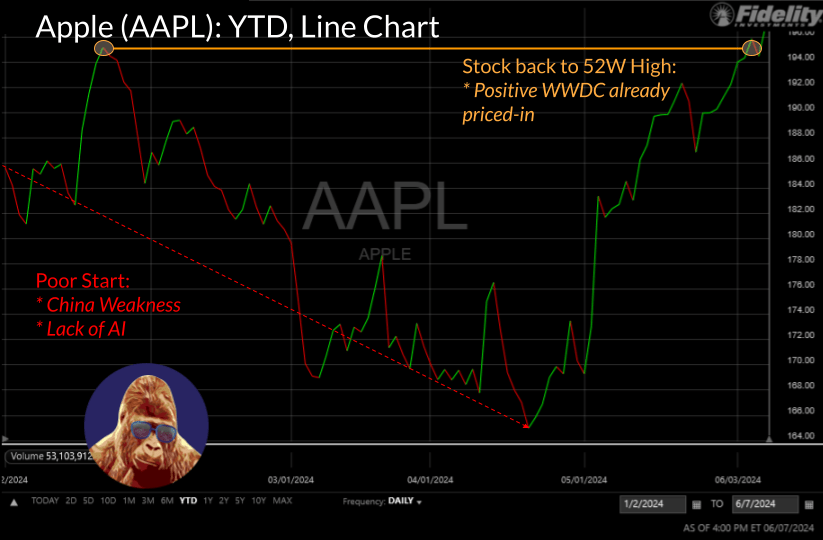

Apple’s Worldwide Developers Conference (WWDC): In the first four months of the year, Apple’s stock price dropped by 10% due to a popular theory that weakness in China and a lack of AI integration would allow competitors to threaten Apple’s iPhone-driven ecosystem. Since then, the stock has rallied 18%. While part of the rally can be attributed to better economic data from China, the price action clearly suggests the market expects WWDC to address AI.

Due to CEO Tim Cook’s posture when answering questions on the topic of AI, we can reasonably expect that the market’s expectations will be met. Consequently, I don’t anticipate WWDC to significantly move the stock.

Nvidia 10-for-1 Stock Split: Splits are like cocaine for stocks. As per Bank of America Global Research, the average 12 month returns for companies post-split are 25%, which is double the historic yearly return of 12% for the S&P 500.

This is purely conjecture, but I think some investors may choose to sell 1-2 shares and keep the remaining 8-9 after the split on Monday. That kind of selling pressure has the potential to dampen the stock for a day or two. I am not sure if it’ll create a real buying opportunity, but worth noting so you’re not caught off guard.

I am long NVDA.

Eli Lilly FDA Advisory Meeting: Similar to how Nvidia followed up the Hopper GPU with the Blackwell, Eli Lilly (LLY) will look to build upon their GLP-1 success with an Alzheimer’s breakthrough. After Monday’s close, LLY will meet with the FDA regarding their Alzheimer’s medication candidate, donanemab. With LLY’s stock trading at all-time highs, the market appears to be pricing-in a positive outcome.

If approved, donanemab has the potential to generate revenue on par with their GLP-1 business. If you’re in the stock, this is why you stay in. If you’re not, this is why you aren’t too late to get in.

I am long LLY.

Leave a Reply