Weekly Performance

| S&P 500 | -0.51% |

| Equal Weight S&P 500 (RSP) | — |

| NASDAQ | -1.10% |

| DOW | -0.98% |

| Russell 2000 (VTWO) | 0.02% |

Talk of the Tape

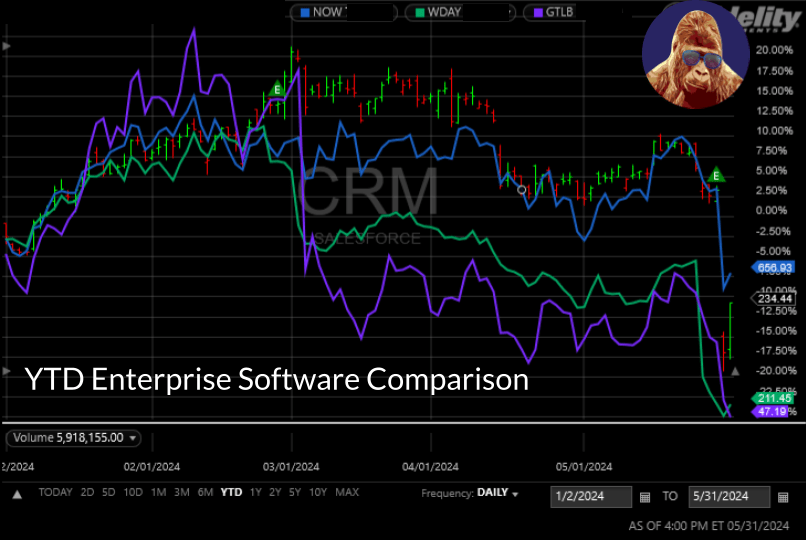

The Personal Consumption Expenditure (PCE) Index aligned with expectation, providing real evidence interest rates are sufficiently high to achieve the Fed’s 2% inflation mandate. For the first time in recent memory, hardware, championed by Nvidia, is markedly outperforming software, as Salesforce triggered a mass exodus for the sector.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| GitLab (GTLB) | Job Openings (JOLTs) CrowdStrike (CRWD) | ADP Employment | Nio (NIO) | Payrolls |

Macro Movers

With PCE reaffirming the notion that the “trend is our friend” on inflation, the market should exhibit greater resilience in the face of this week’s labor data. The cooler the job data – with exception to unemployment – the better we’ll feel about inflation throughout June. In my opinion, risk to downside is more likely to come from job data coming in so cool it hints at recession. Thus, investors should hope for results that are largely in-line to slightly below consensus.

Job Openings (JOLTs): Consensus is 8.3 million, slightly down from the prior 8.5 million.

ADP Employment: Job creation for May is expected to print 179,000 jobs, down from April’s 192,000. The focus will be on wage data within the “Pay Insights” section. “Job stayers” experienced a 5% raise YoY; “job changers” experienced a 9.3% raise.

Payrolls: Job creation is forecasted at 178,000, slightly higher than the prior month’s 175,000. Unemployment is expected to remain at 3.9%. Hourly wages are expected to tick up from 0.2% to 0.3% on a monthly basis but not change from 3.9% on a yearly basis.

For what it is worth, although I view the wage data as most important, more recently, greater emphasis has been paid to unemployment. The new popular thought on Wall Street is that the Fed will not even begin “talking about talking about” cutting rates without unemployment rising above 4%.

Micro Movers

GitLab (GTLB): A relatively new name for me, GitLab offers SaaS through its proprietary DevSecOps Platform. It aims to streamline the software development process by providing a one-stop, collaborative platform for development teams. Management plans to propel growth by integrating AI to their DevSecOps Platform.

Over the last twelve months, AI-driven demand growth has inspired Wall Street optimism and stock price performance. However, Salesforce’s recent quarter has challenged that optimism. Now, consensus is forming that demand for enterprise software is tapering off as the economy softens.

This shift has led to a sector-wide exodus, which should eventually create an opportunity to buy the cohort’s best-in-breed, ServiceNow (NOW). In the meantime, the sector is in the penalty box for at least the next two quarters. That said, the reaction to GitLab’s quarter should help gauge how close the sector is to forming a bottom.

CrowdStrike (CRWD): Cybersecurity also took a hit courtesy of Salesforce’s lackluster quarter. Wall Street’s concern is that if enterprise software is experiencing weakness, then cybersecurity may face similar headwinds.

This concern sent CRWD 15% lower in three sessions, creating a better opportunity to surpass expectations. Recently, competitors Palo Alto and Zscaler delivered solid quarters. For traders, the combination of lowered expectations and solid peer-group performance makes CRWD an attractive earnings play. For longer-term investors, I recommend avoiding the volatility by waiting until after the quarter.

Nio (NIO): I am highlighting Nio, a China-based electric vehicle (EV) manufacturer, to discuss Tesla (TSLA). The narrative surrounding TSLA recently improved as Chinese regulators approved full self-driving (FSD), which will be offered as a monthly subscription for Tesla owners in the country. However, competitive pressures persist in that market, with competitors like Nio offering EVs at lower price points. Nio’s quarter will provide insight into the EV landscape in China, which is material to TSLA stockholders.

Leave a Reply